Daily technical analysis and forecast for 11 July 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 11 July 2025.

EURUSD forecast

On the H4 chart of EURUSD, the market completed a correction wave to 1.1700. Today, 11 July 2025, we consider the possibility of a compact consolidation range developing around 1.1740. It is relevant to consider a downward breakout and continuation of the downward wave towards 1.1640 as the first target. After reaching this level, a correction towards 1.1737 is expected.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a rotation centre at 1.1735. This remains key within the EURUSD wave structure. Currently, the market completed a correction to the Price Envelope’s central line at 1.1735. Today, the market continues developing its downward structure towards its lower boundary at 1.1640.

Technical indicators for today’s EURUSD forecast suggest considering the start of a downward wave towards 1.1640.

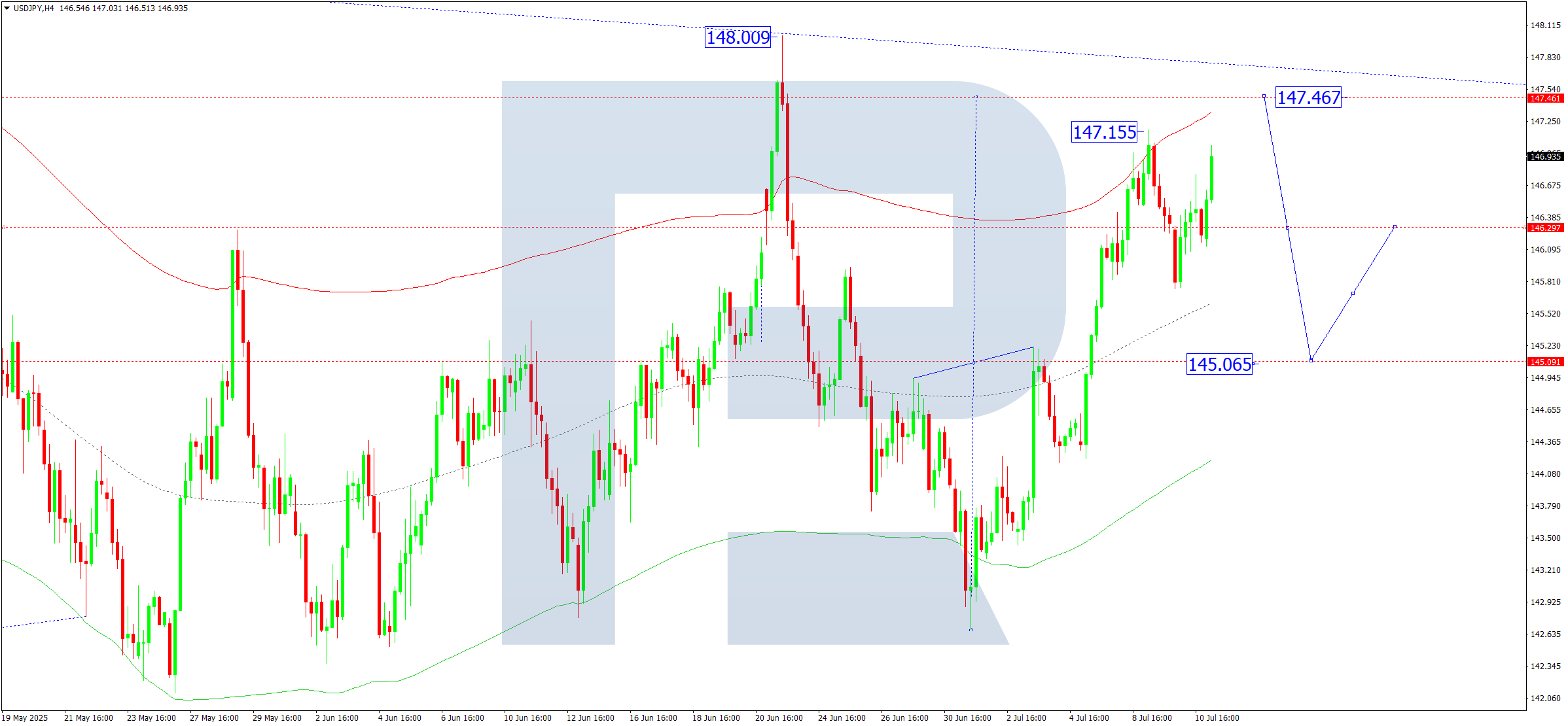

USDJPY forecast

On the H4 chart of USDJPY, the market is forming a consolidation range around 146.30 without a clear trend. Today, 11 July 2025, expansion of the range upwards towards 147.47 is possible. Afterwards, a decline towards 145.06 is expected.

Technically, this scenario for USDJPY is confirmed by the Elliott wave structure and the downward wave matrix with a rotation centre at 144.84. This remains key within this wave structure. Currently, the market completed a correction structure to the Price Envelope’s upper boundary at 147.15. A subsequent decline towards its central line at 145.06 is possible, then growth towards 147.46.

Technical indicators for today’s USDJPY forecast suggest considering continuation of the growth wave towards 147.47.

