AUDUSD stabilises, but this may be temporary

The AUDUSD pair has found a reason to rebound to 0.6564. The market remains tense. Find out more in our analysis for 10 October 2025.

AUDUSD forecast: key trading points

- The AUDUSD pair is recovering, but the overall trend remains bearish

- The market is watching for signals from the US regarding the government shutdown

- AUDUSD forecast for 10 October 2025: 0.6590

Fundamental analysis

The AUDUSD rate is recovering to 0.6564 on Friday. The Australian dollar rebounded from a two-week low recorded the day before, following cautious comments from Reserve Bank of Australia Governor Michele Bullock.

Bullock noted that inflation in the services sector remains persistently high. Although Q2 data came in slightly above forecasts, the overall trend is moving in the right direction. She emphasised the need for caution due to volatility in CPI readings and added that the labour market remains tight but is gradually approaching balance.

Markets generally expect the RBA to keep rates at 3.6% after holding them steady in September. Nevertheless, the Australian currency still shows a moderate weekly decline amid US dollar strength.

The USD is supported by the ongoing US government shutdown and weakness in other major currencies. However, the divergence in the monetary policy outlook between the Fed and the RBA may eventually benefit the Australian dollar. Market participants continue to price in a high probability of Federal Reserve rate cuts in October and December amid signs of labour market weakness.

The AUDUSD forecast is cautious.

AUDUSD technical analysis

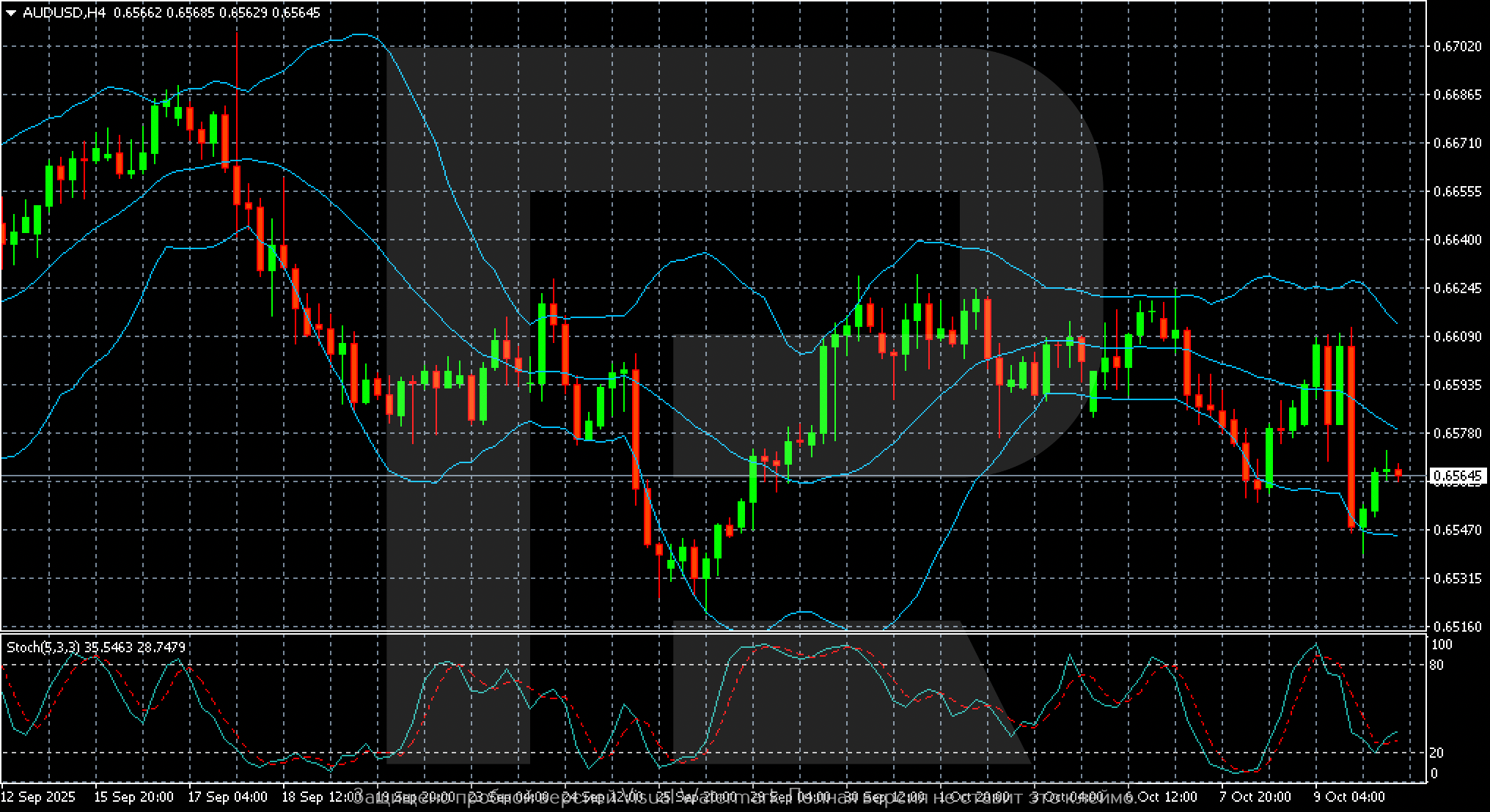

On the H4 chart, bearish pressure on the AUDUSD pair persists. After declining from 0.6670 to 0.6530 in late September, the pair moved into a sideways range between 0.6540–0.6610. The movement remains limited, and upward attempts are constrained near the middle Bollinger Band line, indicating a continuing downward momentum.

Technical indicators show signs of a short-term correction. The price has bounced off the lower Bollinger Band, and the Stochastic Oscillator has exited oversold territory. These signals may lead to a recovery towards 0.6590–0.6600. However, as long as the pair trades below the key resistance level at 0.6620, the risk of renewed decline remains.

The nearest support level is at 0.6530, and a breakout below it would open the way towards 0.6500. To confirm a reversal, the price must consolidate above 0.6600–0.6620. Overall, the market remains in a consolidation phase after the recent decline. Short-term buying looks more like a corrective move than the start of a new bullish trend.

Summary

The AUDUSD pair remains under selling pressure despite a local rebound. The AUDUSD forecast for today, 10 October 2025, suggests a slight recovery towards 0.6590.