Brent may struggle under pressure: India steps into the spotlight

Brent prices stand at 68.55 USD as the market fears the consequences of the OPEC+ production decision and US trade tensions. Discover more in our analysis for 5 August 2025.

Brent forecast: key trading points

- Brent oil remains under pressure due to rising geopolitical risks

- The US increases pressure on India and imposes new tariffs

- Brent forecast for 5 August 2025: 67.82

Fundamental analysis

On Tuesday, Brent prices are hovering around 68.55 USD. Earlier, the quotes declined for three consecutive trading sessions. The pressure on prices persists amid growing concerns about oversupply caused by the OPEC+ decision to ramp up production. This comes despite ongoing risks of supply disruptions from Russia.

On Sunday, the OPEC+ alliance agreed to increase output by 547 thousand barrels per day in September. This decision marks the full reversal of the production cuts introduced by eight member states in 2023, when output had been reduced by 2.2 million barrels per day.

The US increasing pressure on India also adds to uncertainty. Washington is demanding that New Delhi reduce its purchases of Russian oil as part of efforts to pressure Moscow. On Monday, President Donald Trump announced plans to significantly raise tariffs on Indian exports. Currently, goods from India are subject to a 25% tariff.

All of this unfolds against an already unstable global backdrop, weakened by trade disputes and weak economic data.

The Brent forecast is moderately negative.

Brent technical analysis

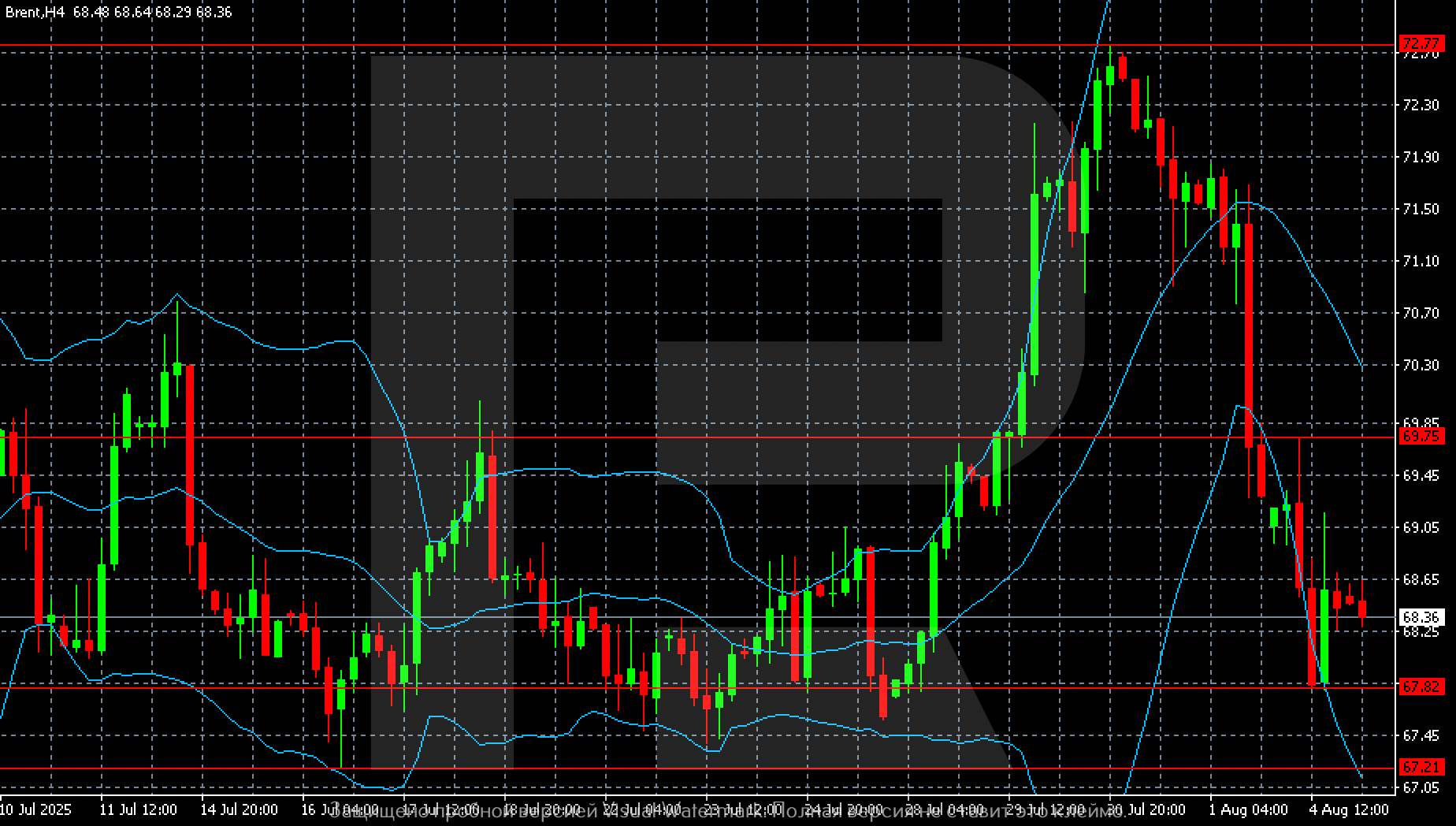

On the H4 chart, Brent prices remain under pressure after falling from the local high near 72.77. At this stage, quotes have stabilised around 68.36 USD per barrel.

The nearest support level is located at 67.82, followed by the 67.21 area. These zones coincide with the lower Bollinger Band, reinforcing their significance.

The resistance level lies at 69.75, where a previous downward reversal occurred. Prices remain below the middle Bollinger Band, indicating a continuing downward momentum. Unless prices return above 69.75, the risk of a decline towards 67.21 remains.

Summary

On Tuesday, Brent oil temporarily stabilised after declining for three consecutive days. The Brent forecast for today, 5 August 2025, does not rule out renewed selling pressure, with the first target at 67.82.