Brent quotes remain under pressure, trading slightly below 68.00 amid concerns about a global economic slowdown. Discover more in our analysis for 17 July 2025.

Brent forecast: key trading points

- Market focus: US crude oil inventories fell by 3.85 million barrels (expected decline of 1.8 million barrels), according to the Energy Information Administration (EIA)

- Current trend: a downtrend is underway

- Brent forecast for 17 July 2025: 70.00 or 66.00

Fundamental analysis

Yesterday’s data from the Energy Information Administration showed a decline in US crude oil inventories by 3.85 million barrels, with gasoline and diesel fuel stocks rising more than expected.

Brent remains under pressure due to easing geopolitical tensions in the Middle East. Additionally, investors worry about potential oversupply and the impact of US trade tariffs on global economic growth and fuel demand.

Brent technical analysis

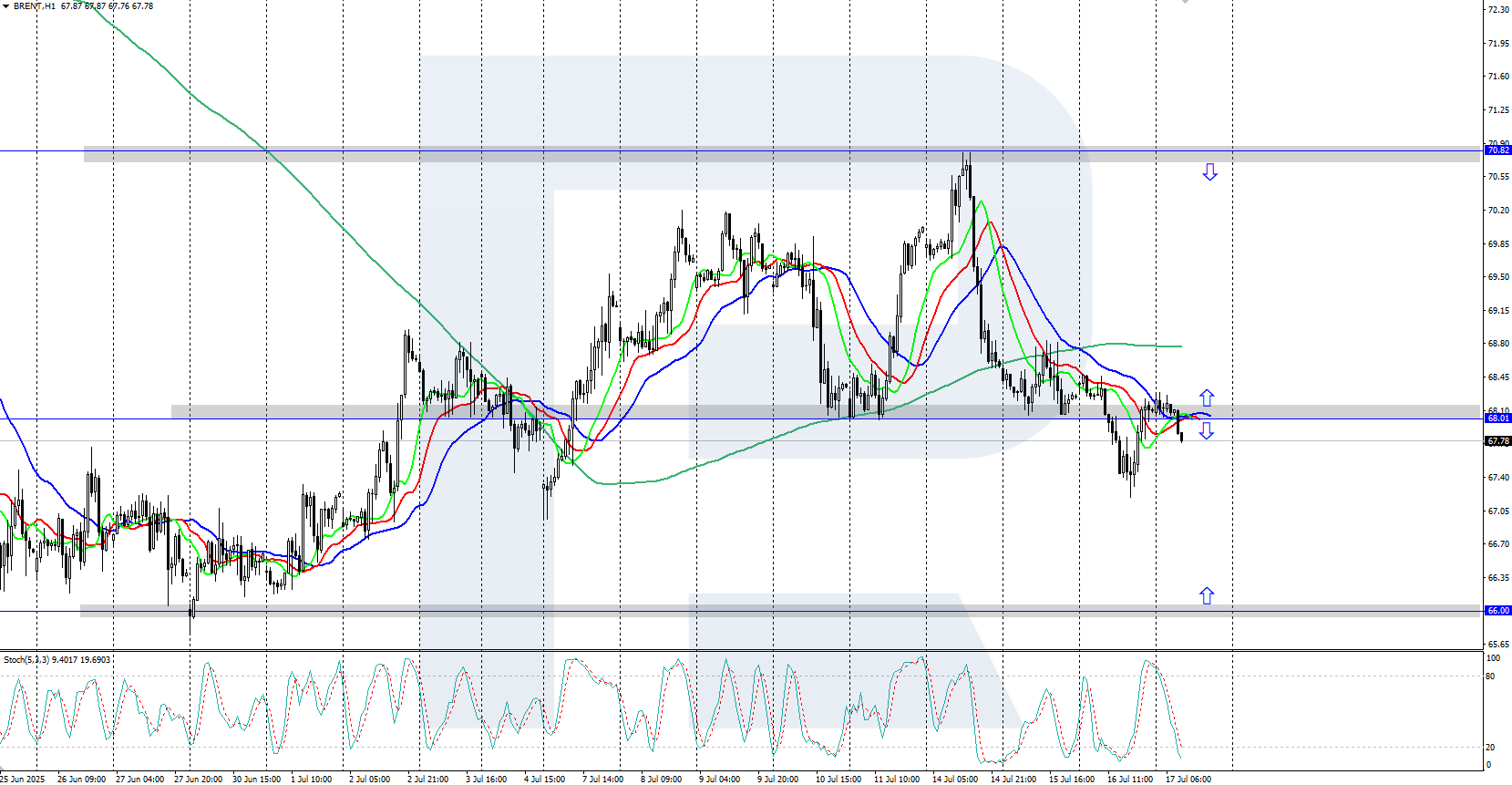

The Brent H4 chart shows a downtrend after prices reversed from the daily high around 77.00. Quotes are now trading within a wide sideways range between 70.80 and 66.00 USD. The direction of a breakout from this range will indicate further prospects for the asset’s movement.

The short-term Brent price forecast suggests a move towards 70.00 USD or higher if the bulls push prices back above 68.00 USD. Conversely, if the bears secure a firm hold below 68.00 USD, the downward move could extend towards 66.00 USD.

Summary

Brent prices slipped below 68.00 amid concerns about global economic growth. The trend remains bearish, with further declines possible.