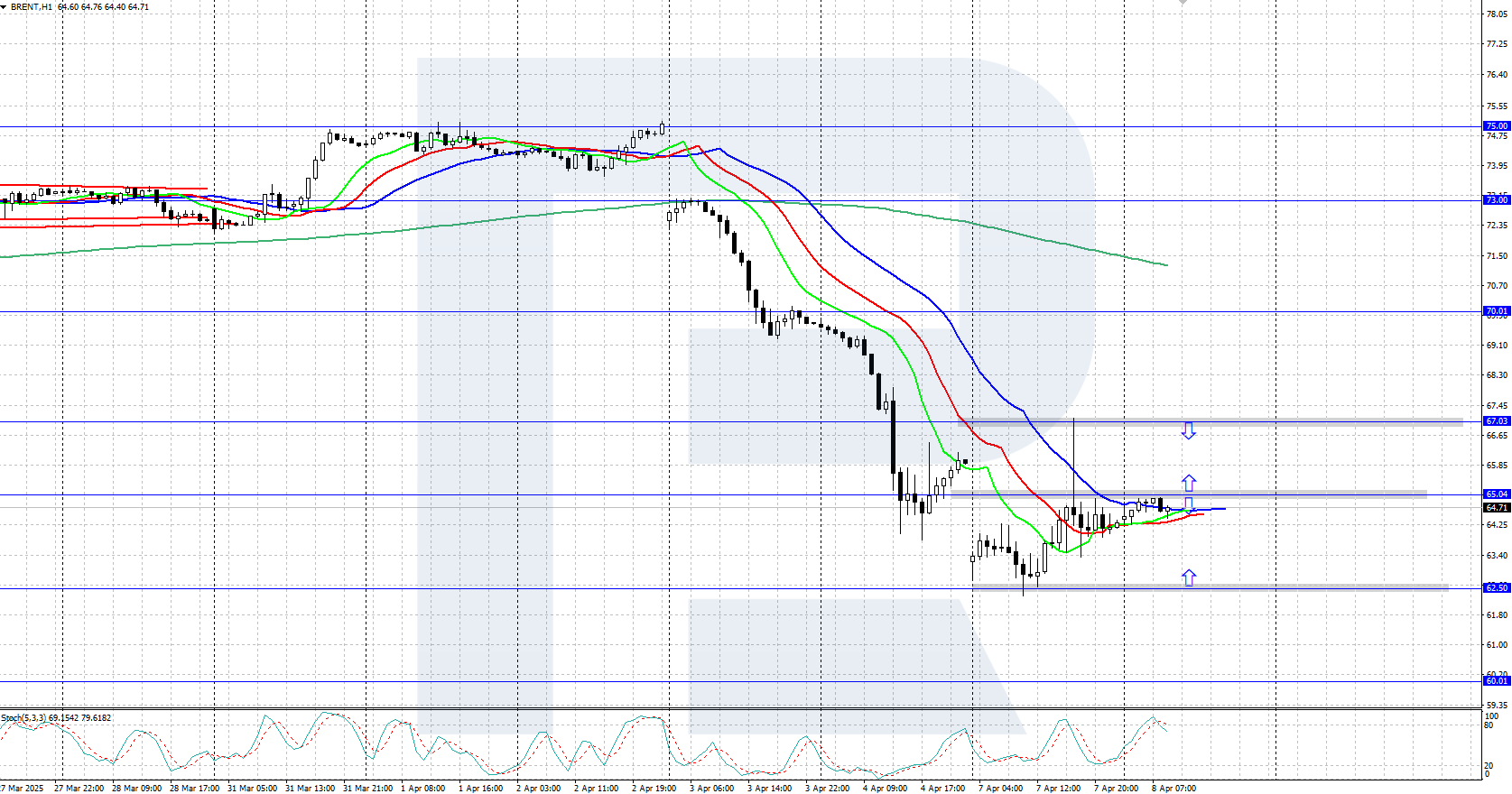

Brent prices corrected to around 65.00 USD after falling to 62.50 USD on Monday. Today, market focus shifts to US crude oil inventory data from API. Discover more in our Brent analysis for 8 April 2025.

Brent forecast: key trading points

- Brent quotes are recovering after falling sharply on Monday

- The market awaits US crude oil inventory data from API today

- Brent forecast for 8 April 2025: 65.00 and 62.50

Fundamental analysis

The recent decline in oil prices stems from fears that President Donald Trump's trade war may trigger a global recession and reduce energy demand. On Monday, Trump threatened to impose an additional 50% tariff on China starting Wednesday if Beijing does not withdraw its retaliatory measures.

At the same time, the EU proposed 25% counter-tariffs on several US goods. Additional pressure came from a planned increase in OPEC+ output starting in May and Saudi Arabia's decision to cut its official selling prices for next month.

During today’s American session, Brent price moves may be influenced by crude oil inventory data from the American Petroleum Institute (API).

Brent technical analysis

Brent quotes corrected towards the 65.00 USD resistance level after the decline triggered by another escalation of the tariff war. The daily chart shows strong downward momentum. After the current correction, the decline may continue, with a key support level at 62.50 USD.

The short-term Brent price forecast suggests that prices could revisit the 67.00 USD area if the bulls push quotes above 65.00 USD. However, if the bears maintain control, a further decline to the 62.50 USD support level is possible.

Summary

Brent crude recovered to the 65.00 USD area after a sharp drop, but the risk of further decline persists. During the American session, markets will closely monitor API US crude oil stock data.