Brent prices fell below 65 USD on Thursday as the market grew uneasy about a global oil glut. Find more details in our analysis for 5 June 2025.

Brent forecast: key trading points

- Brent crude remains under pressure due to the potential rise in global supply

- Asian demand for crude is declining

- Brent forecast for 5 June 2025: 64.04

Fundamental analysis

Brent quotes fell to 64.75 USD per barrel by Thursday. Losses from the previous session remain in place as investors are wary of signals regarding global oversupply.

Saudi Arabia, a key oil producer, is pushing for a significant production increase under the OPEC+ agreement – at least 411,000 barrels per day in August and possibly in September. The aim is to strengthen market positioning during the summer demand peak.

For Asian buyers, Saudi Arabia slashed July crude oil prices to the lowest in nearly four years, clearly signalling weakening demand in the region. Meanwhile, official US data showed a decline in crude oil inventories for the week, while gasoline and distillate stockpiles rose more than expected, adding to pressure on oil prices.

The Brent forecast is cautious.

Brent technical analysis

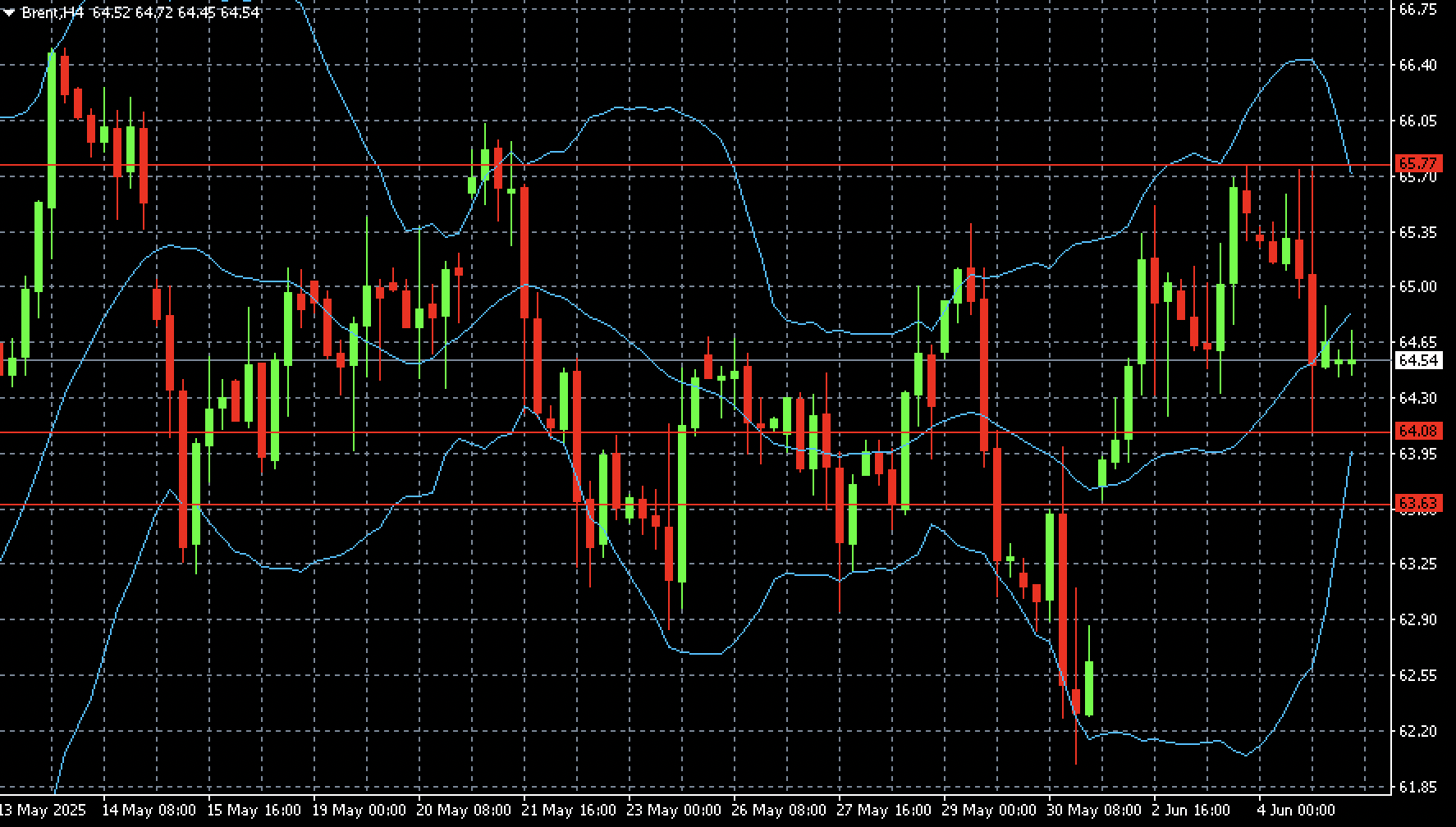

On the H4 chart, Brent is setting up for a decline towards 64.04. A breakout below the 64.00-64.05 area could pave the way for further selling down to 63.63.

Summary

Brent prices are falling, with the market having plenty of justification: waning oil demand in Asia and the likelihood of increased supply from OPEC+ producers. The Brent forecast for today, 5 June 2025, suggests a further decline to 64.04.