Daily technical analysis and forecast for 14 May 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 14 May 2025.

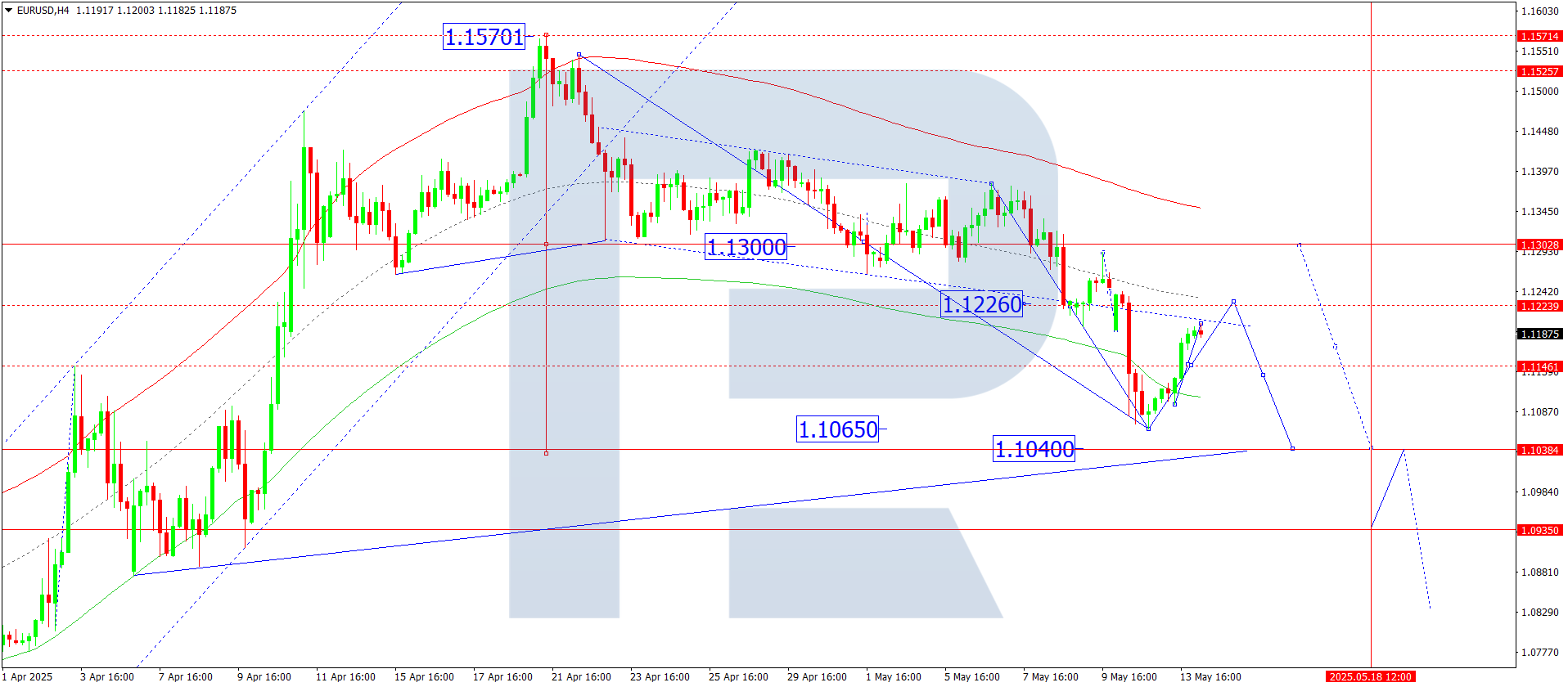

EURUSD forecast

On the H4 chart of EURUSD, the market formed a consolidation range above the 1.1060 level. At the moment, the market has broken upwards out of the range and suggests a potential continuation of the correction towards 1.1222. Today, 14 May 2025, we expect the price to reach this target level and then begin developing a downward wave to 1.1040. This is the initial target.

This scenario aligns technically with the specified Elliott wave structure and the wave matrix pointing to a downward move, pivoting around 1.1300. This level is seen as a key one within this wave structure for EURUSD. The market has already completed a downward wave structure to the lower boundary of the Price Envelope at 1.1060. A corrective link to the central line at 1.1222 is anticipated. Afterwards, another potential downward wave to the lower boundary at 1.1040 is possible.

