Brent crude oil price is rising on Friday, surpassing the upper boundary of the sideways price range.

Brent is on the rise as part of the uptrend after completing a correction and exiting the sideways range

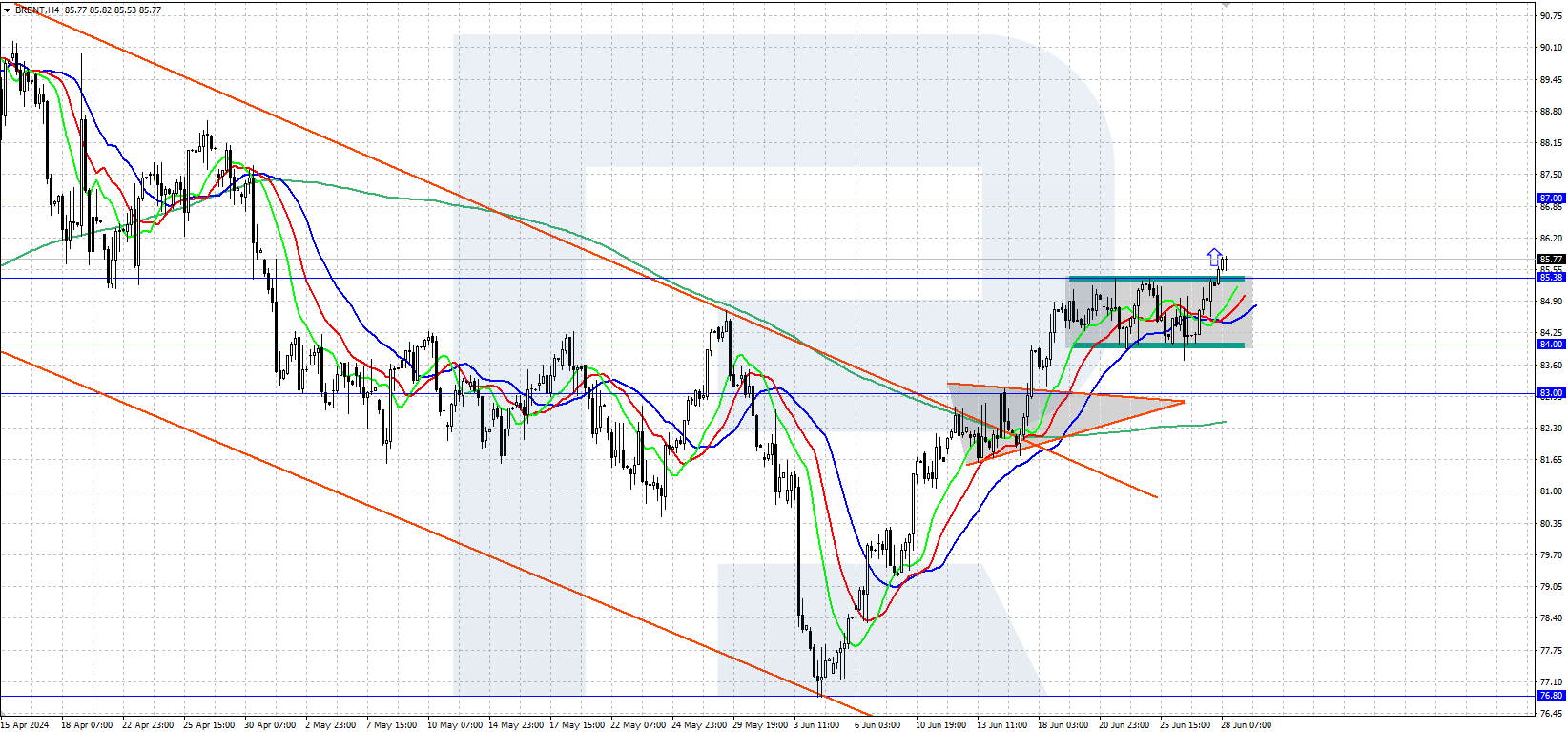

Brent crude oil price rose on Friday, surpassing the upper boundary of the sideways price range. Bulls currently have the initiative to push prices up as part of the uptrend. Not even the Energy Information Administration (EIA) data on increasing US oil stocks helped the bears. According to statistics released on Wednesday, reserves rose by 3.59 million barrels, whereas a decrease of 3.00 million was expected.

The increase in stocks based on the EIA data exerted only short-term pressure on Brent prices. Following the release of the statistics, quotes fell to the lower boundary of the sideways range at 84.00. However, bulls reversed the market upwards, establishing a foothold above the upper boundary at 85.38 today. Oil prices are actively rising after the release of the latest OPEC report, which anticipates sustained growth in demand for energy products in the second half of 2024.

Brent technical analysis

On the H4 chart, Brent crude oil price is experiencing strong upward momentum. Following a correction within the sideways range, quotes found support above the 85.38 resistance level, which was the upper boundary of the sideways range. It is now possible to anticipate the continuation of the uptrend, particularly as the Alligator indicator confirms growth and forms a buy signal.

A short-term forecast suggests further price increases for Brent. The uptrend remains in force, with the nearest growth target at the daily resistance level of 87.00. If the price secures below the 84.00 support level, this will invalidate the growth scenario and signal a downward correction.

Summary

Brent quotes demonstrate steady growth on the price chart, breaking above the upper boundary of the sideways range, where they had consolidated since the end of last week. The target for further growth is the 87.00 resistance level.