GBPUSD forecast

On the H4 chart of GBPUSD, the market formed a consolidation range around 1.3590 and broke downwards. Today, 11 July 2025, we expect a decline towards 1.3520 with potential trend continuation towards 1.3465 as a local target.

Technically, this scenario for GBPUSD is confirmed by the Elliott wave structure and the downward wave matrix with a rotation centre at 1.3656. This remains key within this wave structure. Currently, the market is under downward pressure towards the Price Envelope’s lower boundary at 1.3520. Afterwards, a correction towards 1.3590 is possible, then continuation of the wave towards 1.3465.

Technical indicators for today’s GBPUSD forecast suggest considering a decline towards 1.3465.

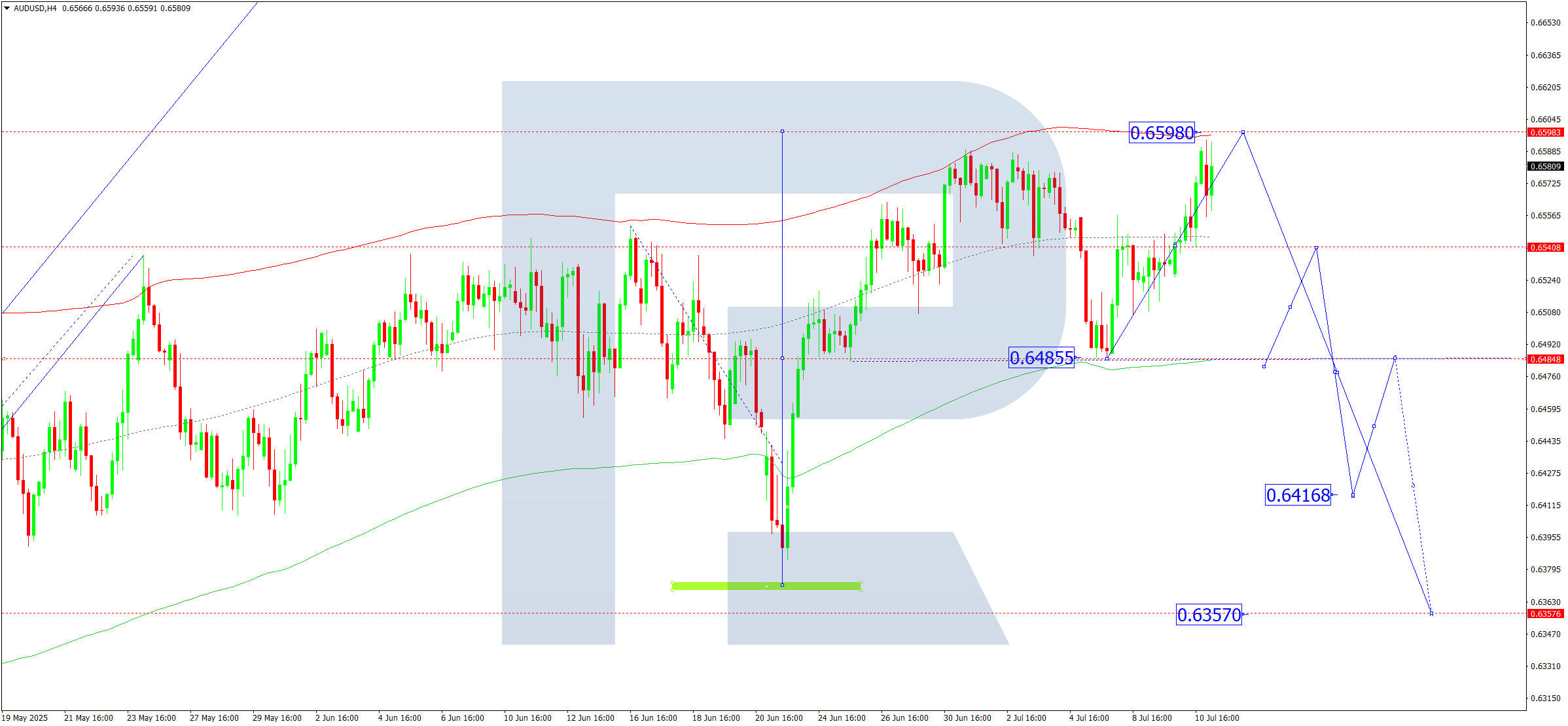

AUDUSD forecast

On the H4 chart of AUDUSD, the market formed a consolidation range around 0.6550 and broke upwards. Today, 11 July 2025, we expect a growth wave towards 0.6598 as the first target. After reaching this level, a correction towards 0.6550 is possible.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a rotation centre at 0.6444. This remains key within this wave structure. Currently, the market is executing a growth wave towards the Price Envelope’s upper boundary at 0.6598. Afterwards, a correction towards its central line at 0.6550 is possible.

Technical indicators for today’s AUDUSD forecast suggest considering development of a growth wave towards 0.6598.

USDCAD forecast

On the H4 chart of USDCAD, the market completed a growth wave to 1.3724. Today, 11 July 2025, we expect the start of a downward wave towards 1.3640. Upon reaching this level, a rise towards 1.3685 is possible, then a decline towards 1.3490.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a rotation centre at 1.3626. This remains key within the USDCAD wave structure. Currently, the market continues developing its consolidation range around the Price Envelope’s central line at 1.3626. Today, a decline towards its lower boundary at 1.3490 is relevant.

