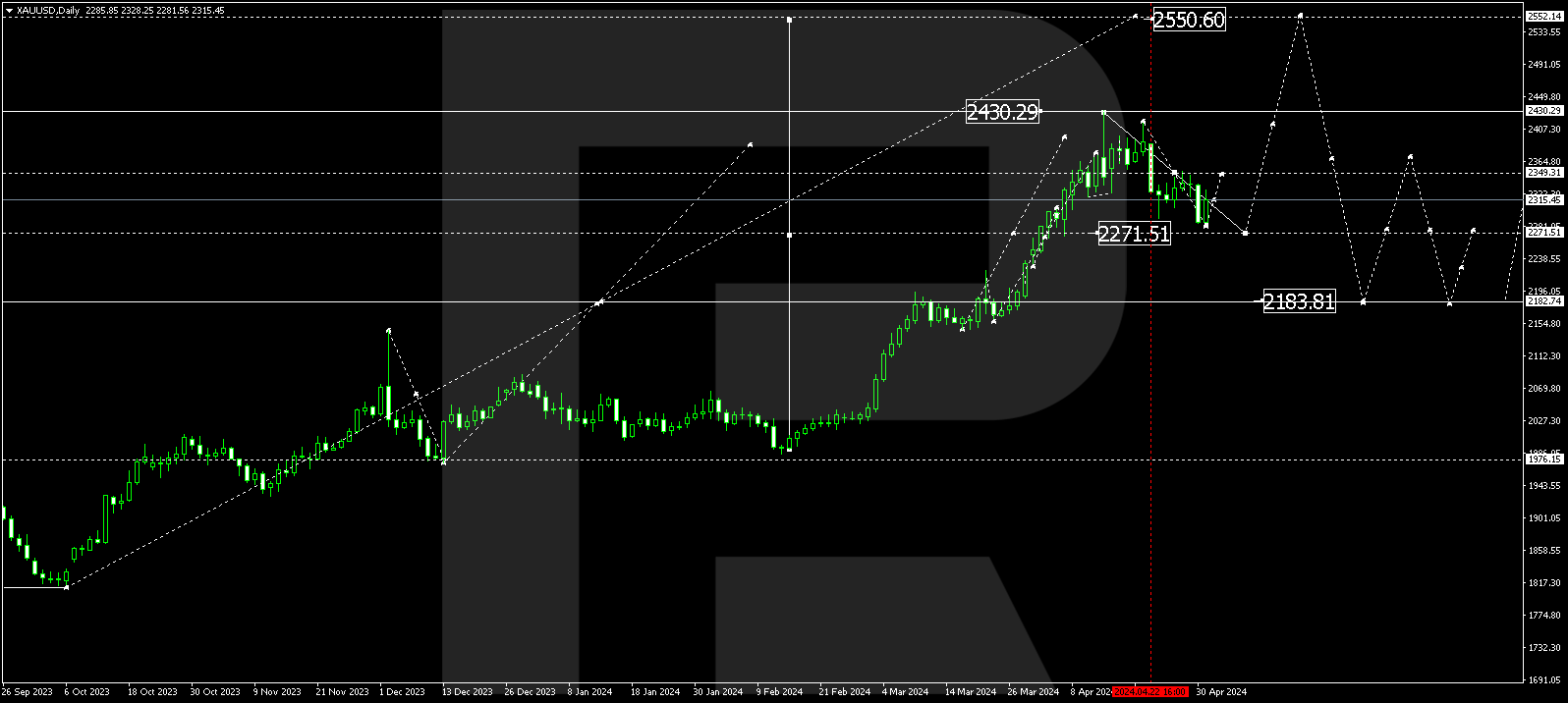

XAUUSD, “Gold vs US Dollar”

In the daily chart, the long-term correction continues; the descending wave has broken 38.2% fibo and may continue towards 50.0% and 61.8% fibo at 1617.50 and 1509.85 respectively. However, there is a convergence on MACD, which may hint at a possible pullback after the instrument reaches one of its key downside targets. The key resistance is the high at 2074.75.

In the H1 chart, a convergence on MACD made the pair start a new pullback to the upside. The possible correctional targets are 23.6%, 38.2%, and 50.0% fibo at 1717.55, 1736.43, and 1751.50 respectively. However, if the price breaks the local low at 1687.14, XAUUSD may continue falling to reach the long-term 50.0% fibo at 1617.50.

