The AUDUSD pair remains in a downward trend, pausing for corrections. Risk appetite is weak. Discover more in our analysis for 24 October 2024.

AUDUSD forecast: key trading points

- The AUDUSD pair declines

- The RBA is expected to keep the interest rate unchanged this year

- AUDUSD forecast for 24 October 2024: 0.6696

Fundamental analysis

The AUDUSD rate fell to 0.6647.

The Australian dollar reached a two-month low, as the strong US dollar and rising yields on US government bonds left it little chance of recovery. The market expects the Federal Reserve to gradually reduce interest rates. Investors also anticipate Donald Trump’s victory in the presidential election in November.

According to new statistical data, Australia’s private sector activity was more stable in October. Activity in the services sector continued to grow, while the manufacturing segment contracted at its sharpest pace since May 2020.

Reserve Bank of Australia Deputy Governor Andrew Hauser noted earlier this week that the central bank is ready to respond based on incoming data. He highlighted the country’s unexpectedly strong employment growth, which came as a surprise.

The baseline AUDUSD forecast appears mixed and suggests that the interest rate in Australia will remain unchanged this year.

AUDUSD technical analysis

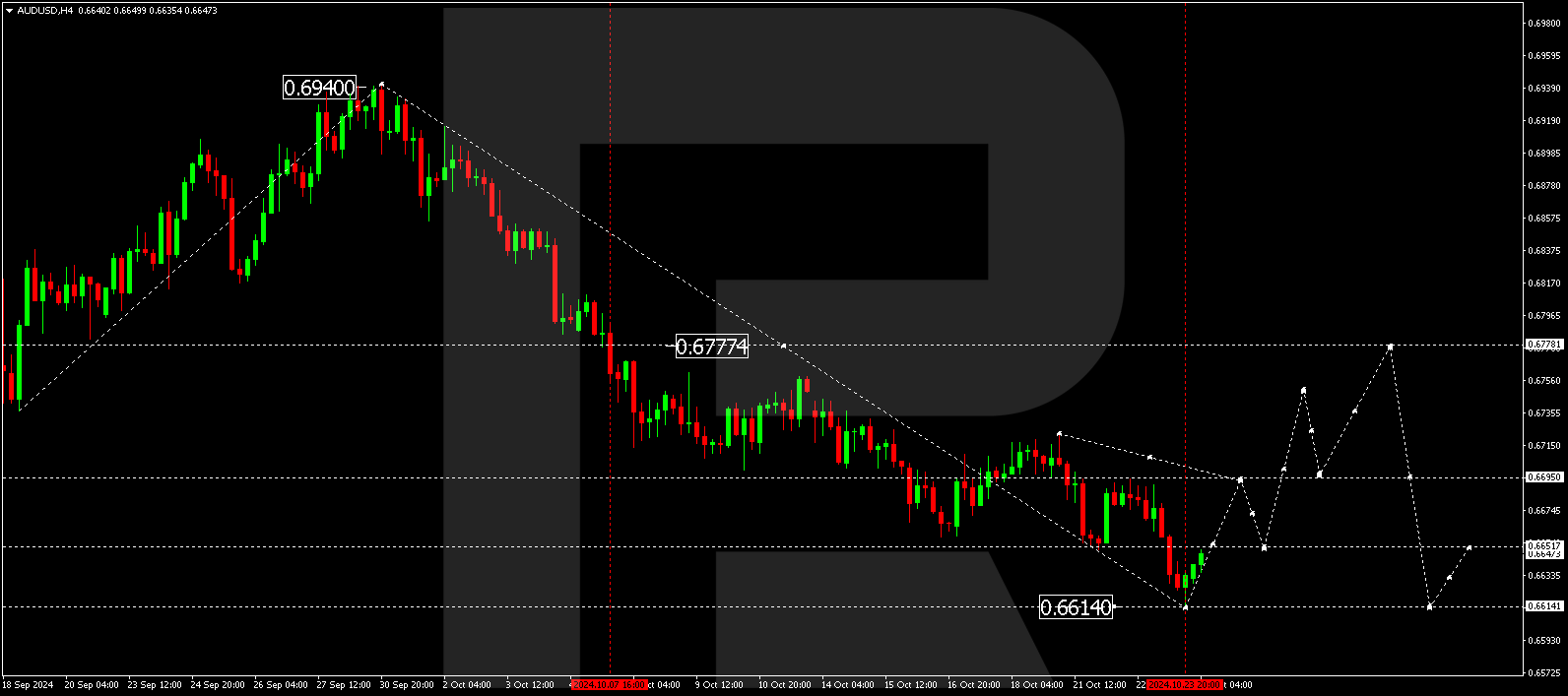

The AUDUSD H4 chart shows that the market has completed its downward movement towards 0.6614, almost reaching the target of the first downward wave. A growth wave structure in the AUDUSD rate is forming today, 24 October 2024, aiming for 0.6655 as the first target. After reaching this level, the price could decline to 0.6633, with a consolidation range forming at the lows of the downward wave. The price is expected to break above this consolidation range, targeting 0.6696.

Summary

The AUDUSD pair remains under selling pressure, with the market currently favouring the US dollar. However, technical indicators in today’s AUDUSD forecast suggest a potential growth wave towards the 0.6696 level.