Daily technical analysis and forecast for 12 August 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 12 August 2025.

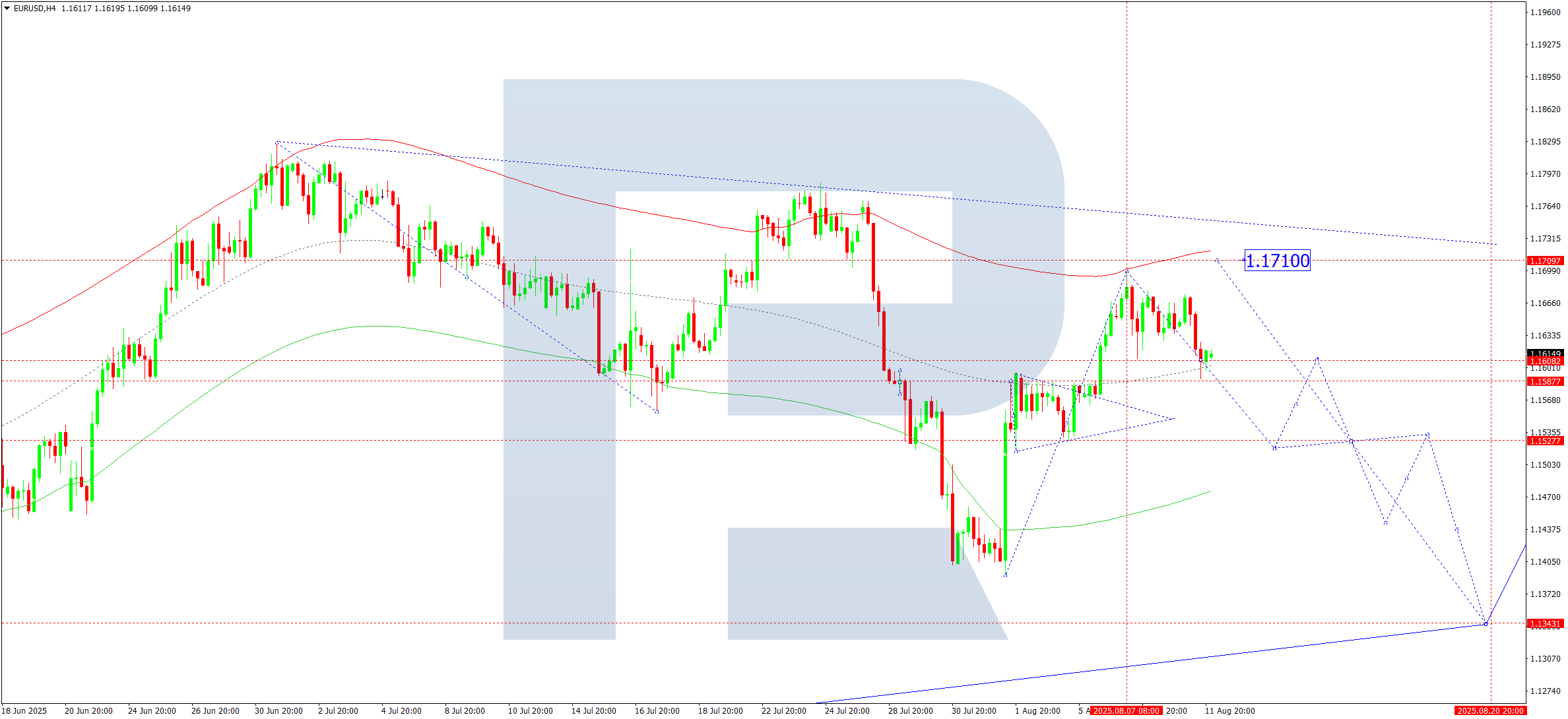

EURUSD forecast

On the H4 chart of EURUSD, the market formed a consolidation range around 1.1650 and broke it downwards. Today, 12 August 2025, the scenario of a downward wave towards 1.1525 is possible. After reaching this level, a rise towards 1.1608 (testing from below) is expected. Afterwards, another downward wave towards 1.1444 is possible. The target is local.

Technically, this scenario is confirmed by the specified Elliott wave structure and the downward wave matrix with a pivot at 1.1550, considered key in the EURUSD wave structure. At the moment, the market completed a corrective wave towards the upper boundary of the price Envelope at 1.1698. After reaching this target, a consolidation range is forming below it. An expansion towards 1.1710 is not excluded. Afterwards, a decline towards the lower boundary at 1.1343 is possible.