Technical indicators for today’s EURUSD forecast suggest viewing the upward movement as a correction towards 1.1222.

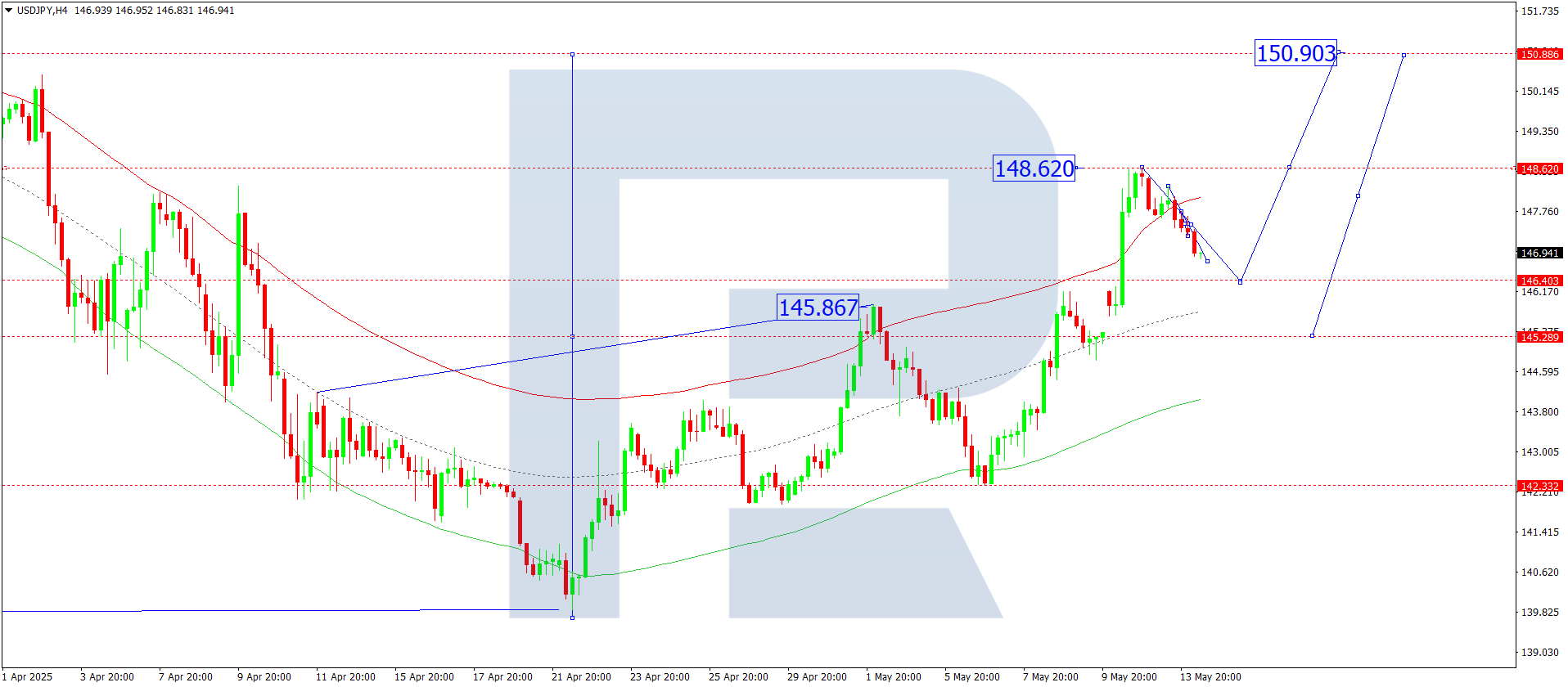

USDJPY forecast

On the H4 chart of USDJPY, the market formed a consolidation range below the 148.62 level. At the moment, the market has broken downwards out of this range. Today, 14 May 2025, a correction towards 146.40 (testing from above) is possible. After this correction ends, we anticipate a new upward wave to 150.90.

This scenario is supported technically by the specified Elliott wave structure and a wave matrix indicating upward development with a pivot at 145.30, considered key in the current structure. The market has completed the third upward wave to the upper boundary of the Price Envelope at 148.64. A correction towards the central line at 146.40 is likely. Subsequently, we expect a new upward wave to the upper boundary at 150.90.

