A slowdown in the US services sector supports EURUSD growth

The EURUSD rate is approaching the crucial 1.0535 resistance level and poised to breach it. More details in our analysis for 5 December 2024.

EURUSD forecast: key trading points

Fundamental analysis

The EURUSD rate has risen for the third consecutive day, as buyers successfully hold the 1.0470 support level. On Wednesday, Federal Reserve Chair Jerome Powell stated that the regulator was not in a rush to lower interest rates, maintaining a focus on stronger economic growth, a resilient labour market, and persistent inflationary pressures.

Meanwhile, November data revealed that the US services sector experienced a sharper slowdown than expected. The services PMI declined to 52.1 points from 56.0 in October, marking the lowest level in three months, while analysts forecast a drop to 55.5 points.

As a result, the likelihood of a 25-basis-point Federal Reserve interest rate cut in December rose to 77.5%, compared to 66.5% a week ago. According to today’s EURUSD forecast, heightened expectations of rate cuts exert pressure on the US dollar, helping the euro strengthen. Investors now await Friday’s US employment report for November, which may provide further insights into the future direction of the Federal Reserve monetary policy.

EURUSD technical analysis

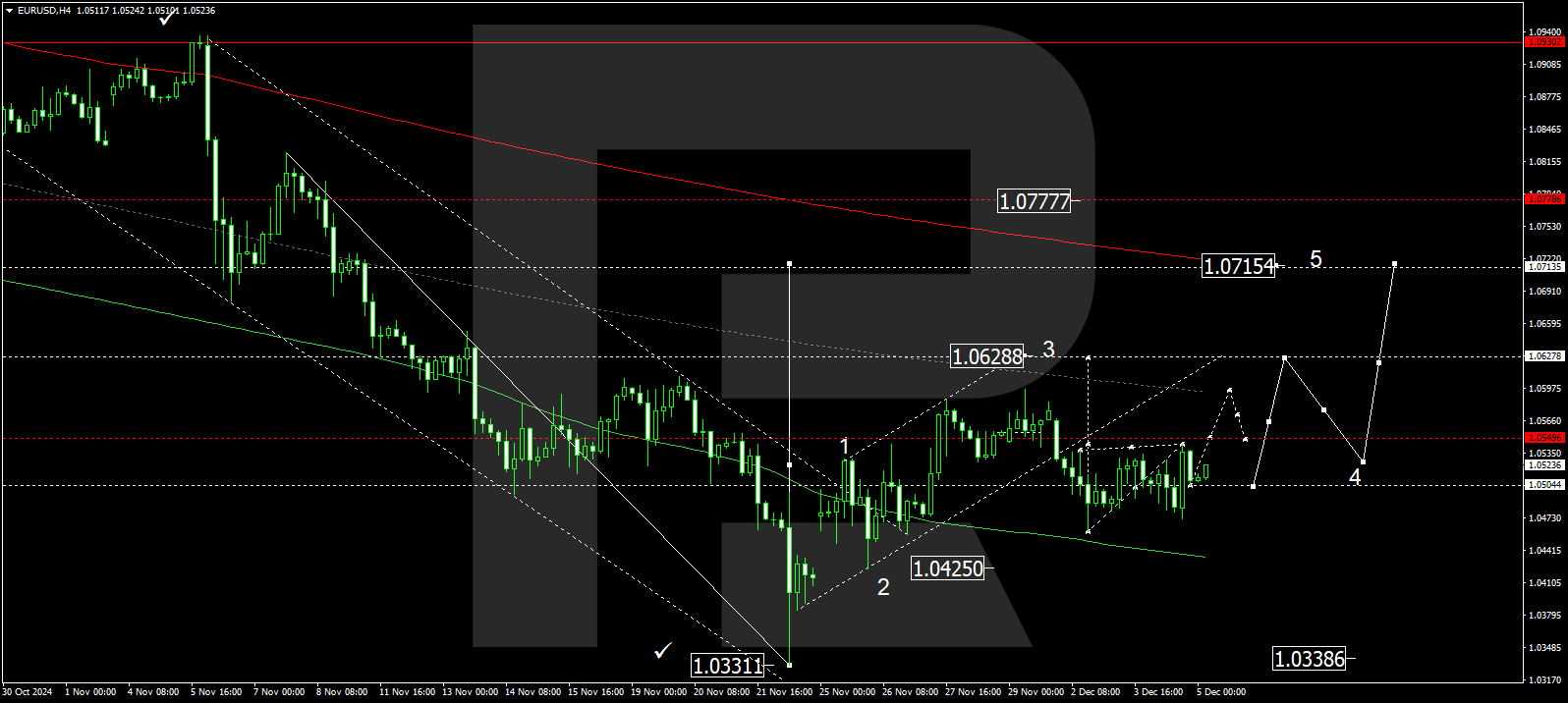

The EURUSD H4 chart shows that the market has completed a growth wave towards 1.0545, followed by a correction to 1.0500. A growth structure towards 1.0595 could develop today, 5 December 2024. Subsequently, the price may decline to 1.0550. The market continues to consolidate around the 1.0500 level without a clear trend. A breakout below this range could extend the downward wave to 1.0333, while an upward breakout would open the potential for a growth wave towards the local target of 1.0628.

The Elliott Wave structure and growth wave matrix, with a pivot point at 1.0500, technically support this scenario. This level is considered crucial for the EURUSD rate. Another growth wave is expected to form, targeting the central line of a price envelope at 1.0628. Once this level is reached, a downward wave is expected to develop, aiming for 1.0525, before the trend continues towards its upper boundary at 1.0715.

Summary

Growth in the EURUSD rate is driven by expectations of Federal Reserve monetary policy easing, prompted by weaker US economic data, including a slowdown in the services sector. The likelihood of an interest rate cut exerts pressure on the US dollar, helping the euro strengthen. Technical indicators for today’s EURUSD forecast suggest a potential growth wave to the 1.0595 level.