Brent quotes are undergoing a minor correction, yet the potential for an upward move towards the 67.05 USD resistance level remains intact. Discover more in our analysis for 13 May 2025.

Brent forecast: key trading points

- The US and China suspended reciprocal tariffs for 90 days, sparking optimism over trade war de-escalation

- Supply concerns continue to weigh on oil markets

- Brent forecast for 13 May 2025: 67.45

Fundamental analysis

Brent crude prices are declining after three consecutive sessions of gains, as renewed concerns about increasing supply pressure the market. Optimism following the temporary truce in the US-China trade dispute has not fully offset bearish sentiment.

On Monday, Washington and Beijing announced a 90-day suspension of mutual tariffs, raising hopes for easing trade tensions between the world’s two largest economies. However, fears of oversupply have returned to the spotlight.

Market participants highlight the expected increase in output from OPEC+ in May and June as a key bearish factor. Additional pressure comes from President Donald Trump's comments on progress in nuclear negotiations with Iran, increasing expectations that US sanctions on Iranian oil exports could soon ease.

Brent technical analysis

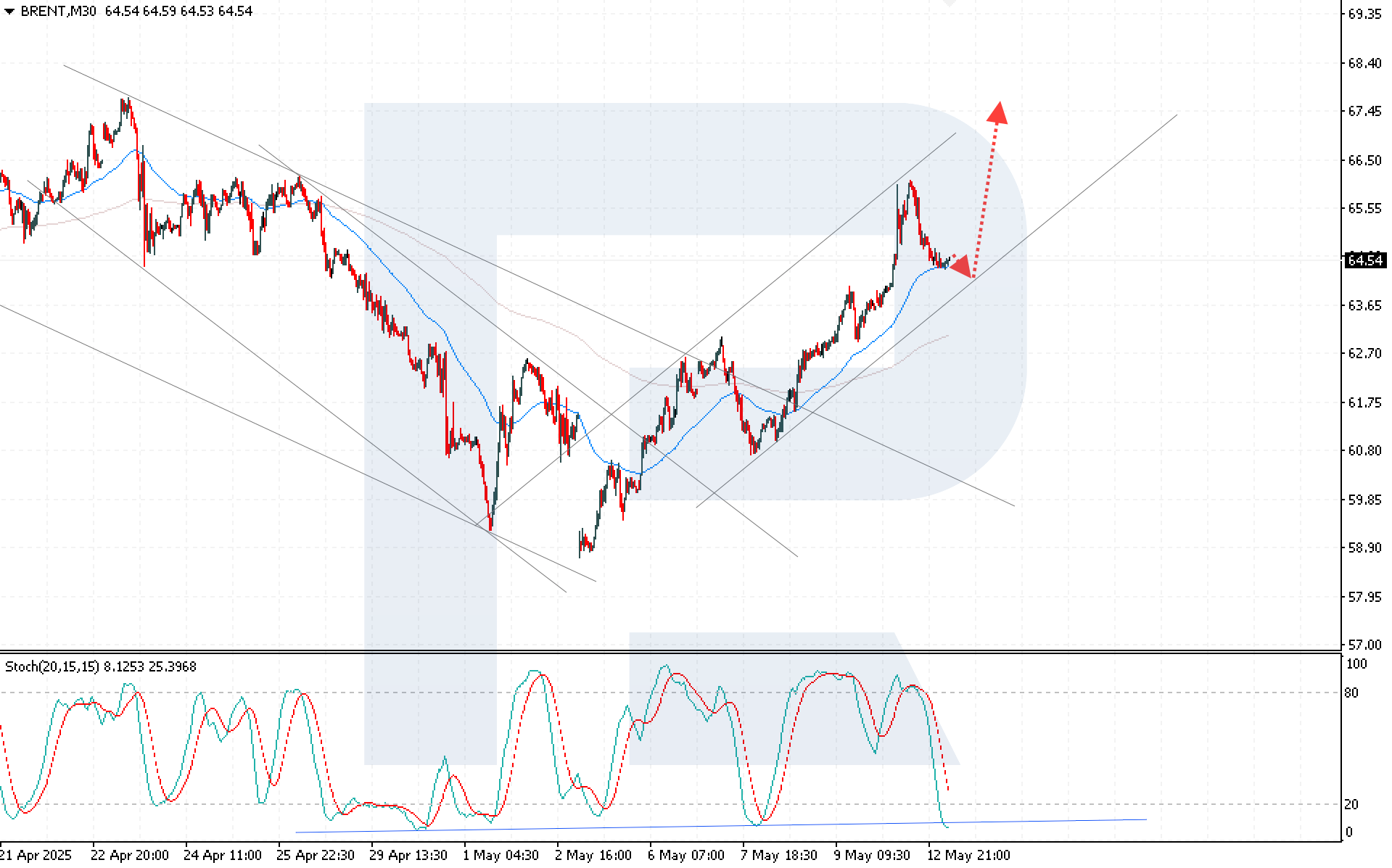

Brent crude continues to move within a bullish structure despite the current correction, with prices declining towards the EMA-65. The Brent price forecast suggests a rebound from this line with an immediate upside target at 67.45 USD. The Stochastic Oscillator supports this scenario: it is nearing the oversold area, indicating the correction phase may end soon. The price consolidation above 65.00 USD would signal the continuation of the upward movement.

Summary

The decline in Brent prices is driven by growing concerns over rising global supply, even as geopolitical tensions ease slightly. Today’s Brent analysis points to continued bullish momentum, with an upside target at 67.45 USD.