Alibaba Group Holding Ltd (BABA) and Palantir Technologies, Inc. (PLTR): Q3 and Q4 2024 earnings reports and stock forecasts

Alibaba Group (NYSE: BABA) has reported revenue growth for Q3 of the 2024 financial year, along with investments of 53.00 billion USD in cloud infrastructure and artificial intelligence (AI). The company’s stock has risen by 70% since the beginning of the year, driven by a series of positive developments. Meanwhile, Palantir Technologies (NASDAQ: PLTR) has also reported an increase in revenue, with projections for further growth in 2025. However, news of a planned reduction in the US Department of Defense budget caused a sharp drop in the company’s stock price.

This article presents the key financial metrics from the latest quarterly reports of Alibaba Group and Palantir Technologies and a technical analysis of BABA and PLTR shares. Based on these insights, it offers stock forecasts for Alibaba Group Holding Ltd and Palantir Technologies, Inc. for March 2025.

Alibaba Group Holding Ltd Q3 2024 earnings report

Alibaba’s Q3 2024 financial year earnings report, covering the quarter ended 31 December 2024, reflects strong performance. The company reported revenue of 280.15 billion CNY (38.38 billion USD), surpassing analysts’ expectations of 279.34 billion CNY, driven by significant growth in Cloud Intelligence Group and international commerce. Net profit surged by an impressive 339% year-on-year to 48.95 billion CNY (6.72 billion USD), substantially exceeding forecasts of 40.60 billion CNY. However, moderate 5% growth in its core Taobao and Tmall segment and a 1% decline in Cainiao’s revenue highlight continued weakness in China’s domestic consumer market.

Alibaba’s management expressed optimism regarding 2025, emphasising its strategic focus on e-commerce, artificial intelligence (AI), and cloud computing as key growth drivers. Over three years, the company plans to invest 380.00 billion CNY (approximately 53.00 billion USD) in cloud technology and AI infrastructure. While detailed full-year revenue projections were not disclosed, the company’s confidence in operational efficiency and international expansion suggests expectations of sustained growth, with a focus on stabilising Taobao and Tmall’s market share and enhancing shareholder returns through share buybacks.

Investors responded positively to the Q3 2024 earnings report, with Alibaba’s stock rising by 10% to its highest level in three years. Stronger-than-expected revenue, exceptional profit growth, and robust performance in AI-driven cloud technology fuelled bullish sentiment. However, concerns remain regarding the planned 53.00 billion USD investment in AI and cloud infrastructure, which could weigh on profitability.

Alibaba Group Holding Ltd stock forecast for March 2025

Since 13 January 2025, Alibaba’s stock has risen by 80% without significant corrections, and a price decline is expected now. On the daily timeframe, the price has reached resistance at 145 USD and bounced off it. Based on the current price dynamics of Alibaba Group Holding Ltd, potential scenarios for stock movement in March 2025 are outlined below.

The primary forecast for Alibaba Group Holding Ltd’s stock suggests a price decline as part of a correction towards support at 115 USD. A rebound from this level would signal the end of the correction and a resumption of the uptrend towards resistance at 145 USD.

The alternative forecast anticipates a break below the 115 USD support level, which could result in a further decline to 104 USD.

Alibaba Group Holding Ltd stock analysis and forecast for March 2025Palantir Technologies, Inc. Q4 2024 earnings report

Palantir Technologies Inc. released its Q4 2024 earnings report on 3 February 2025, with strong results highlighting its growing significance in AI-driven data analytics. The company reported revenue of 828 million USD, up 36% year-on-year and exceeding analysts’ expectations of approximately 776 million USD. US commercial revenues reached 214 million USD, increasing by 64% year-on-year, indicating rising demand from the private sector. US government revenues totalled 343 million USD, up 45% year-on-year, reflecting sustained interest from government agencies. Adjusted free cash flow stood at 517 million USD, with a 63% margin, demonstrating the company’s strong cash generation capabilities. Despite these robust figures, some sources point to ongoing GAAP net losses, though specific loss figures were not disclosed.

Palantir’s management provided an optimistic outlook for the 2025 financial year, forecasting revenue between 3.74 billion USD and 3.76 billion USD, representing a 31% increase compared to 2024. For Q1 2025, the company expects revenue between 858 million USD and 862 million USD.

Palantir management also projects that US commercial sales will grow by at least 54% in 2025, reaching approximately 1.08 billion USD. CEO Alexander Karp highlighted the company’s strategic positioning at the forefront of the AI revolution, stating that this growth trajectory reflects years of preparation and increasing adoption of Palantir’s platforms, particularly in the US.

Investors responded positively to the earnings report and optimistic 2025 outlook, with Palantir’s shares surging by more than 22% during trading on 3 February 2025. However, the company’s high valuation (P/E ratio of 180) remains a point of contention, with some analysts warning that it is priced for perfection, leaving little margin for error. The first major blow came from reports that Donald Trump intends to implement an 8% annual reduction in the US defence budget over the next five years. Since approximately 40% of Palantir’s revenue comes from government defence contracts, this news triggered a 30% decline in its share price.