Technical indicators for today’s USDJPY forecast support the likelihood of a correction to 146.40.

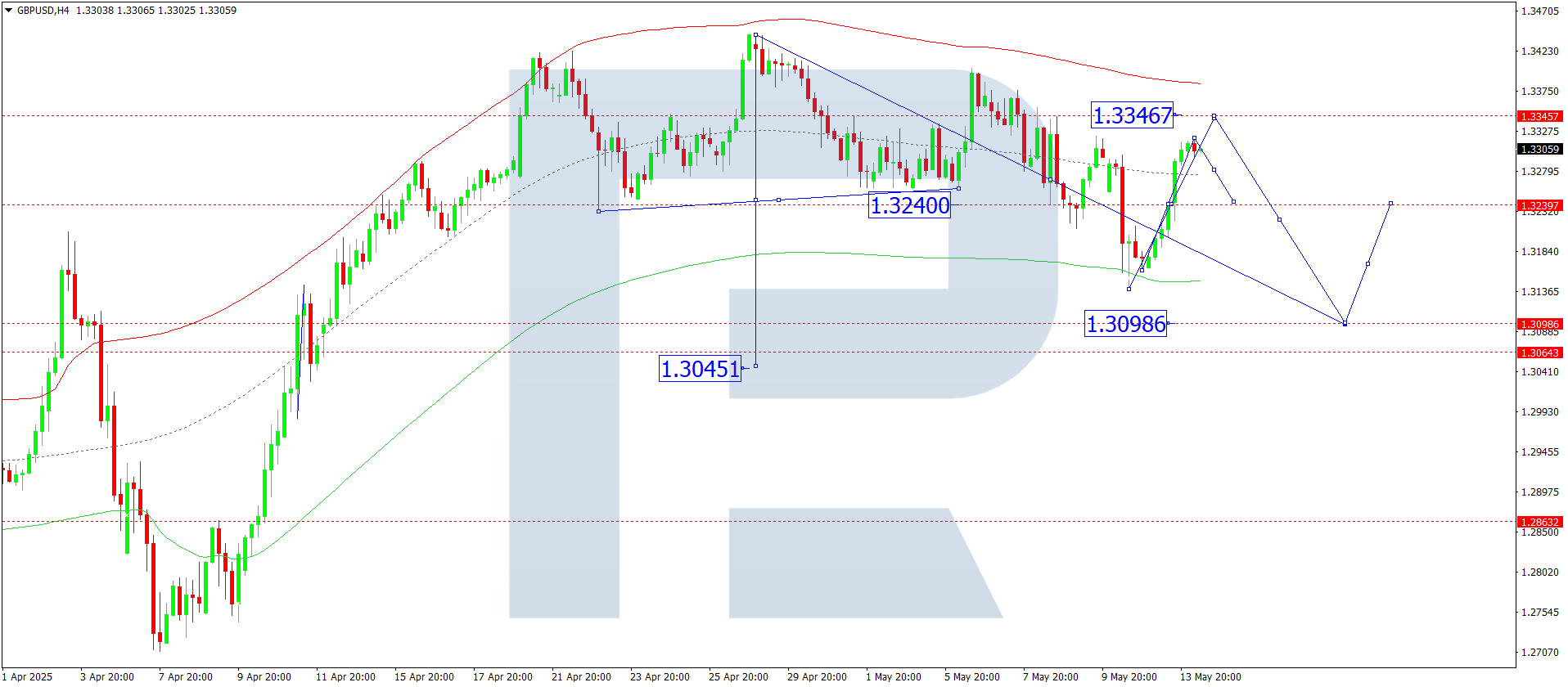

GBPUSD forecast

On the H4 chart of GBPUSD, the market broke through the 1.3240 level upwards, suggesting a possible correction towards 1.3346. Today, 14 May 2025, we consider the likelihood of this correction concluding, followed by a downward wave towards 1.3100. This is the initial target.

This scenario for GBPUSD finds technical confirmation in the Elliott wave structure and the wave matrix pointing downwards with a pivot at 1.3270, regarded as key. Currently, the market has completed a downward wave to the lower boundary of the Price Envelope at 1.3141. Next, a correction to the upper boundary at 1.3346 is likely.

Technical indicators for today’s GBPUSD forecast view the upward movement as a correction towards 1.3346.

