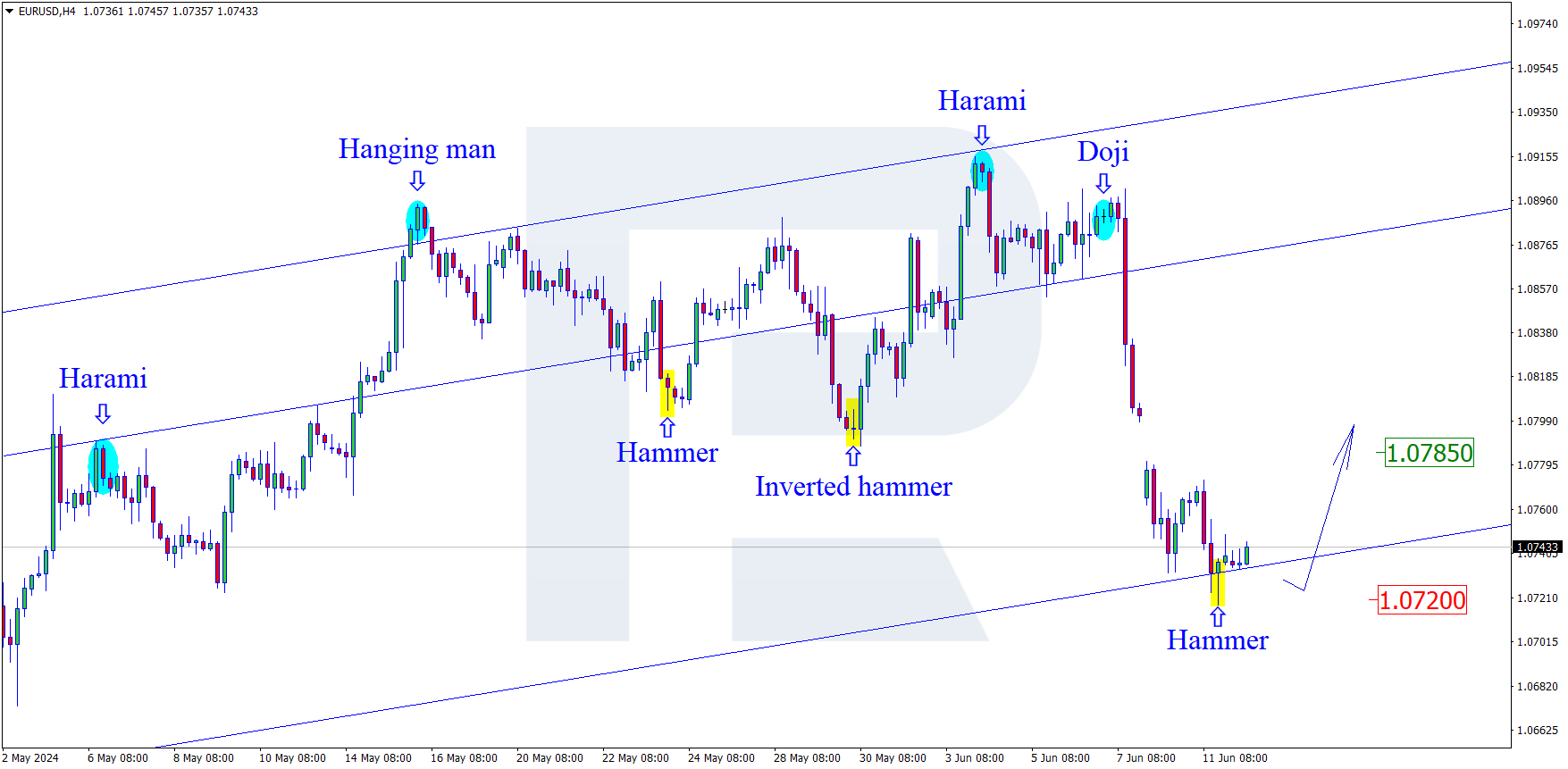

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, the convergence made EURUSD reverse after reaching the post-correctional extension area between 138.2% and 161.8% fibo at 1.0742 and 1.0657 respectively and start a new pullback, which has already reached 23.6% fibo. The next correctional targets may be 38.2% and 50.0% fibo at 1.0898 and 1.0936 respectively.

