29 September is decisive: what will Isabel Schnabel say and how will it affect EURUSD?

The speech of European Central Bank representative Isabel Schnabel could become a trigger for euro strengthening and push the EURUSD rate towards 1.1780. Discover more in our analysis for 29 September 2025.

EURUSD forecast: key trading points

- Speech by European Central Bank representative Isabel Schnabel

- The ECB is in no hurry to cut interest rates

- EURUSD forecast for 29 September 2025: 1.1780

Fundamental analysis

The forecast for 29 September 2025 does not appear very promising for the USD; today, European Central Bank representative Isabel Schnabel will give a speech.

Possible key points and signals:

- Stability or cautious tone

In past speeches, Schnabel already noted that there is no need to rush with rate cuts, and that the current rate remains moderately accommodative. Therefore, today she may confirm that the ECB will not hurry with further easing until the economy and inflation provide clear signals.

- Focus on inflation and trade barriers

Schnabel has repeatedly emphasised risks related to trade tariffs and rising global prices as factors that could limit room for policy easing. She may again point out that even if inflation looks moderate now, external risks and external pressures could become significant factors.

- Comment on the euro exchange rate

Schnabel has previously stated in interviews that she does not comment on the exchange rate level, but she may indirectly address issues related to the euro exchange rate, inflation, and export orientation. Today, cautious remarks can be expected about how euro fluctuations affect pricing processes and trade flows.

- Conditions for easing amid weak data

Schnabel is likely to emphasise that any decision on further rate cuts will depend on consistent and significant deviations in data. She has previously said the likelihood of a cut remains high. If the eurozone economy starts to show signs of slowdown, she may hint at future easing, but without committing to specific timing.

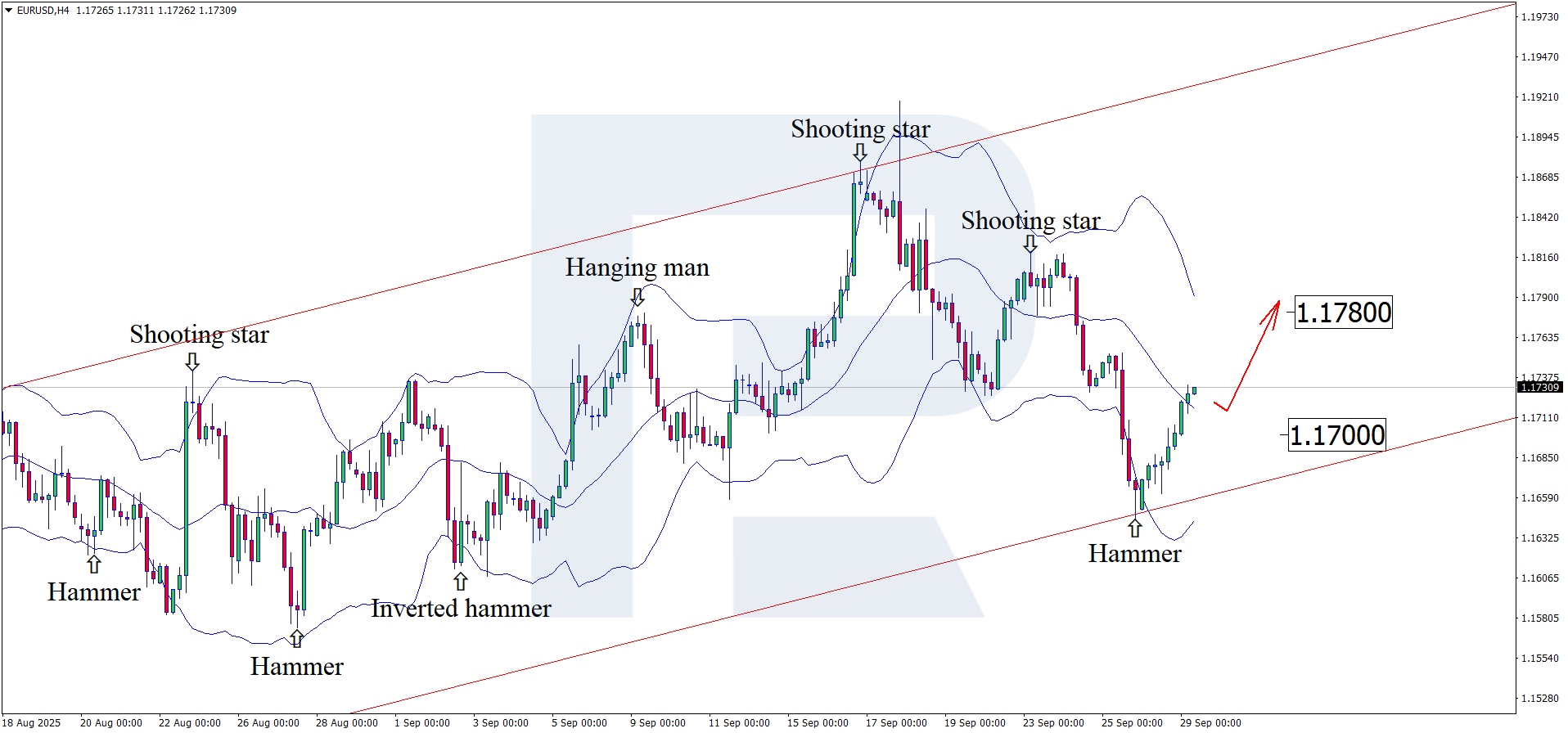

EURUSD technical analysis

On the H4 chart, the EURUSD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may continue its upward trajectory following this signal. Since quotes remain within an ascending channel, the pair is likely to rise to the nearest resistance level at 1.1780. A breakout above this level would open the door for the continuation of the uptrend.

At the same time, the EURUSD forecast does not rule out a correction towards 1.1700 before growth resumes.

Summary

The EURUSD forecast for today is not in favour of the USD, as Schnabel’s speech may strengthen the euro. Technical analysis of EURUSD suggests growth towards the 1.1780 USD resistance level.