Brent price closed yesterday’s session with sustained growth, driven by statistics on decreased US oil inventories. Find out more in our Brent analysis for today, 8 August 2024.

Brent trading key points

- US data: according to EIA data, US oil inventories decreased by 3.7 million barrels last week

- Brent forecast for 8 August 2024: 79.30 and 76.80

Fundamental analysis

Brent quotes have halted their decline during the downward correction, showing steady growth by the end of yesterday. This was likely fuelled by the US oil stock data released by the Energy Information Administration (EIA) during the American trading session, which indicated a decrease of 3.7 million barrels.

Oil prices have recently been falling under pressure from declining global stock markets and potential signs of a looming recession in Japan. However, the reduction in inventories (according to the EIA data) and the escalating Middle East conflict support oil prices.

Brent technical analysis

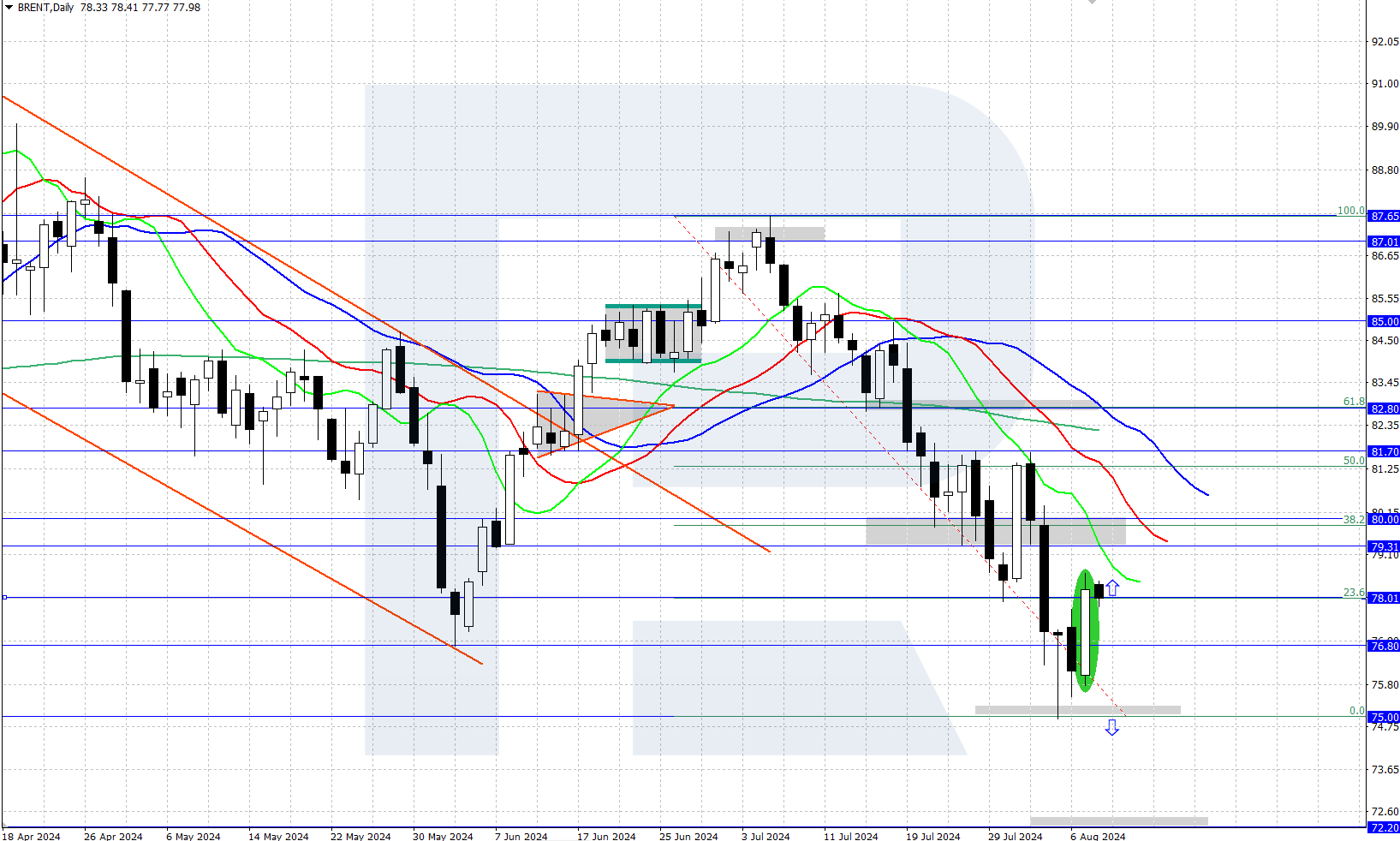

Brent price halted its decline after reaching a local low of 75.00, with the quotes currently hovering around 78.00. A bullish engulfing candlestick pattern formed on the daily chart, indicating a potential upward reversal in the daily trend.

The short-term Brent price forecast suggests that the price could rise to the 79.30-80.00 resistance area and possibly higher if the bullish engulfing candlestick pattern realises. If bearish pressures push the quotes below 75.00, the growth scenario will be invalidated, potentially leading the price to a new daily low of 72.20.

Summary

A bullish engulfing candlestick reversal pattern has formed on the Brent crude oil daily chart, signalling a potential upward trend reversal. The EIA data on decreased oil inventories and the escalating conflict in the Middle East support oil prices.