AUDUSD strengthens despite Australia’s weak data

The AUDUSD rate is rising on Thursday following a three-day correction. Find out more in our analysis dated 29 August 2024.

AUDUSD forecast: key trading points

- Australia’s private capital expenditure decreased by 2.2%

- Private real estate investments in the Australian economy dropped by 3.8%, marking the most significant decline over the past four years

- Private equipment investments of Australian companies decreased by 0.5%

- The US dollar remains under pressure ahead of a crucial inflation data release

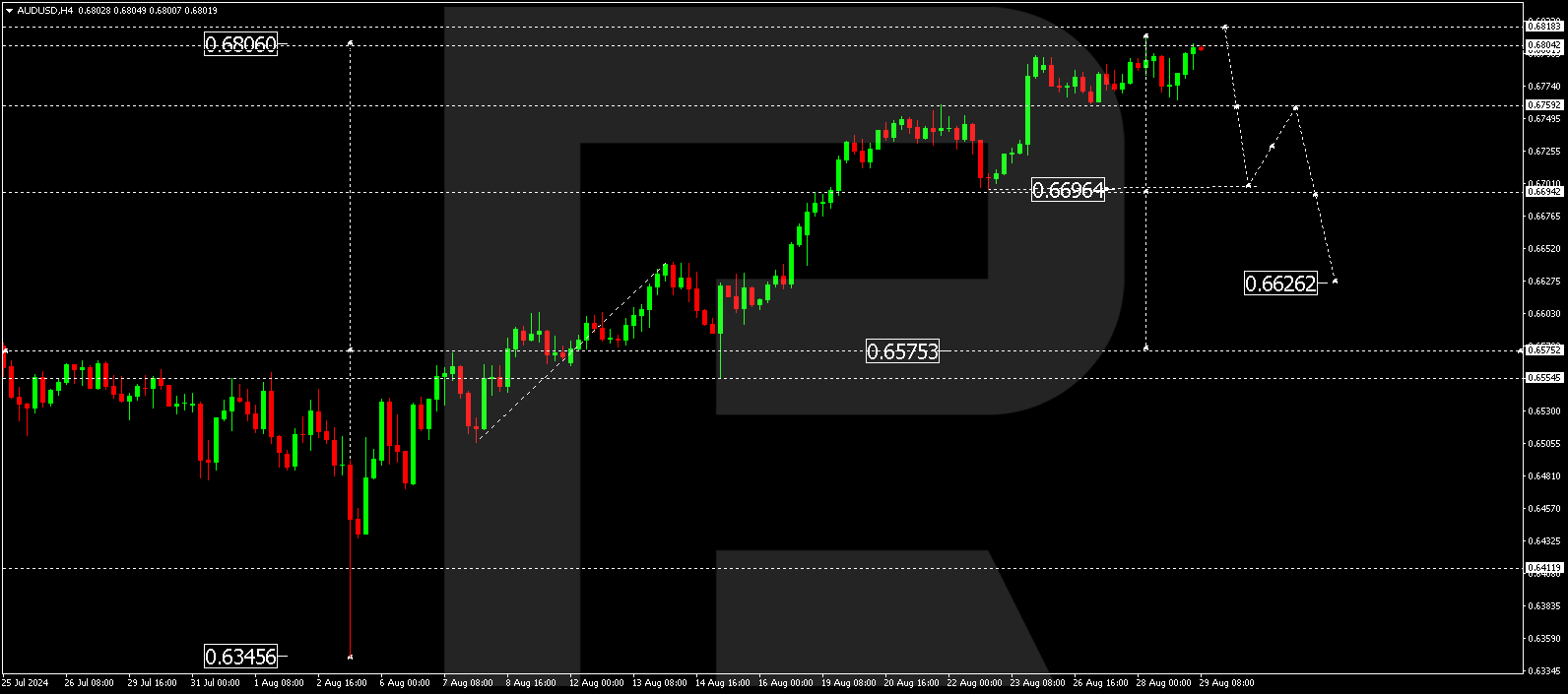

- AUDUSD forecast for 29 August 2024: 0.6760, 0.6626 and 0.6575

Fundamental analysis

The AUDUSD rate has gained a foothold above the 0.6795 resistance level and, despite negative data from Australia, has exited a sideways range where it had traded since Monday. Traders believe the USD remains under pressure ahead of a crucial US inflation data release.

The Australian economy faced an unexpected downturn, with private capital expenditure decreasing by 2.2% in Q2 2024. Following growth in the previous quarter, the indicator declined for the first time in the past two years, driven by reductions in both equipment and construction.

Australia’s private real estate investments in Q2 2024 dropped by 3.8%, marking the most significant decline in four years. The decline was primarily driven by cuts in spending on major infrastructure projects, including in the transportation and production sectors. Investments in the manufacturing sector, arts and entertainment, and transportation and logistics were most affected.

Australian companies’ equipment investments fell by 0.5% in Q2 2024, breaking a series of quarterly increases. The most noticeable decline was in non-resource economic sectors. In this context, the release of the US core PCE price index will be the week’s key event and may significantly impact further movements in the pair as part of today’s AUDUSD forecast.

AUDUSD technical analysis

The AUDUSD H4 chart shows that the market continues to develop a consolidation range at the top of a growth wave. The consolidation range could expand to 0.6818 today, 29 August 2024. Subsequently, the AUDUSD rate could decline to the lower boundary of the range at 0.6760. A breakout below the range will open the potential for a wave towards 0.6696, the first target. Following this, a correction could start, aiming for 0.6560 (testing from below). A downward wave could develop, targeting the 0.6626 and 0.6575 levels.

Summary

The decline in Australia’s capital and investment expenditure emphasises economic instability. Nevertheless, the AUDUSD pair is rising thanks to pressure on the US dollar ahead of a crucial inflation data release. Technical indicators in today’s AUDUSD forecast suggest a potential decline to the 0.6760, 0.6626, and 0.6575 levels.