Brent prices plunged to 76.55 USD, with US oil inventories increasing again. Find out more in our analysis for 30 January 2025.

Brent forecast: key trading points

- Brent prices fell to 76.55 USD

- The increase in US crude oil inventories put additional pressure on the sector

- Brent forecast for 30 January 2025: 74.62

Fundamental analysis

Brent tumbled to 76.55 USD on Thursday. Barrel prices continue to go down, and the outlook for oil looks alarming.

Yesterday, oil prices lost nearly 1%. The market is anxious about uncertainty around the US trade policy. News about US oil inventories is also exerting pressure on oil. According to the US Department of Energy report, hydrocarbon reserves grew by 3.463 million barrels last week, marking the first increase after a nine-week decline.

The US Federal Reserve’s meeting was neutral, with the interest rate left unchanged at 4.5% per annum. The market focus is now shifting to the OPEC+ meeting scheduled for 3 February.

The Brent forecast appears negative.

Brent technical analysis

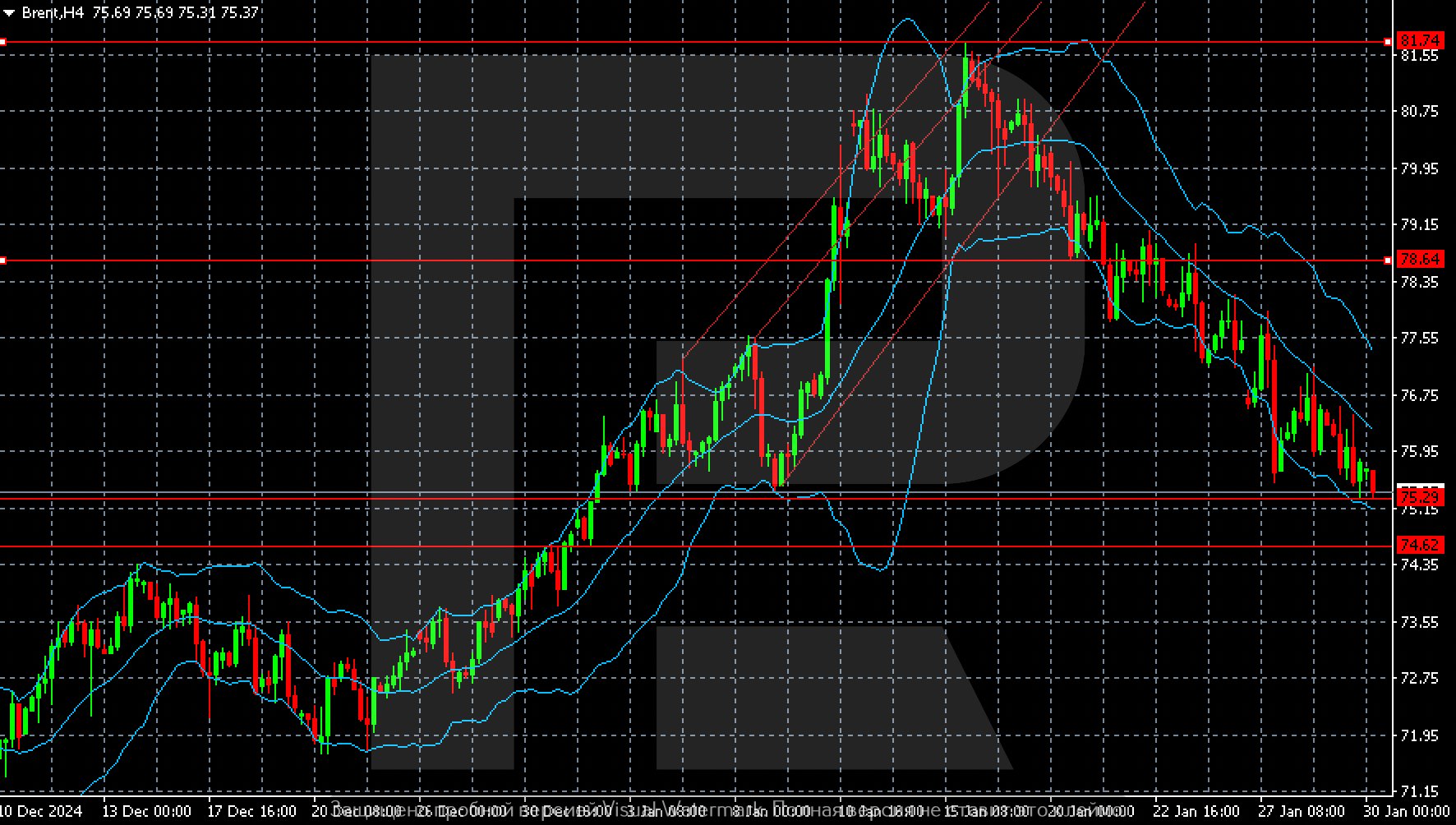

Prerequisites for the extension of the selling wave to 74.62 are forming on the Brent H4 chart. After testing this level, the market may turn to 75.30, but additional conditions are needed to move to a more ambitious target of 78.64.

Summary

Brent prices are falling, without halting this movement yet. The Brent forecast for today, 30 January 2025, does not rule out a significantly deeper decline to 74.62.