The correction may soon be over, and the AUDUSD pair may embark on a new growth wave, with the price reaching last year’s highs.

AUDUSD trading key points

- Australia’s home loans (m/m): currently at -2.0% compared to the previous reading of 4.5%

- Australia’s real estate investments (m/m): currently at -1.3% compared to the previous reading of 5.3%

- CFTC net AUD speculative positions: previous reading of 23.7 thousand

- AUDUSD price targets: 0.6800, 0.6822, and 0.6858

Fundamental analysis

Following the publication of month-over-month data on home loans and Australian real estate investments, the Australian dollar is developing a corrective wave. Home loans dropped significantly in June compared to the previous period, reaching -2.0% and negatively affecting the AUDUSD rate.

Investors reduced the volume of real estate investments to -1.3%, eventually halting the bullish trend and leading the AUDUSD rate to a correction.

After completing the pullback, the Australian dollar is expected to continue strengthening ahead of interest rate revisions in Australia and the US.

AUDUSD technical analysis

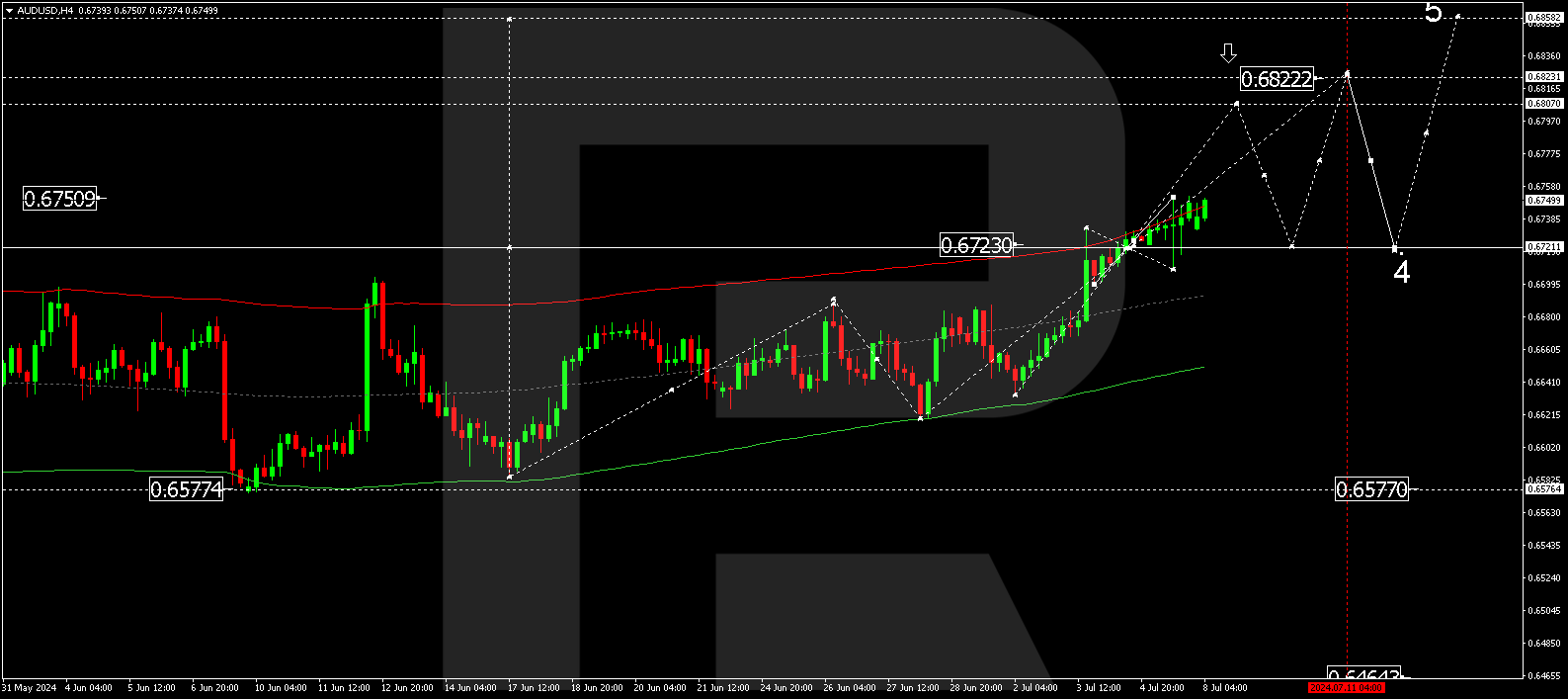

On the H4 chart, AUDUSD has formed a consolidation range around 0.6723, a crucial level for the AUDUSD pair. Today, on 8 July 2024, the price is expected to breach the 0.6750 level and exit the range upwards. A growth wave might continue to the local target of 0.6822. After reaching this target, the price could decline to 0.6750 (testing from above). Subsequently, another growth structure could develop, aiming for 0.6858.

Summary

Despite decreasing home loans and real estate investments, the AUDUSD quotes may continue their upward trajectory, aiming for the 0.6800, 0.6822, and 0.6858 targets, which aligns with the technical analysis.