Brent forced to reassess its outlook

Brent crude prices have slipped to 65.86 USD per barrel as the market reacts swiftly to changing headlines and shifting sentiment. Details — in our analysis for 28 October 2025.

Brent forecast: key trading points

- Brent continues to decline and may enter a sideways range.

- Rapid changes in news flow are forcing investors to reassess the outlook.

- Brent forecast for 28 October 2025: 64.00 and 63.50.

Fundamental analysis

On Tuesday, Brent crude oil fell for the third consecutive session, dropping to 64.86 USD per barrel amid growing concerns of oversupply following signals from OPEC+ about a potential output increase.

According to sources, at the upcoming Sunday meeting, members of the alliance are expected to discuss a moderate production hike for December, with Saudi Arabia reportedly pushing to regain lost market share.

Adding to the downside pressure, analysts noted that U.S. sanctions against Russian oil companies may turn out to be less severe than anticipated. Reports suggest that Washington’s strategy focuses on complicating and raising the costs of Russian oil trade without triggering a fresh surge in global prices.

These developments outweighed optimism stemming from progress in U.S.–China trade negotiations, where high-level delegates agreed on a framework deal that Presidents Donald Trump and Xi Jinping are expected to formalize later this week in South Korea.

Overall, the short-term Brent forecast remains moderate, reflecting a fragile balance between supply-side concerns and global economic optimism.

Brent technical analysis

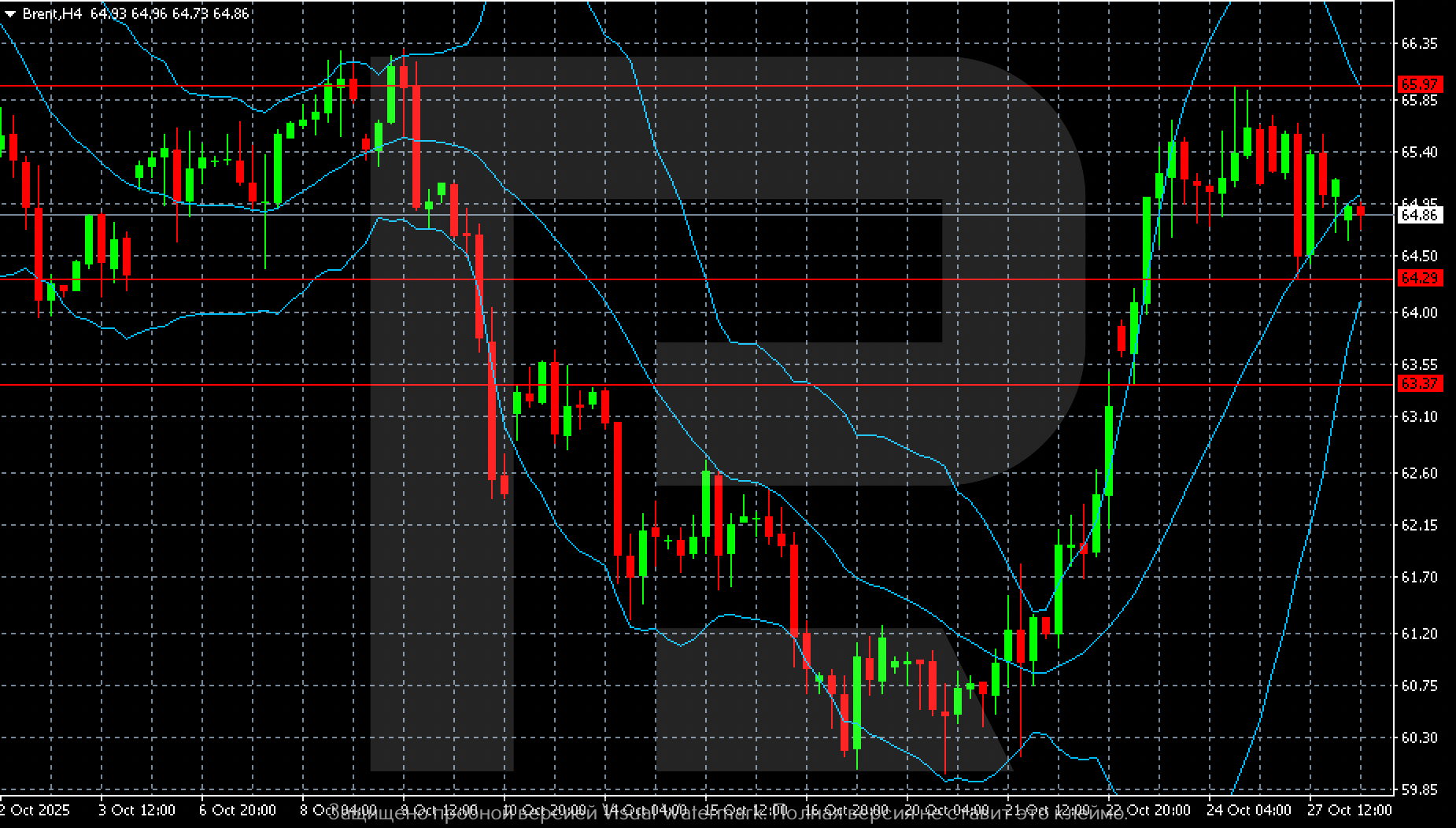

On the H4 chart, Brent shows a recovery pattern following sharp losses seen earlier in October. The monthly lows near 60 USD marked a turning point, with prices rebounding above 65 USD by October 25.

Currently, the asset is consolidating after its rapid rise. The nearest resistance lies at 65.9 USD, where sellers have repeatedly emerged. Support levels are seen at 64.3 and 63.3, both of which previously acted as demand zones.

The Bollinger Bands indicate that prices have exited overbought territory and moved back inside the channel, signaling potential for a short-term correction. However, the indicator’s midline remains upward-sloping, confirming that the broader trend is still bullish.

As long as prices hold above 63.3 USD, the market retains potential for another test of the 66.00 USD mark. In the near term, sideways movement or a mild pullback toward 64.00–63.50 USD appears likely as traders lock in profits.

Summary

Brent crude continues to face pressure from multiple fronts — OPEC+ supply expectations, geopolitical headlines, and shifting sentiment. The Brent forecast for today, October 28, 2025, suggests potential movement toward 64.00 USD and possibly 63.50 USD before renewed buying interest emerges.