Although Brent’s price has declined following the EIA US oil stock data release, growth prospects persist. Find out more in our Brent analysis for today, 29 August 2024.

Brent forecast: key trading points

- Market focus: market participants await the Q2 US GDP data today

- Current trend: oil is trading within a broad sideways range

- Brent forecast for 29 August 2024: 80.50 and 75.00

Fundamental analysis

Oil prices have gradually declined, falling below 78.00 USD. The Energy Information Administration (EIA) released US oil inventory data yesterday. According to the statistics, US hydrocarbon reserves decreased by just 0.84 million barrels over the past week, while the forecast had suggested a decrease of 3.00 million.

Market participants anticipate the release of the Q2 US GDP data during the American session, with experts forecasting the indicator to come in at 2.8%. More significant GDP growth would support the stock market and Brent price, while weaker-than-forecasted readings could lead to further declines in oil prices.

Brent technical analysis

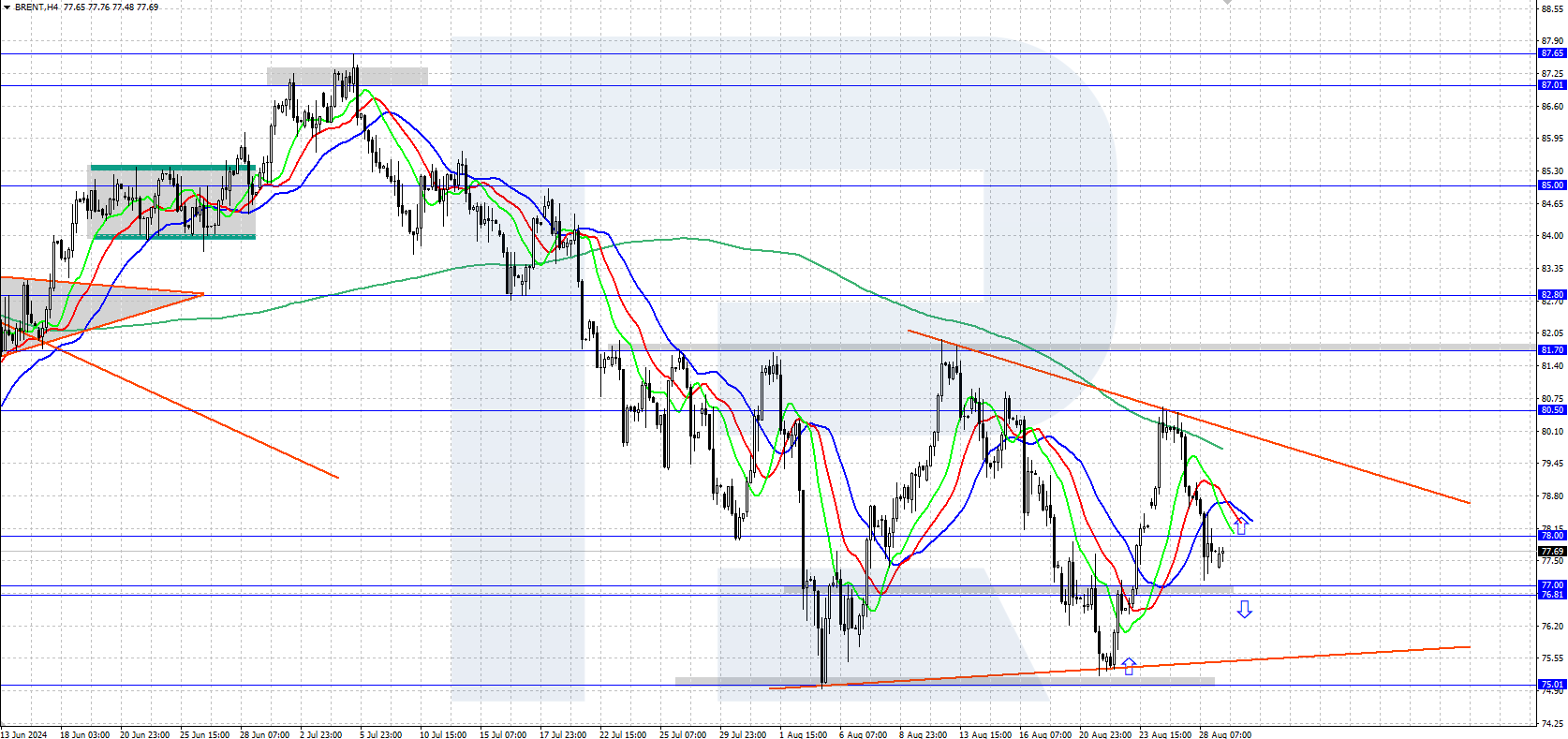

Oil is now trading within a broad sideways range. Brent quotes are experiencing a moderate decline after bulls failed to overcome bears’ resistance at the 80.50 level at the start of the week. A triangle price pattern is forming on the H4 chart; the direction of the price movement out of the pattern will outline further prospects for oil price movements.

The short-term Brent price forecast suggests that quotes could potentially return to the 80.50 resistance level if bulls halt a price decline and push the price back above 78.00. If bears continue to dominate and send the oil price below 77.00 USD, it will likely decline towards the support area near 75.00.

Summary

Oil prices are moderating their decline, falling below the 78.00 USD mark. Market focus is on the Q2 US GDP data today, with the release potentially adding to volatility in Brent quotes.