Brent crude oil price continues to strengthen after breaking above a sideways range. Market participants are awaiting the US crude oil stock statistics.

Brent trading key points

- Current trend: Brent is trading within an uptrend, which formed after the recent OPEC meeting

- Market focus: The release of the API and EIA crude oil stock statistics and US employment market data

- Price dynamics: Brent quotes are rising moderately after breaking above a sideways range

- Brent price targets: 87.00, 83.00

Brent fundamental analysis

Brent crude oil price is rising after breaking above a sideways range. The market is preparing to assess the US crude oil stock statistics. The American Petroleum Institute (API) will release oil reserve data during the American trading session, while the Energy Information Administration (EIA) statistics are scheduled for tomorrow.

Further oil price movements will depend on oil stock statistics and the US employment market data. Following these releases, market volatility is expected to increase, leading to further growth or a reversal and the beginning of a downward correction.

Brent technical analysis

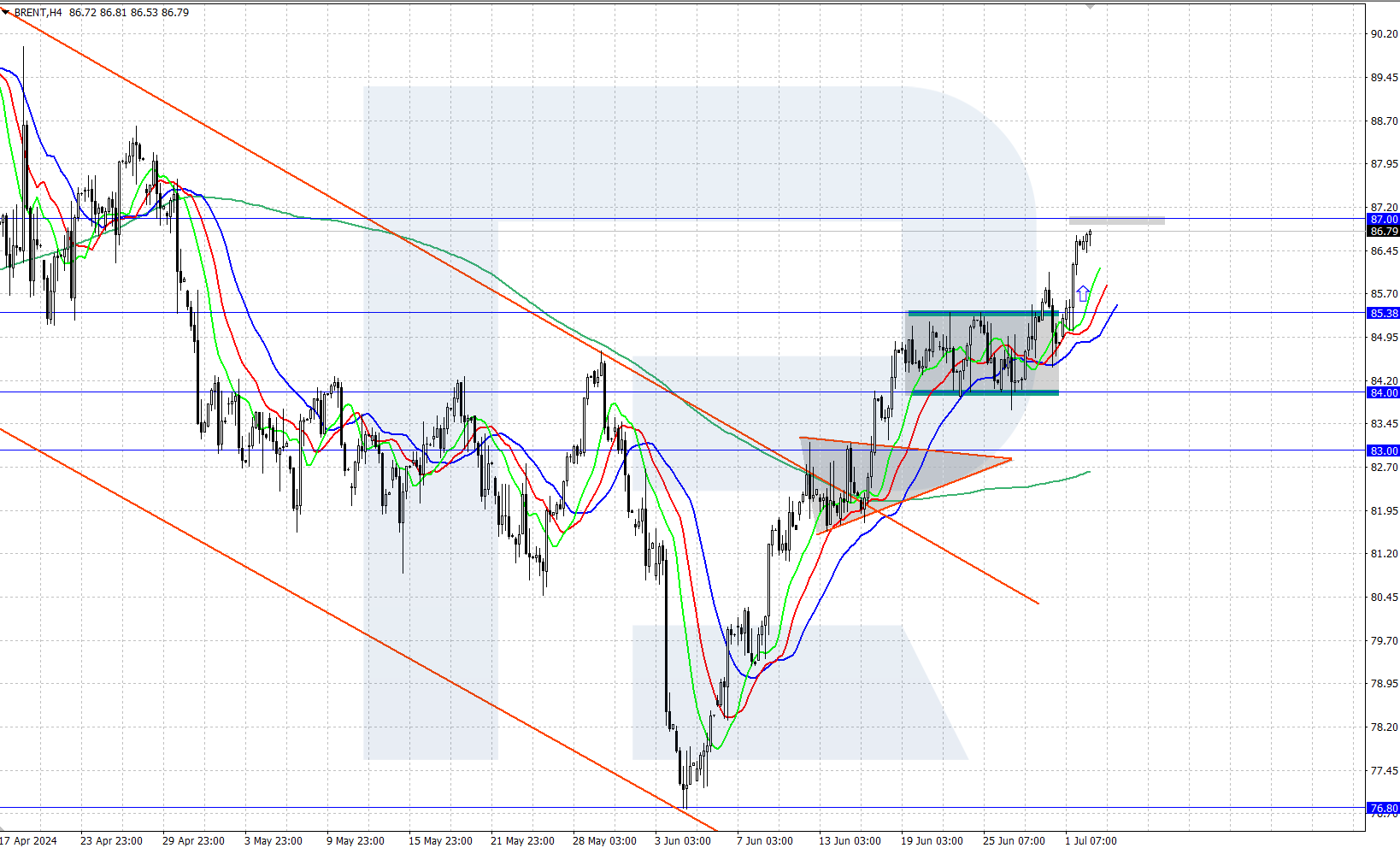

Having broken above the sideways range of 84.00-85.38, Brent quotes continued their upward momentum and are currently hovering near 86.70. The nearby daily resistance level of 87.00 curbs price growth locally.

According to a short-term forecast, if Brent's quotes steadily surpass the 87.00 level after the US statistics release, this will open the way for a rise to the annual high of 91.50. A downward correction might begin if the price fails to surpass 87.00, aiming for 83.00 and lower.

Summary

Brent crude oil price continues to strengthen within the current uptrend. Market participants are awaiting the release of US crude oil stock data and employment market statistics, which may determine the direction of oil price movements.