The USDCHF rate declined on Wednesday, 10 July 2024. The pair reacted weakly to the Federal Reserve chair’s speech, and the current USDCHF exchange rate is 0.8971.

USDCHF trading key points

- SNB is poised for two rate cuts this year

- The Swiss regulator is clearly discontent with the rising national currency’s rate

- USDCHF price target: 0.8930

Fundamental analysis

The USDCHF currency pair has closely approached the 0.8967 support level. Investors are analysing yesterday’s comments from Jerome Powell, stating that the Federal Reserve does not plan to lower interest rates until it is confident inflation is steadily moving towards 2%. However, Q1 data does not add to confidence.

On the other hand, traders expect the Swiss National Bank to cut rates twice this year to withstand the franc’s potential strengthening. Although the SNB clearly expressed its discontent with the strength of the national currency, a decline in the rate should be limited. On the upside, should inflation rise unexpectedly, the central bank is ready to intervene in the currency market situation if necessary.

Investors estimate the likelihood of another SNB rate cut in September at 50% as Switzerland’s recent consumer price index report fell short of expectations again. This may significantly support the US dollar against the franc.

USDCHF technical analysis

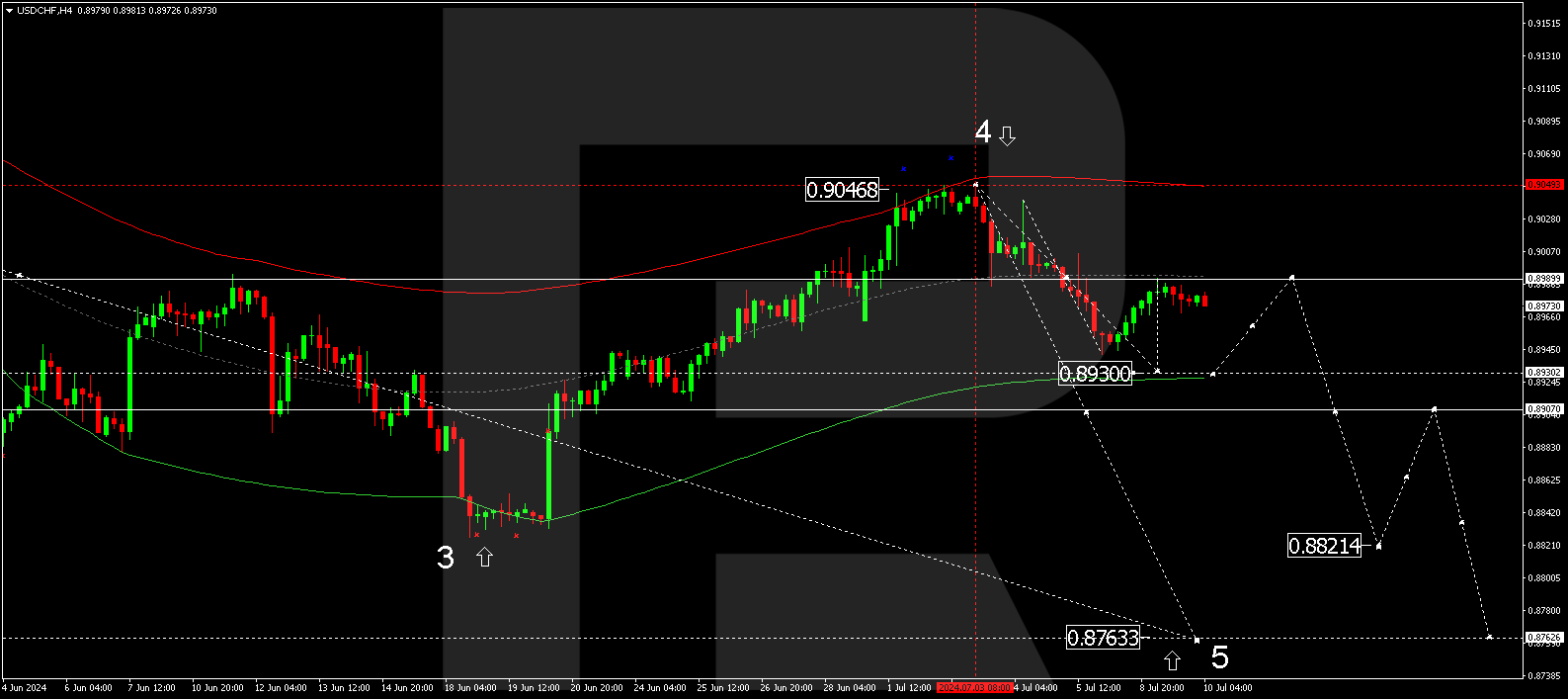

Technical analysis of the USDCHF pair on the H4 chart as of 10 July 2024 indicates a further decline to the first target of 0.8930. After this is reached, the price could correct to 0.8989. Subsequently, another decline wave is expected, aiming for 0.8822 and potentially continuing to 0.8763.

Summary

The Swiss National Bank is poised for two interest rate cuts this year, potentially providing medium-term support for the US dollar. Technical analysis for today’s USDCHF forecast suggests the wave will develop further to the 0.8930 target.