Brent is hovering at 65.53 USD per barrel on Tuesday. Market focus remains on developments involving Iran, dialogue with Russia, and China’s statistics. Discover more in our analysis for 20 May 2025.

Brent forecast: key trading points

- Brent prices edged higher and stabilised amid a heavy news flow

- China’s data and the Iran issue may influence commodity prices in the near term

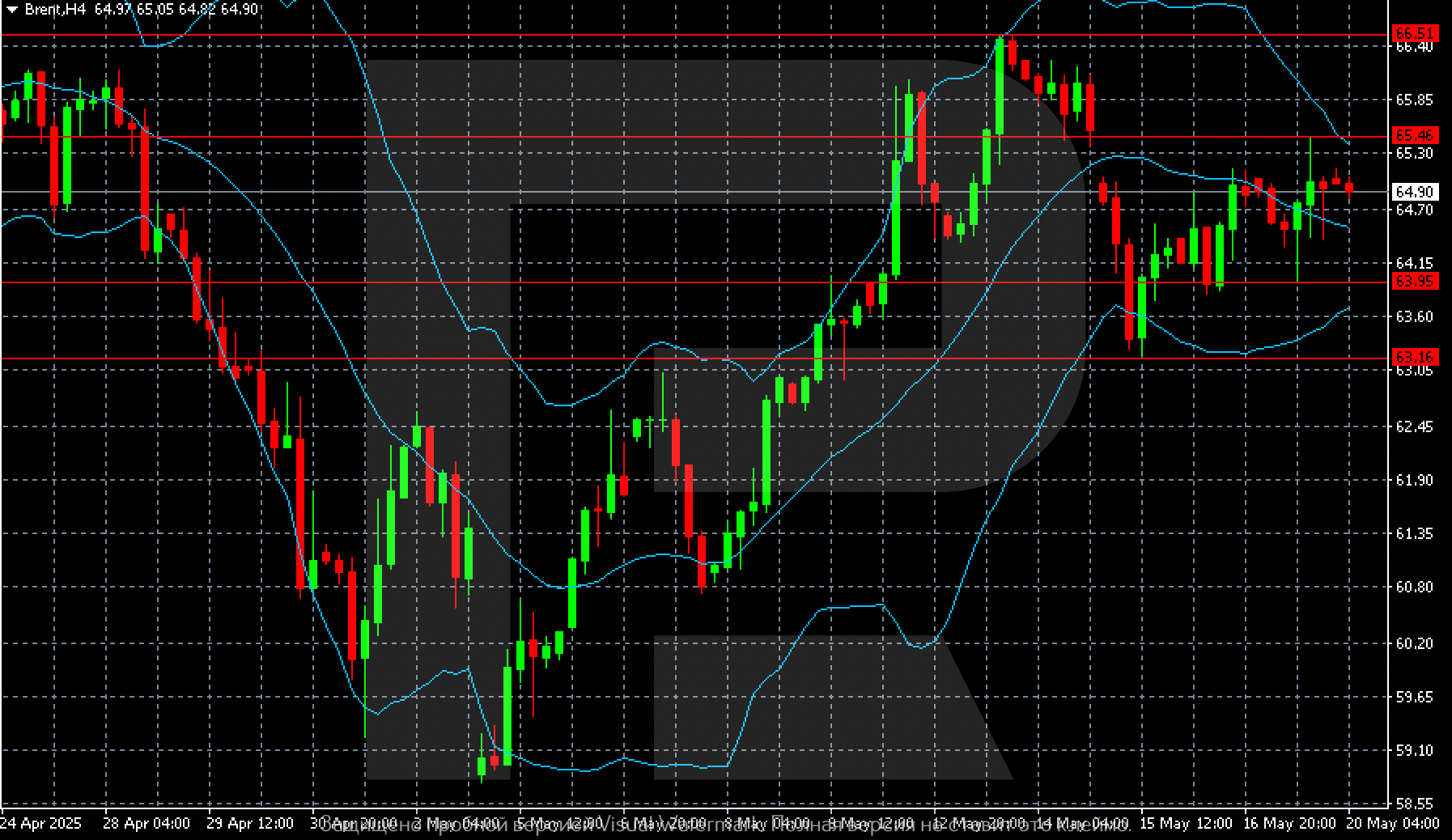

- Brent forecast for 20 May 2025: 63.95 and 63.16

Fundamental analysis

Brent is trading around 65.53 USD per barrel on Tuesday. Prices are attempting to climb as the market reacts to uncertainty surrounding US-Iran nuclear negotiations. On Monday, Iranian Deputy Foreign Minister Majid Takht Ravanchi warned that the talks would fail if Washington insists on a complete halt to uranium enrichment by Tehran.

Meanwhile, discussions about a peace agreement between Russia and Ukraine are also unfolding. US President Donald Trump did not rule out ceasefire talks following his phone conversation with Russia’s leader. A potential truce could increase Russian oil exports if sanctions ease, which might cap further price gains.

Earlier, pressure on oil prices came from Moody’s downgrade of the US credit rating, which raised concerns about the economic outlook for the world’s largest oil consumer. Sentiment also suffered from slowing industrial production and retail sales in China.

The Brent forecast is neutral.

Brent technical analysis

On the H4 chart, Brent shows potential for a decline towards 63.16 if the intermediate support at 63.95 fails without much resistance.

On a slightly larger timeframe, conditions suggest a sideways trading range is forming between 63.16 and 65.46.

Summary

Brent’s rally has paused amid an oversaturated news flow. Oil remains sensitive to both China’s demand and Iran’s supply prospects if the situation continues to develop at the current pace. Today’s Brent forecast for 20 May 2025 does not rule out a move lower to 63.16 if the 63.95 level is breached without difficulty.