Technical indicators for today’s EURUSD forecast suggest a downward wave towards 1.1525.

USDJPY forecast

On the H4 chart of USDJPY, the market continues to form a consolidation range around 147.77. Today, 12 August 2025, growth towards 148.77 is possible. Afterwards, a decline towards 147.77 (testing from above) is expected. A broad consolidation range around this level is likely. A downward breakout will open the potential for a wave towards 145.30. An upward breakout will open the potential for growth towards 150.90, with prospects to extend the trend to 153.00.

Technically, this scenario for USDJPY is confirmed by the specified Elliott wave structure and the upward wave matrix with a pivot at 146.66, considered key in this wave structure. At the moment, the market is forming a consolidation range around the central line of the price Envelope at 144.77. Growth towards the upper boundary at 148.77 is expected.

Technical indicators for today’s USDJPY forecast suggest further growth towards 148.77.

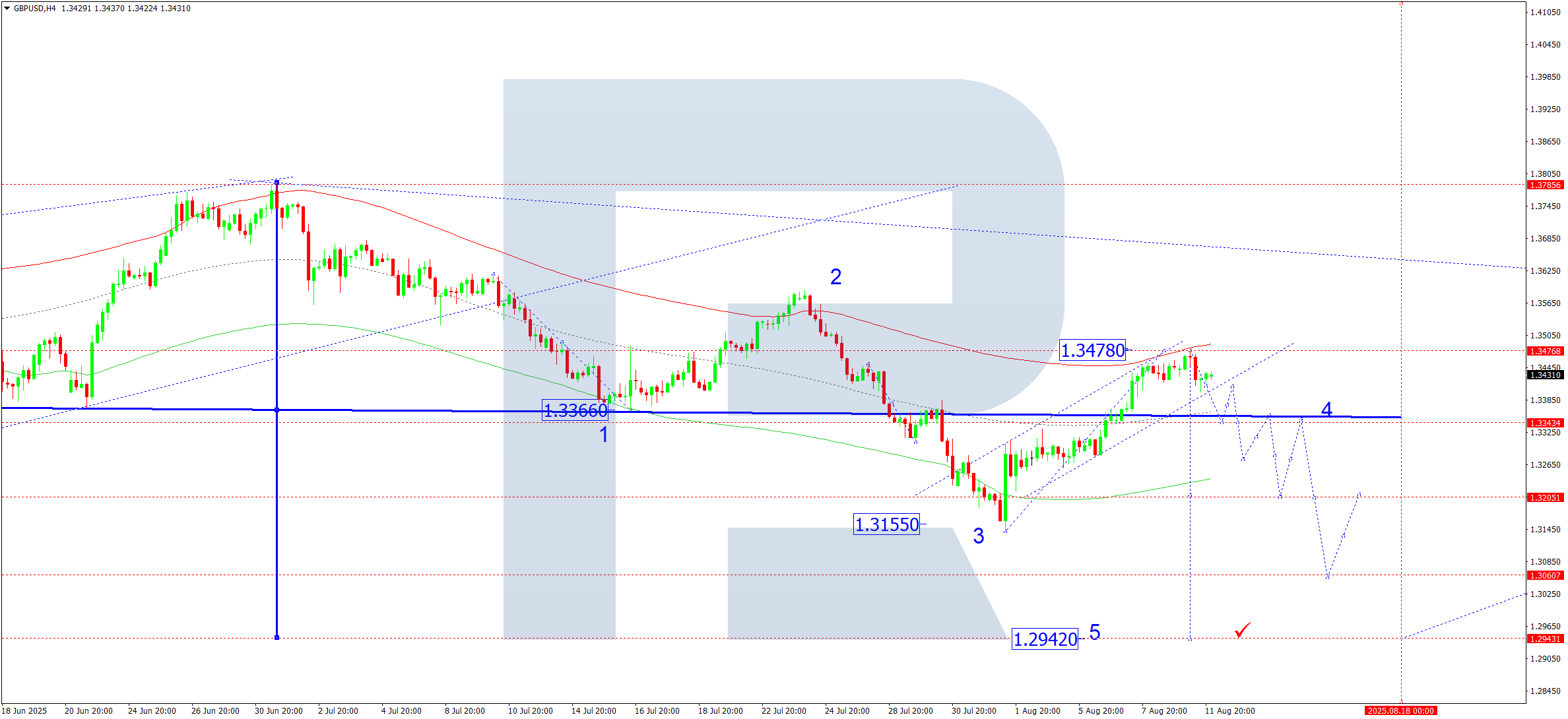

GBPUSD forecast

On the H4 chart of GBPUSD, the market is forming a consolidation range below 1.3478. Today, 12 August 2025, a downward breakout from this range is expected, targeting 1.3344. Afterwards, a rise towards 1.3410 (testing from below) is possible. This will set the boundaries of a new consolidation range. An upward breakout could lead to another corrective leg towards 1.3500. A downward breakout will open the potential for a continued decline to 1.3200.

Technically, this scenario for GBPUSD is confirmed by the specified Elliott wave structure and the downward wave matrix with a pivot at 1.3366, considered key in this wave structure. At the moment, the market completed a corrective wave towards the upper boundary of the price Envelope at 1.3444. The development of a consolidation range below this level remains relevant. An expansion towards 1.3500 is not excluded. Afterwards, a downward wave towards the central line at 1.3200 is possible, with prospects to extend the wave to the lower boundary at 1.2942.

Technical indicators for today’s GBPUSD forecast suggest a downward wave towards 1.3200.

AUDUSD forecast

On the H4 chart of AUDUSD, the market continues forming a consolidation range around 0.6494. Today, 12 August 2025, an upward breakout towards 0.6555 is expected. Afterwards, a downward wave towards 0.6490 is possible. A breakout below this level will open the potential for a trend continuation towards 0.6408, the first target.

Technically, this scenario is confirmed by the specified Elliott wave structure and the downward wave matrix for AUDUSD with a pivot at 0.6515, considered key in this wave structure. At the moment, the market is forming a corrective wave towards the upper boundary of the price Envelope at 0.6555. Afterwards, a continuation of the downward wave towards the lower boundary at 0.6408 is expected.

