Brent prices fell to 72.75 USD per barrel. The market is concerned about future supply growth. Discover more in our analysis for 27 February 2025.

Brent forecast: key trading points

- Brent prices continue to fall

- The commodity market is preparing to record the biggest decline in five months in February

- Brent forecast for 27 February 2025: 71.90

Fundamental analysis

Brent prices fell to 72.75 USD on Thursday, reaching the lowest level since December 2024. Oil seems to be preparing to close February with the strongest decline in five months.

Investors are still concerned about the prospects for growth in oil supply and pessimistic demand forecasts. The possibility of easing sanctions against Russia may increase global oil supply, putting pressure on prices.

An additional negative factor is the US tariff policy. Market participants believe that the White House tariffs on China may slow down economic growth and weaken demand.

The Brent forecast is still negative.

Brent technical analysis

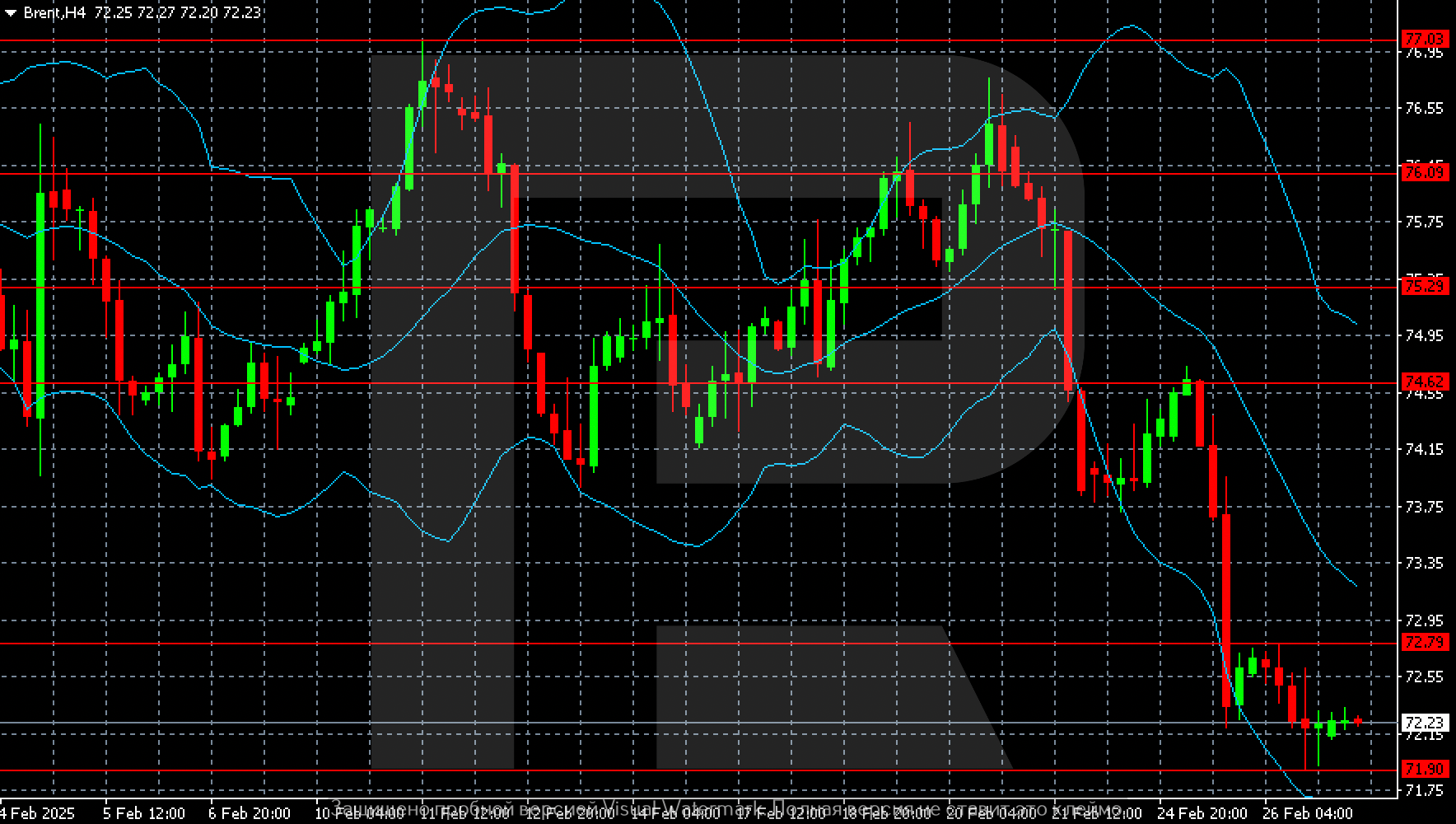

The Brent H4 chart shows a negative scenario, with sales aimed at 71.90 if pressure increases.

Summary

Brent continues to fall, with nothing holding it back so far. The main negative factor is fears about the supply of raw materials. The Brent forecast for today, 27 February 2025, confirms that a downward wave could develop towards 71.90.