Overall, Palantir’s Q4 2024 report presents a company operating at full capacity, with exceptional revenue growth, profitability, and cash flow performance. However, the company’s aggressive 2025 forecast, combined with its already high valuation, indicates a heightened investment risk, mainly if external factors – such as budget cuts – come into play.

Palantir Technologies Inc. stock forecast for March 2025

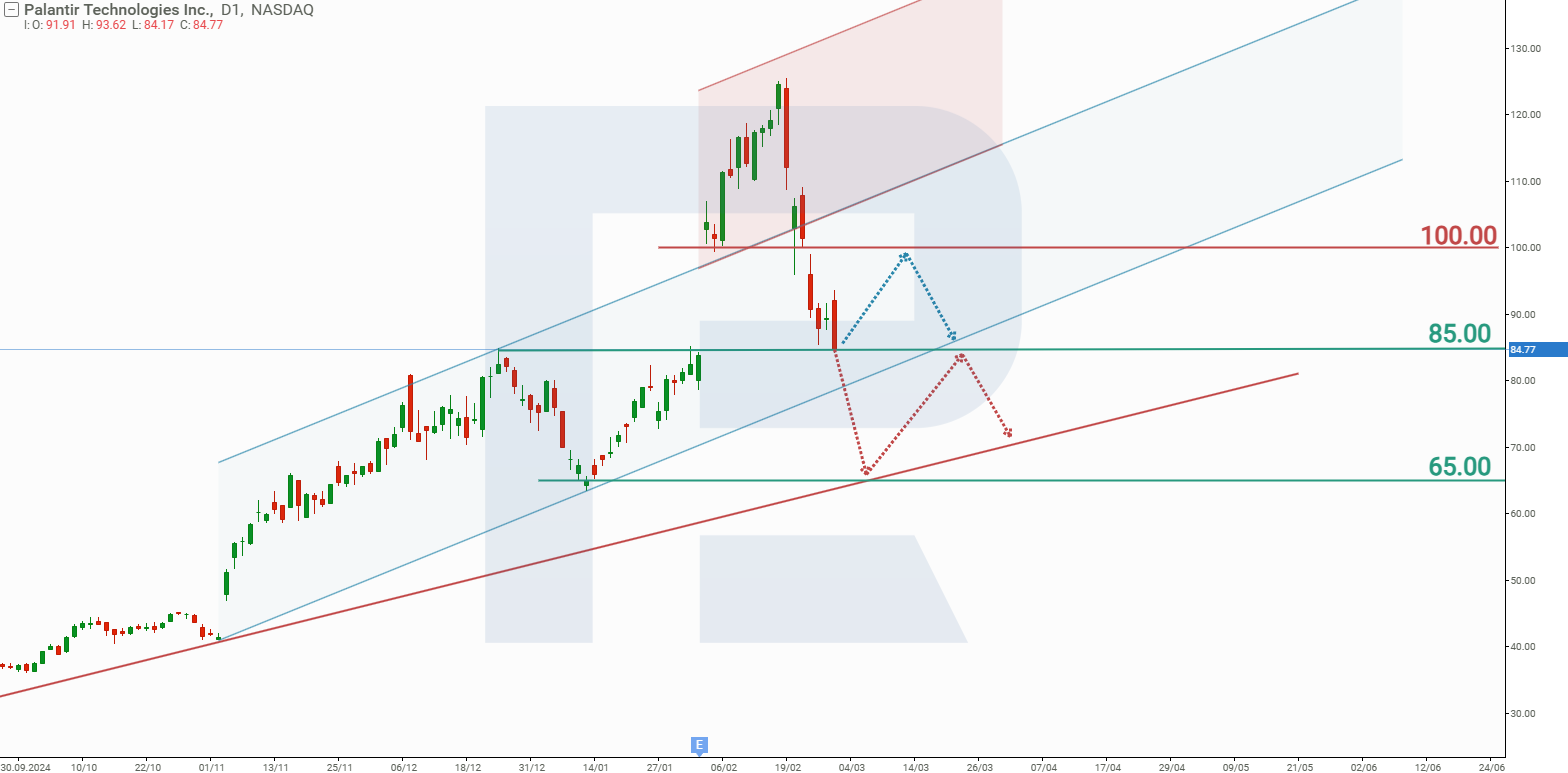

Following reports of a potential reduction in the US defence budget, Palantir’s shares dropped, breaking through support at 100 USD and falling to the next support level of 85 USD. Investors’ concerns are well-founded, as revenue from US government contracts accounts for over 40% of the company’s total revenue. Even Palantir’s optimistic 2025 outlook failed to restore investor confidence. Given the current market conditions of Palantir Technologies’ shares, let’s examine the possible price movements in March 2025.

The base-case scenario anticipates a break below support at 85 USD, potentially leading to a further decline towards 65 USD.

The alternative scenario suggests a rebound from support at 85 USD, followed by a rise towards resistance at 100 USD. However, after testing this level, the decline may resume.

Palantir Technologies, Inc. stock analysis and outlook for March 2025