Brent is trading within a limited price range at the beginning of the week. Market participants are awaiting the release of the US crude oil stock statistics.

Brent is consolidating within a small price range ahead of EIA data

Brent is trading within a limited price range at the beginning of the week. Market participants are awaiting the release of US crude oil stock data from the Energy Information Administration (EIA) during the American session, with the reserves projected to decline by 3.00 million barrels. A significant discrepancy between the actual and forecasted values may drive Brent quotes further.

The American Petroleum Institute (API) published data on US crude oil stocks yesterday. According to the statistics, US crude oil reserves increased by 0.90 million barrels last week, while the forecast suggested a decrease of 3.00 million. In the previous release, this indicator showed an increase of 2.26 million barrels.

Brent technical analysis

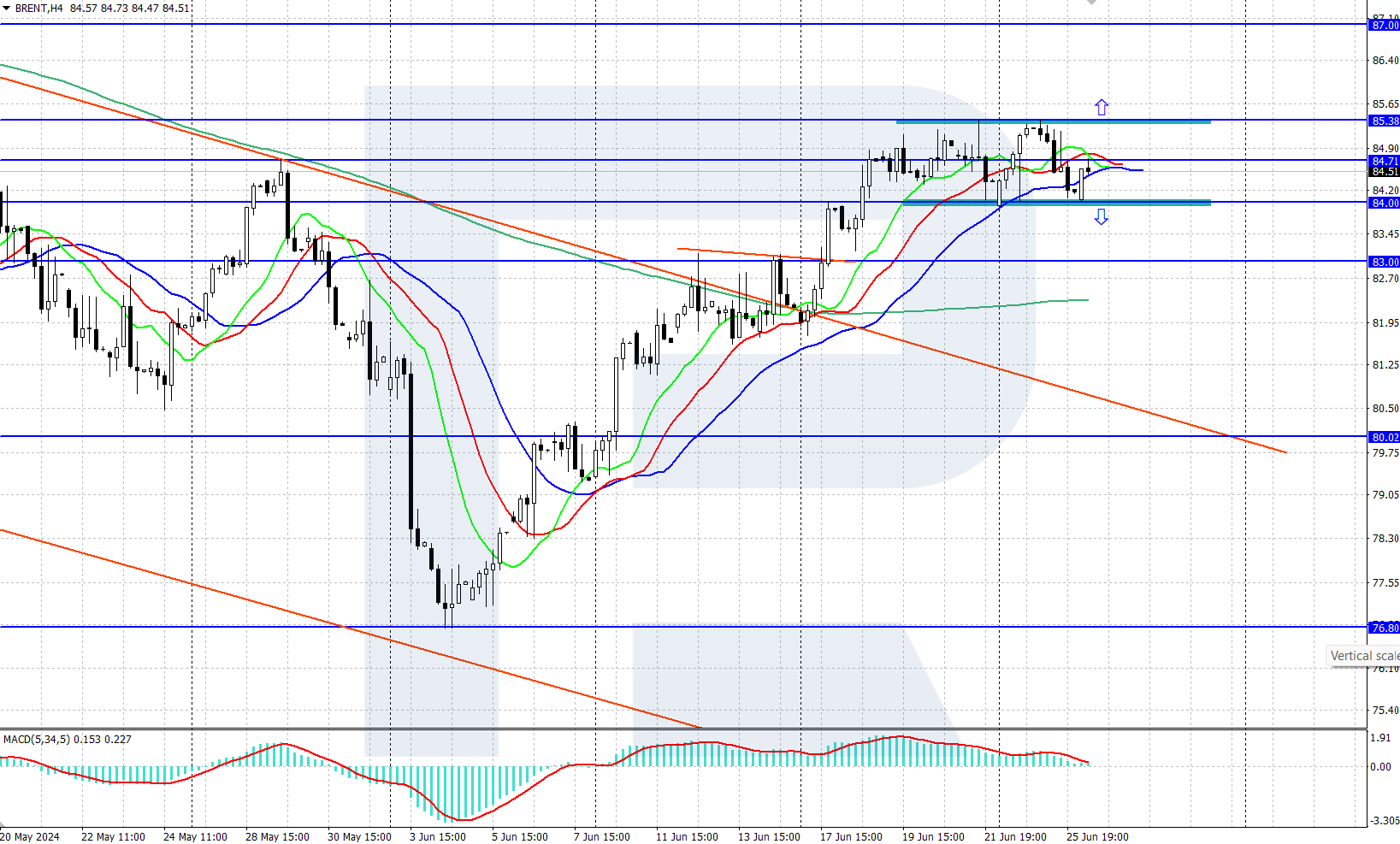

Following last week’s surge, Brent crude oil prices are consolidating on the H4 chart within a limited sideways range, with its upper boundary at the 85.38 resistance level and its lower boundary at the 84.00 support level. The direction of the price movement out of the range will indicate further prospects for oil price movements.

Brent technical analysis 26.06.2024

Today, oil quotes are hovering near the 84.50 mark. The EIA data release during the American session could catalyse market upheaval and a significant price breakout. If the price exits the range above 85.38, a rise to 87.00 could be forecasted. Conversely, if the quotes drop below 84.00, this will create conditions for a further downward correction towards 83.00 or even lower.

Summary

Brent quotes are consolidating within a limited sideways range at the beginning of the week. Market participants are awaiting today’s release of the EIA’s US crude oil stock data. A large discrepancy between the figures and the forecast may drive further movement, potentially pushing the price out of the range.