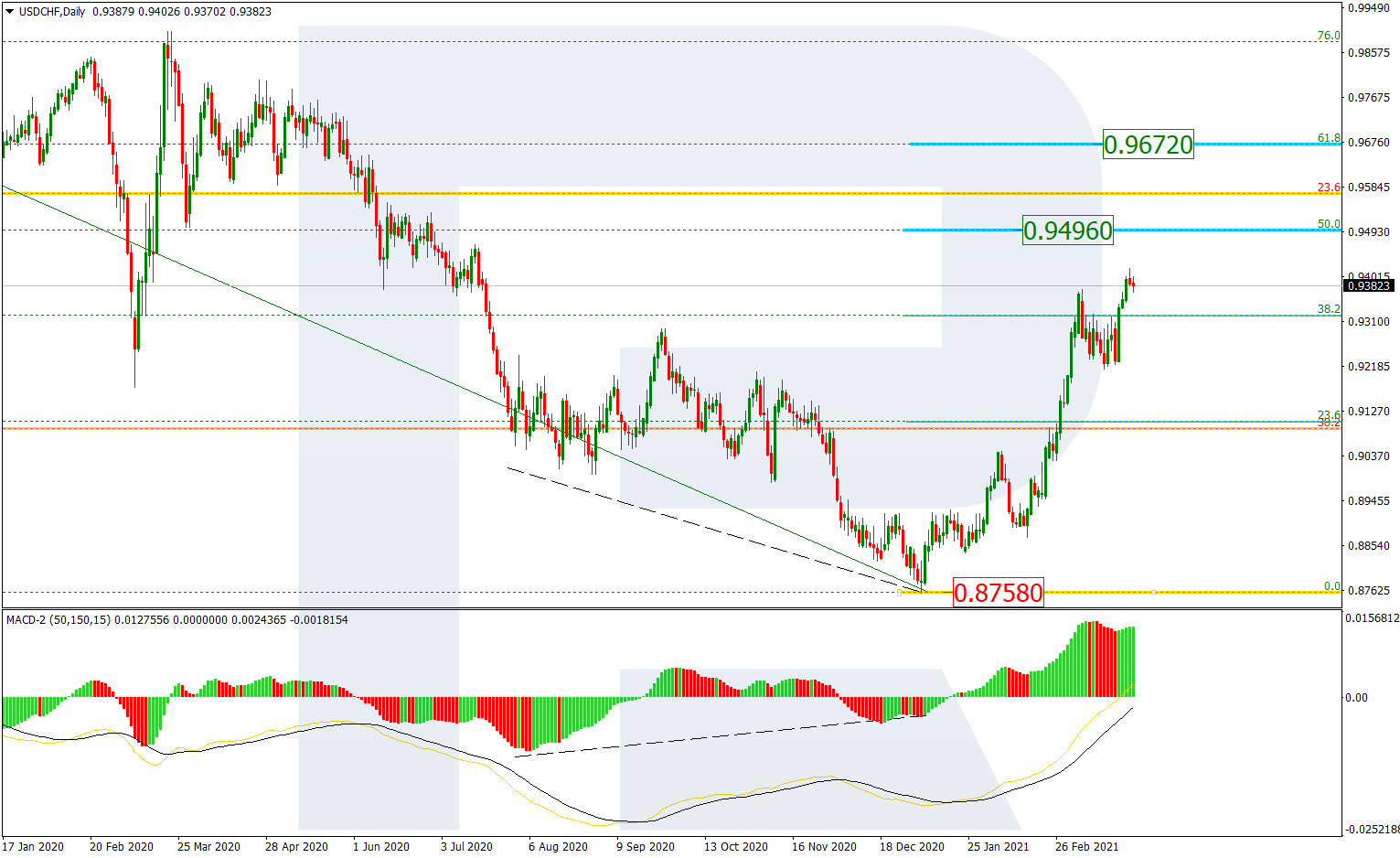

USDCHF, “US Dollar vs Swiss Franc”

The daily chart shows that USDCHF has reached a very important level, 38.2% fibo. Later, the market may continue growing towards 50.0% and 61.8% % fibo at 0.9496 and 0.9672 respectively. However, if the asset breaks the support at 0.8758, the correction may be over.

As we can see in the H4 chart, the asset is moving within a stable uptrend but may start a new pullback to the downside after reaching the long-term 38.2% fibo. The correctional targets may be 23.6% and 38.2% fibo at 0.9222 and 0.9155 respectively. The support is the local low at 0.8871.