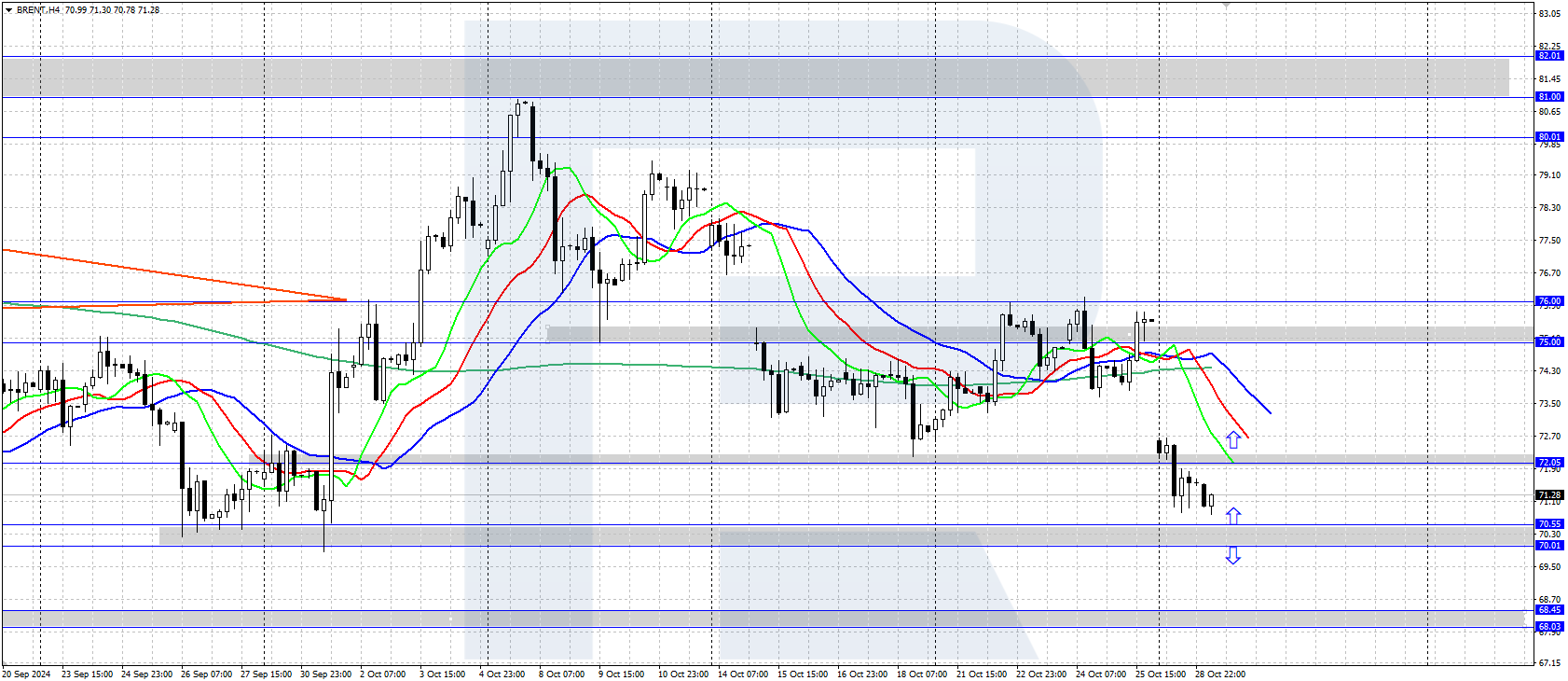

Brent dropped to the area around 71.00 USD

Brent prices continue to decline moderately after the underwhelming OPEC report and eased concerns over a potential escalation of the Middle East conflict. Discover more in our Brent analysis for today, 29 October 2024.

Brent forecast: key trading points

- US data: API crude oil inventory statistics will be released today

- Current trend: a downward movement is underway

- Market focus: market participants await US labour market statistics this week

- Brent forecast for 29 October 2024: 72.00 and 70.00

Fundamental analysis

Oil quotes fell to around 71.00 USD at the start of the week amid decreasing concerns over an escalation of the Middle East conflict. Israel conducted a counterattack on Iran over the weekend, avoiding energy infrastructure and focusing solely on military targets. The limited scope of the attack fuels hopes for a potential ceasefire.

The US crude oil inventory report from the American Petroleum Institute (API) is scheduled for release today. This week, the market also awaits US labour market statistics, with employment data from Automatic Data Processing Inc. (ADP) due on Wednesday, and nonfarm payrolls and the unemployment rate scheduled for Friday.

Oil will probably react to the US stock market’s response to the employment data. A stock rise will help strengthen Brent prices, while a decrease will push them down.

Brent technical analysis

Brent’s quotes show a downward movement. The asset price fell to around 71.00 USD, where it found temporary support from buyers. The daily trend is currently downward, and the decline will likely continue. The nearest strong support is the 70.00-70.55 USD price range.

The short-term Brent price forecast suggests that if bulls manage to hold above 72.00 USD, the price could rise further (and close the gap) to the 75.00 USD resistance level. If bears maintain pressure and push the price below 70.00 USD, it could fall further to the 68.00-68.50 USD support level.

Summary

Brent quotes continue to decline moderately, falling to around 71.00 USD amid growing hopes for a potential Middle East ceasefire. US crude oil inventory data from the American Petroleum Institute (API) may further impact oil price movements today.