AUDUSD: the pair may continue to fall, having completed its correction

Michele Bullock’s speech and increased US jobless claims may support the AUDUSD pair in forming a corrective wave. More details in our analysis for 21 November 2024.

AUDUSD forecast: key trading points

- A speech by Reserve Bank of Australia Governor Michele Bullock

- US initial jobless claims: previously at 217,000, currently at 220,000

- The US Philadelphia Fed Manufacturing Index: previously at 10.3, projected at 6.3

- AUDUSD forecast for 21 November 2024: 0.6430

Fundamental analysis

Fundamental analysis for 21 November 2024 takes into account the upcoming speech by Federal Reserve Bank of Australia Governor Bullock, which often provides insight into the development of Australia’s monetary policy.

According to the forecast for 21 November 2024, US initial jobless claims are expected to rise to 220,000, potentially offsetting some of the Australian data, which could become a positive factor for the Australian dollar.

The Philadelphia Fed Manufacturing Index reflects the health of the economy in the region’s manufacturing sector. A reading above zero indicates growth and improving conditions, while a value below zero suggests deterioration.

The index is based on surveys of about 250 manufacturers across the Philadelphia federal district. The reading is projected to decrease to 6.3 from the previous 10.3. The drop in the indicator may adversely impact the US dollar to Australian dollar rate.

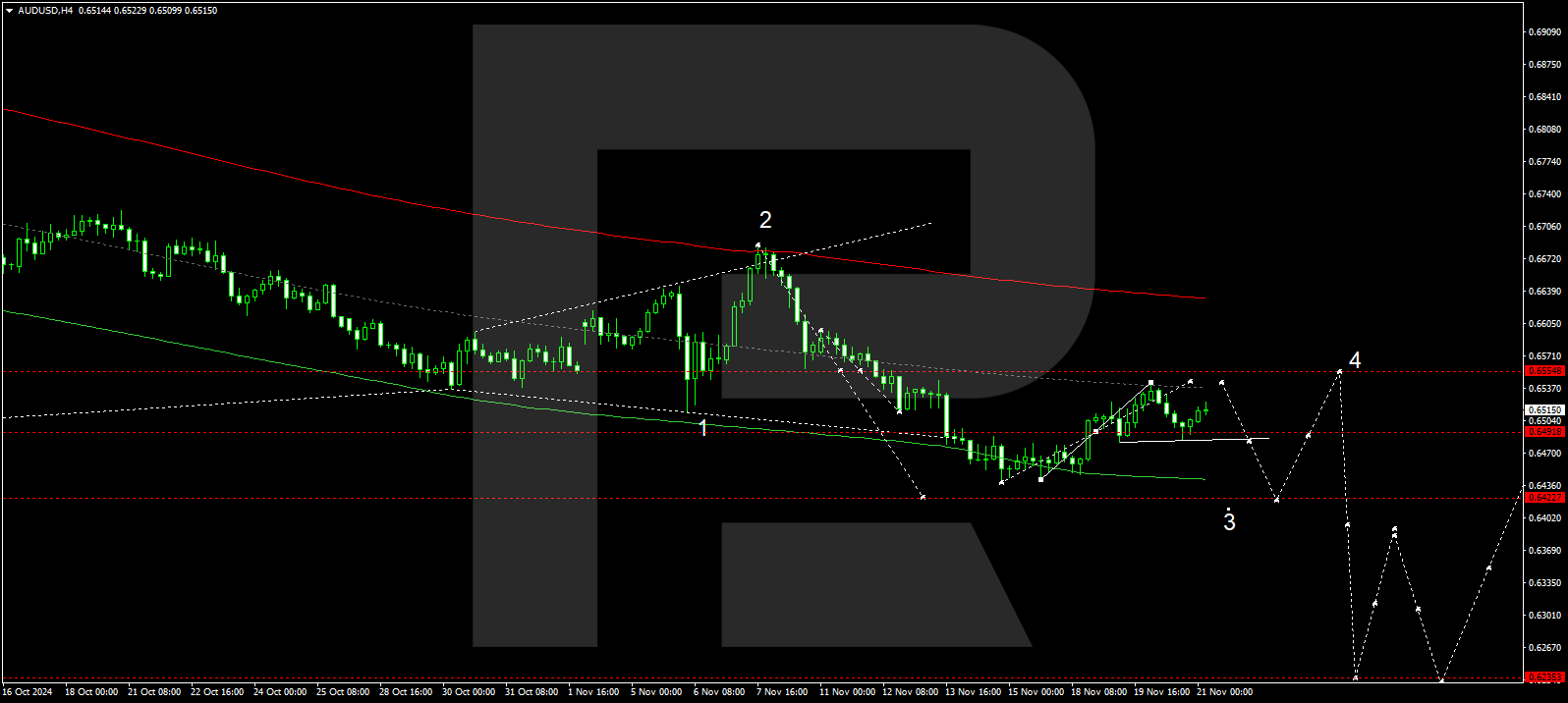

AUDUSD technical analysis

The AUDUSD H4 chart shows that the market has formed a narrow consolidation range around 0.6491 and, breaking above it, corrected towards 0.6543. A corrective move to 0.6545 is possible today, 21 November 2024. Once completed, a downward wave is expected, aiming for 0.6430 as the local estimated target. A wide consolidation range is forming around 0.6555.

The Elliott Wave structure and downward wave matrix, with a pivot point at 0.6555, technically support this scenario for the AUDUSD rate. The market has declined to the lower boundary of a price envelope at 0.6480. A corrective wave might develop, targeting its central line at 0.6545. Subsequently, a downward wave is expected to form, aiming for the envelope’s lower boundary at 0.6430.

Summary

With technical analysis for today’s AUDUSD forecast, negative US news suggests a potential correction towards 0.6545, followed by a decline to 0.6430.