Brent falls into the hands of the bears: rising supply signals nothing good

Brent slipped to 66.42 USD per barrel. The market is filled with negativity ahead of additional supply entering the market. Discover more in our analysis for 30 September 2025.

Brent forecast: key trading points

- Brent crude declines under pressure from geopolitics and OPEC+ rhetoric

- Additional supply on the global market will push prices down even faster

- Brent forecast for 30 September 2025: 65.40

Fundamental analysis

Brent crude fell to 66.42 USD per barrel on Tuesday, extending the decline of the previous session. Prices are under pressure from expectations of increased global supply and discussions of a possible ceasefire in Gaza.

Media reports suggest that at Sunday’s meeting, OPEC+ may approve an additional output increase of at least 137,000 barrels per day starting in November.

Another factor was the resumption of oil exports from Iraqi Kurdistan. Flows through the Iraq–Turkey pipeline were restored on Saturday after a US-brokered agreement between regional authorities, Baghdad, Turkey, and foreign companies.

On the geopolitical front, US President Donald Trump and Israeli Prime Minister Benjamin Netanyahu announced a preliminary agreement on a 20-point US peace plan for Gaza. At the same time, Trump warned that if Hamas rejects it, Israel will receive Washington’s full support to continue operations.

Meanwhile, the EU reinstated sanctions against Iran for failing to comply with the nuclear deal, echoing the UN’s position.

The Brent forecast is mixed.

Brent technical analysis

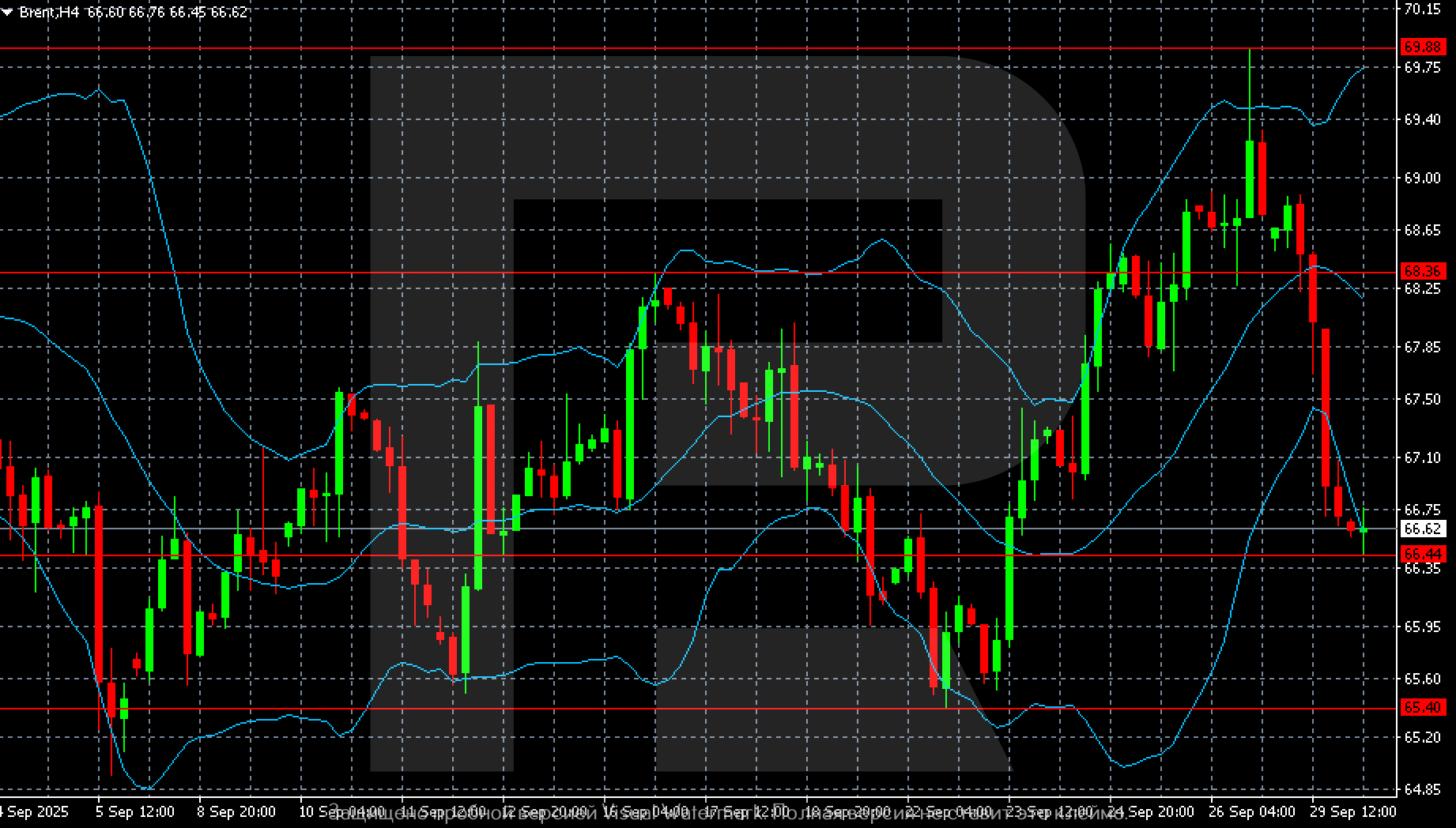

On the H4 chart, Brent prices sharply reversed downwards after climbing to highs near 69.90.

Breaking below the 68.36 support level, quotes dropped to the 66.50 area. Currently, prices are testing the 66.44 level, which acts as the nearest support. Bollinger Bands are widening, reflecting higher volatility and the likelihood of continued downward pressure.

Consolidation below 66.40 would open the way towards the next target around 65.40. The resistance level has now shifted to 68.30, and a move back above this level would signal weakening bearish momentum. Thus, the oil market has entered a correction phase after failing to consolidate near the upper boundaries of the range.

Summary

Brent crude failed to sustain the growth wave and is correcting lower. The Brent forecast for today, 30 September 2025, does not rule out a further decline to 65.40.