In the H1 chart, the pair is correcting close to 23.6% fibo. The local divergence on MACD is a signal for a decline. The support is the low at 1.0777.

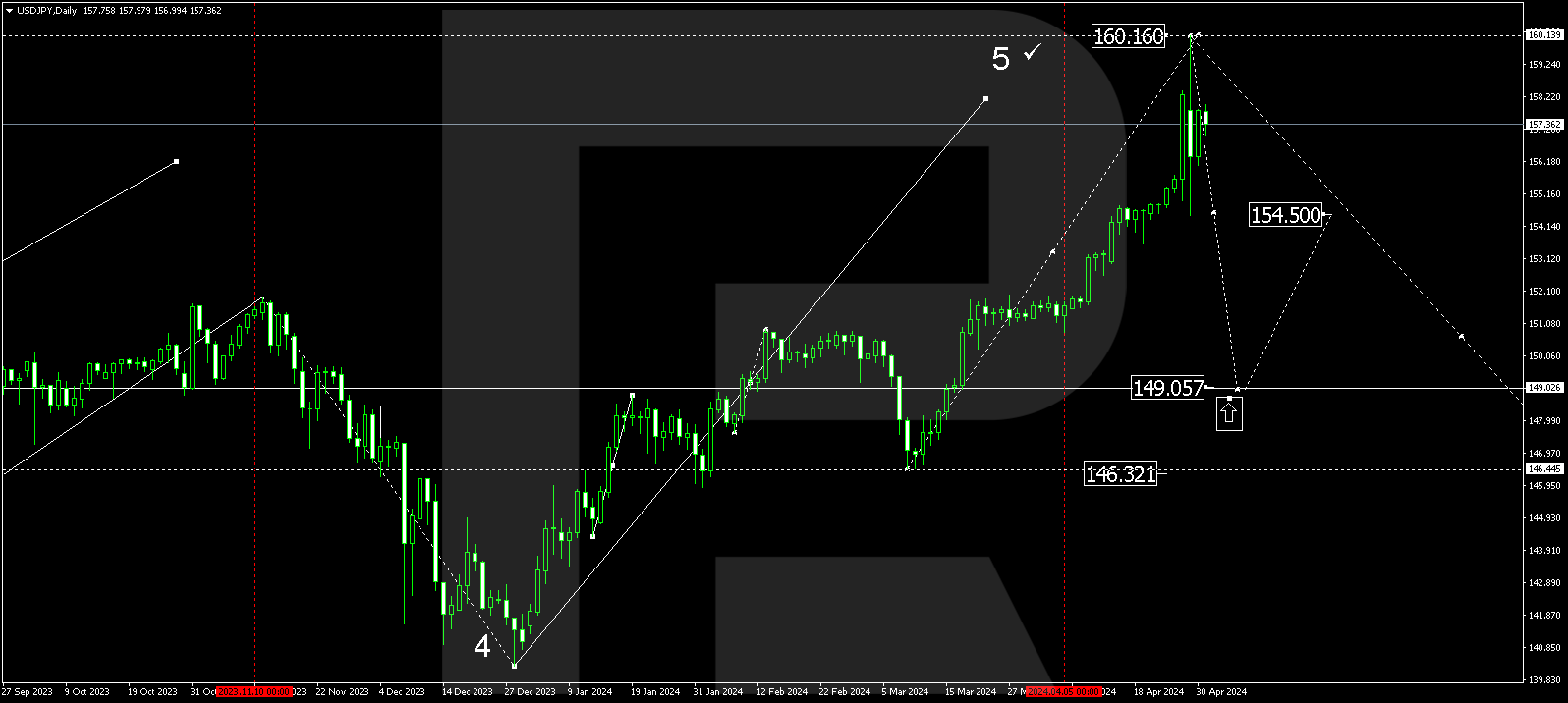

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the daily chart, after reaching the fractal high at 112.40, the pair is trying to start a new decline. Another strong signal to confirm the long decline in the nearest future is the divergence on MACD that was formed earlier. The first descending impulse has already reached 23.6% fibo and may continue towards 38.2%, 50.0%, and 61.8% fibo at 109.26, 108.35, and 107.42 respectively.

In the H1 chart, the pair has rebounded from 23.6% fibo. However, the bearish tendency isn’t over as long as the price is moving below the previous high at 112.23.