Technical indicators for today’s USDCAD forecast suggest considering a decline towards 1.3490.

XAUUSD forecast

On the H4 chart of XAUUSD, the market continues forming a consolidation range around 3300 without a clear trend. Today, 11 July 2025, expansion of the range upwards towards 3344 is possible, then downwards towards 3300. It is relevant to consider a downward breakout from this range for continuation of the downward wave towards 3233.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a rotation centre at 3344. This remains key within this wave structure. Currently, the market completed a wave to the Price Envelope’s central line at 3344. Today, we expect development of a downward wave towards its lower boundary at 3233.

Technical indicators for today’s XAUUSD forecast indicate the possibility of continued decline towards 3233.

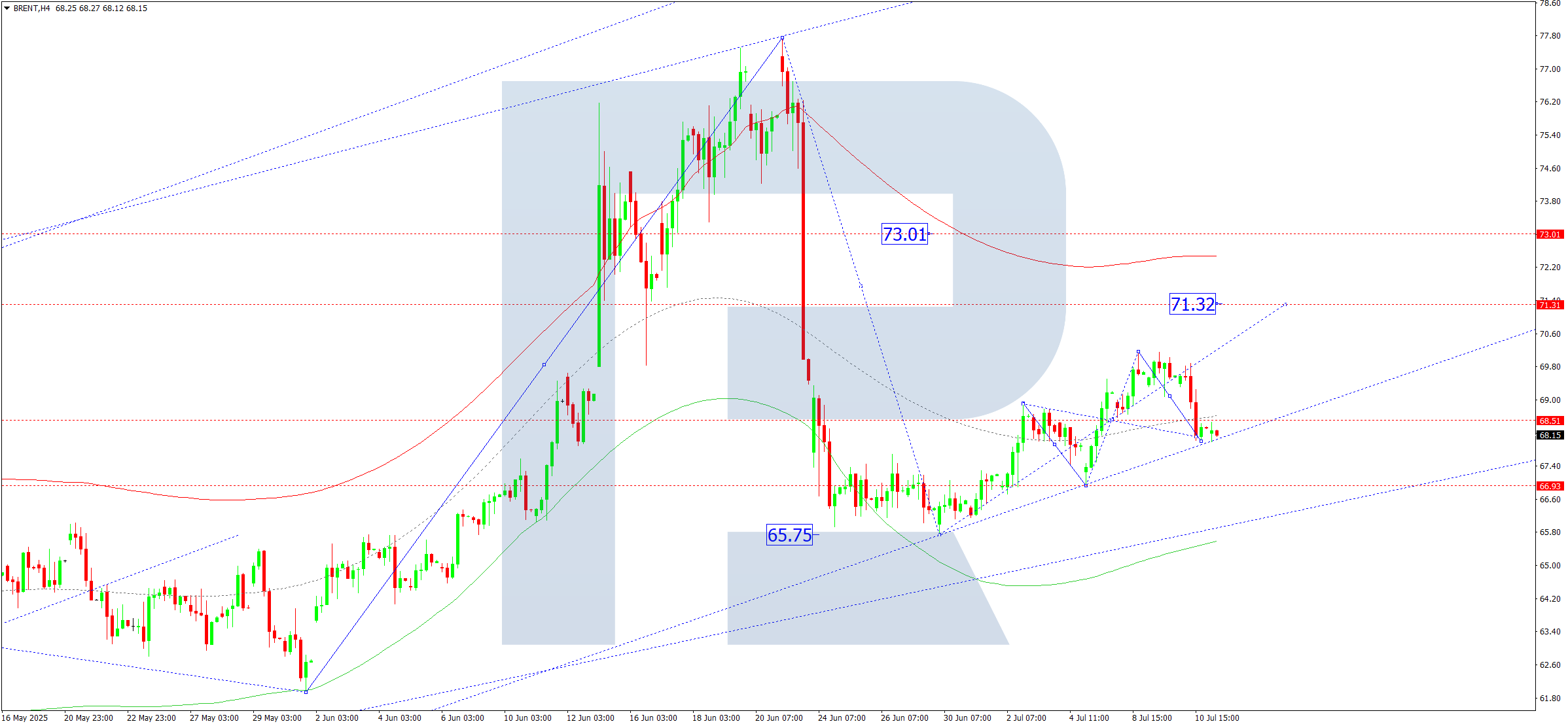

Brent forecast

On the H4 chart of Brent crude, the market completed a correction wave to 68.00. Today, 11 July 2025, we consider the possibility of a growth wave developing towards 71.32 as the first target. Afterwards, a correction towards 69.50 is possible, then growth towards 73.00.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a rotation centre at 69.50. This remains key within Brent’s wave structure. Currently, the market is forming a consolidation range around the Price Envelope’s central line at 69.50. Growth towards its upper boundary at 73.00 is relevant.

Technical indicators suggest today’s Brent forecast considers potential continuation of the growth wave towards 73.00.