Technical indicators for today’s AUDUSD forecast suggest a possible extension of the correction to 0.6555 and the start of a downward wave towards 0.6408.

USDCAD forecast

On the H4 chart of USDCAD, the market continues a correction towards 1.3715 at least. Today, 12 August 2025, a growth leg to 1.3790 (testing from below) has been completed. A new downward structure towards 1.3747 is expected. A breakout below this level will open the potential for a wave towards 1.3700.

Technically, this scenario is confirmed by the specified Elliott wave structure and the upward wave matrix with a pivot at 1.3715, considered key in this wave structure for USDCAD. At the moment, the market formed a consolidation range around the central line of the price Envelope at 1.3787 and broke it downwards. Today, a decline towards the lower boundary at 1.3700 remains relevant. The entire downward structure is considered a correction to the previous upward wave. After completing this correction, an upward wave towards the upper boundary at 1.3890 is possible.

Technical indicators for today’s USDCAD forecast suggest a continuation of the downward wave towards 1.3700.

XAUUSD forecast

On the H4 chart of XAUUSD, the market completed a downward wave to 3,342. Today, 12 August 2025, the possibility of forming a consolidation range above this level is considered. An upward breakout from this range could extend the correction to 3,420. A downward breakout will open the potential for a wave towards 3,295 as a local target.

Technically, this scenario is confirmed by the specified Elliott wave structure and the downward wave matrix with a pivot at 3,345, considered key in this wave for XAUUSD. At the moment, the market is correcting towards the lower boundary of the price Envelope at 3,295. Afterwards, a rise towards the upper boundary at 3,420 is possible.

Technical indicators for today’s XAUUSD forecast suggest a continued correction towards 3,295.

Brent forecast

On the H4 chart of Brent crude, the market continues to develop a consolidation range around 66.11. Today, 12 August 2025, the range is expected to expand upwards to 67.22. Later, a downward leg towards 65.00 is possible, followed by growth towards 68.88.

Technically, this scenario is confirmed by the specified Elliott wave structure and the growth wave matrix with a pivot at 69.50. It is considered key for Brent in this wave. At present, the market continues a correction towards the lower boundary of the price Envelope at 65.00. Growth towards its upper boundary at 72.60 is likely, with the prospect of continuing the trend towards 76.00.

Technical indicators for today’s Brent forecast suggest the correction could complete at 65.00, followed by a growth wave towards 72.60.