A decline in Australia’s PPI may help the Australian dollar to rise to 0.6250 USD. Find out more in our analysis for 31 January 2025.

AUDUSD forecast: key trading points

- Australia’s PPI in Q4: previously at 3.9%, currently at 3.7%

- US core PCE price index for December: previously at 2.8%, currently at 2.8%

- AUDUSD forecast for 31 January 2025: 0.6200 and 0.6250

Fundamental analysis

The Producer Price Index (PPI) is an inflation gauge that tracks average price changes for goods and services sold by domestic producers. The index records price changes from the sellers’ perspective and covers three production sectors: manufacturing, commodities, and processing. The PPI is often regarded as a leading inflation gauge for consumers, as rising producer costs for products and services typically filter through to consumers.

Fundamental analysis for 31 January 2025 takes into account that Australia’s actual PPI has decreased to 3.7% from the previous period.

The forecast for 31 January 2025 takes into account that the US core PCE price index for December may remain flat at 2.8%. Given this, today’s AUDUSD forecast appears rather optimistic, with the Australian dollar able to regain ground against the USD.

AUDUSD technical analysis

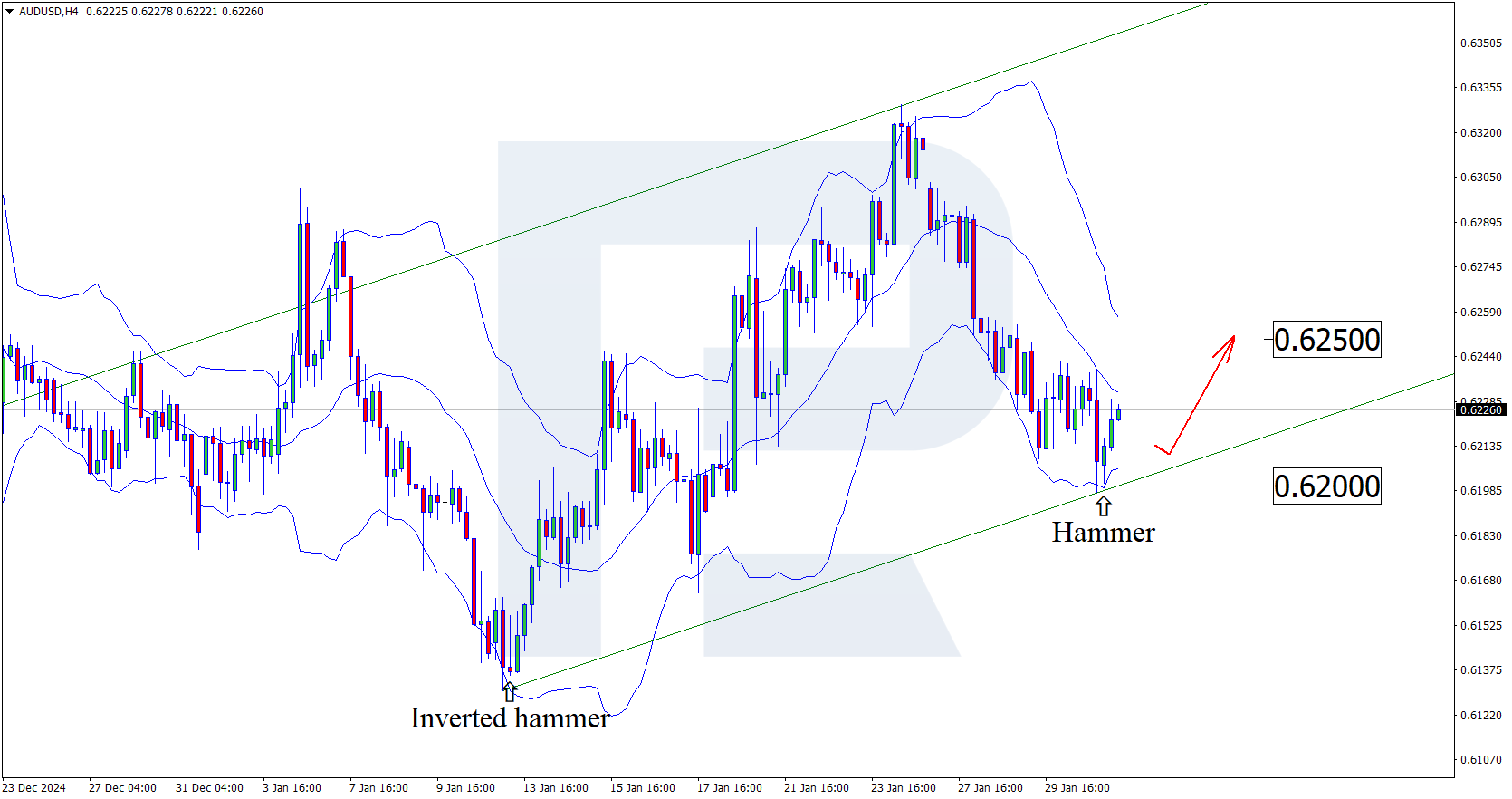

Having tested the lower Bollinger band, the AUDUSD price has formed a Hammer reversal pattern on the H4 chart. At this stage, it continues its upward trajectory following the signal received. The price could rise to the nearest resistance level at 0.6250 as it remains within the ascending channel. A breakout above this level will open the door for the development of the uptrend.

However, the AUDUSD rate could undergo a correction towards 0.6200 before gaining upward momentum.

Summary

Together with the AUDUSD technical analysis, positive fundamental data from Australia suggests growth towards the 0.6250 resistance level.