Oil is in an uptrend and currently undergoing a slight correction

Brent crude oil prices are moderately correcting after actively rising in the previous days, driven by data published by the American Petroleum Institute (API).

According to the statistics published on Wednesday, US oil inventories increased by 2.26 million barrels in the past weeks. A week ago, there was a decrease in inventories by 2.42 million barrels.

Overall, Brent has shown a solid upward trend following last week’s OPEC report, which anticipates a steady increase in demand for energy sources in the second half of 2024. The report on US oil inventories from the Energy Information Administration (EIA) will be published during today’s US trading session. The report may drive further movement of gold prices.

Brent technical analysis

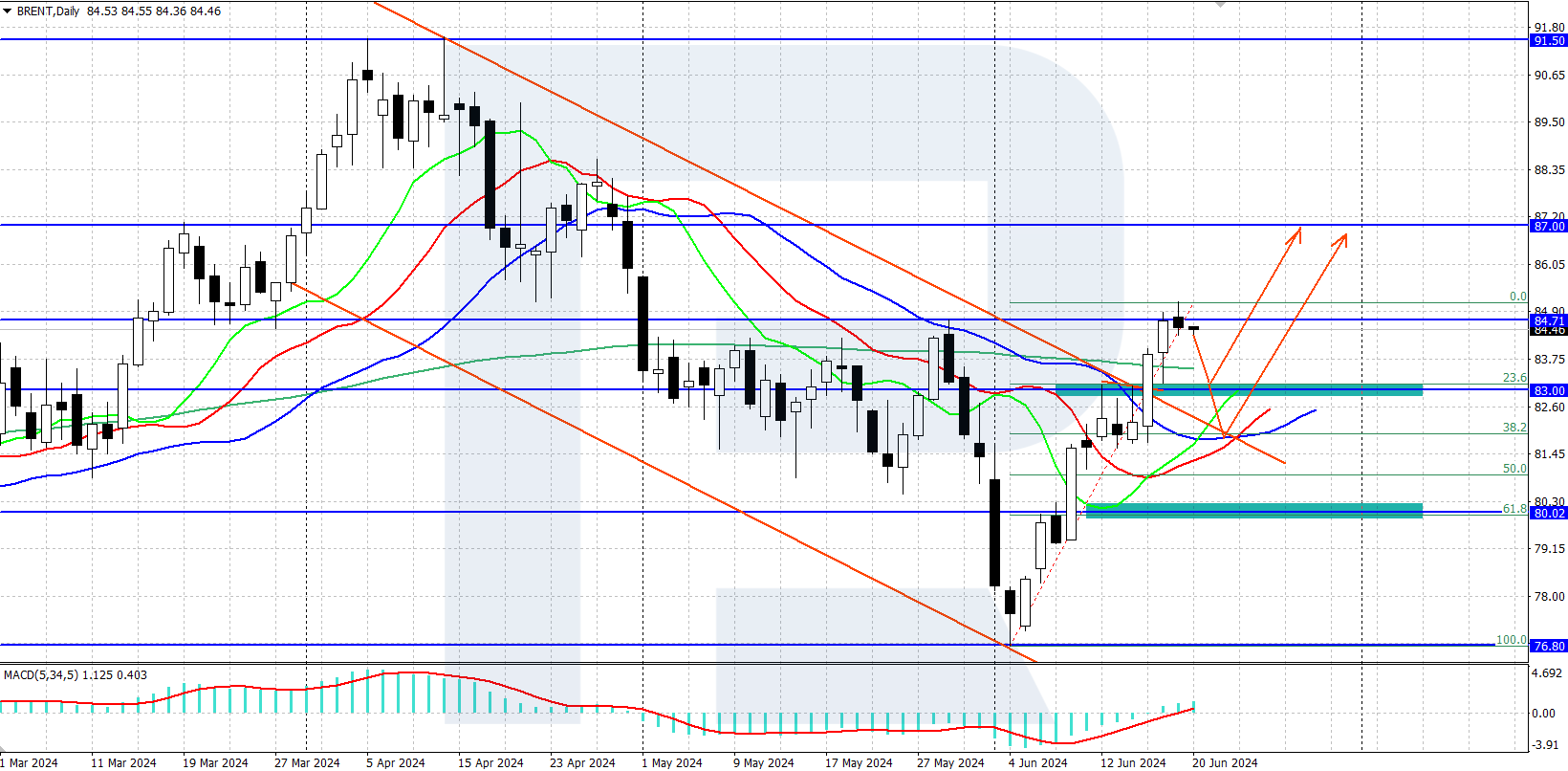

Brent crude oil price is experiencing a strong upward momentum on the daily chart, reaching a local daily high of 85.14 on Wednesday. The quotes rose above a significant resistance level at 83.00, coinciding with the upper boundary of a descending price channel. This clearly indicates an upward reversal of a daily trend and a shift from a downtrend to an uptrend.

Brent technical analysis 20.06.2024

The quotes are currently trading near the 84.50 mark, and a downward correction is underway following a test of the 85.14 resistance level. Although there is an uptrend now, a correction is imminent after an almost pullback-free growth from 76.80 to 85.14. Its nearest target is the previously breached 83.00 resistance level, which will now serve as support. Once a downward correction is complete, the price might continue its upward trajectory to 87.00 and above.

Summary

Brent crude oil price is experiencing upward solid momentum, breaking above the upper boundary of the daily descending price channel. This indicates a reversal of the downtrend. Following a correction, the Brent price is expected to continue its ascent.