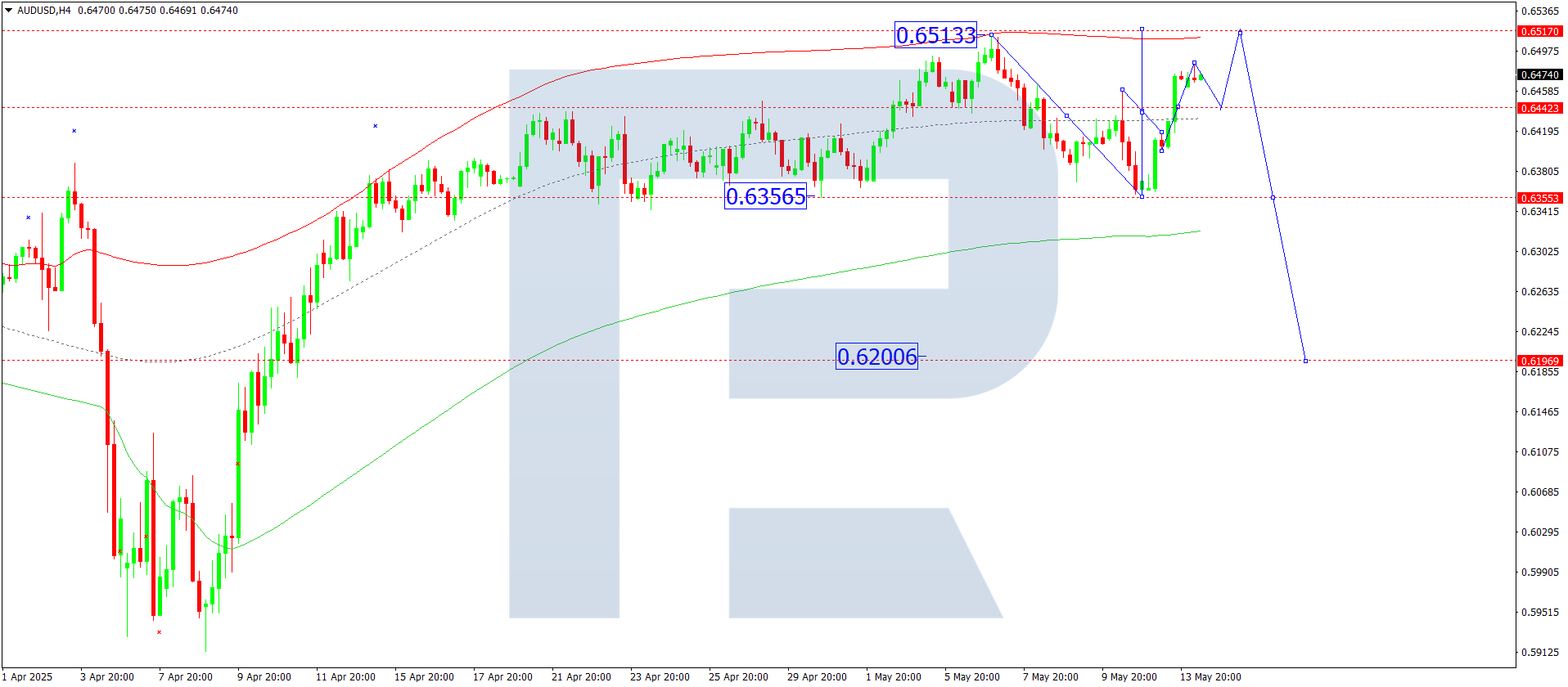

AUDUSD forecast

On the H4 chart of AUDUSD, the market is shaping a broad consolidation structure around the 0.6434 level. Today, 14 May 2025, a possible range expansion upwards to 0.6515 is not excluded. Afterwards, a decline towards 0.6355 is possible. If the market breaks this level downwards, a further downward wave towards 0.6200 may develop. This is the initial target.

This scenario aligns with the specified Elliott wave structure and the downward wave matrix for AUDUSD, pivoting at 0.6434, considered key within the structure. At the moment, a wave is forming towards the upper boundary of the Price Envelope at 0.6515. Next, a correction to the central line at 0.6355 is likely.

Technical indicators for today’s AUDUSD forecast point to a possible downward wave towards 0.6355.

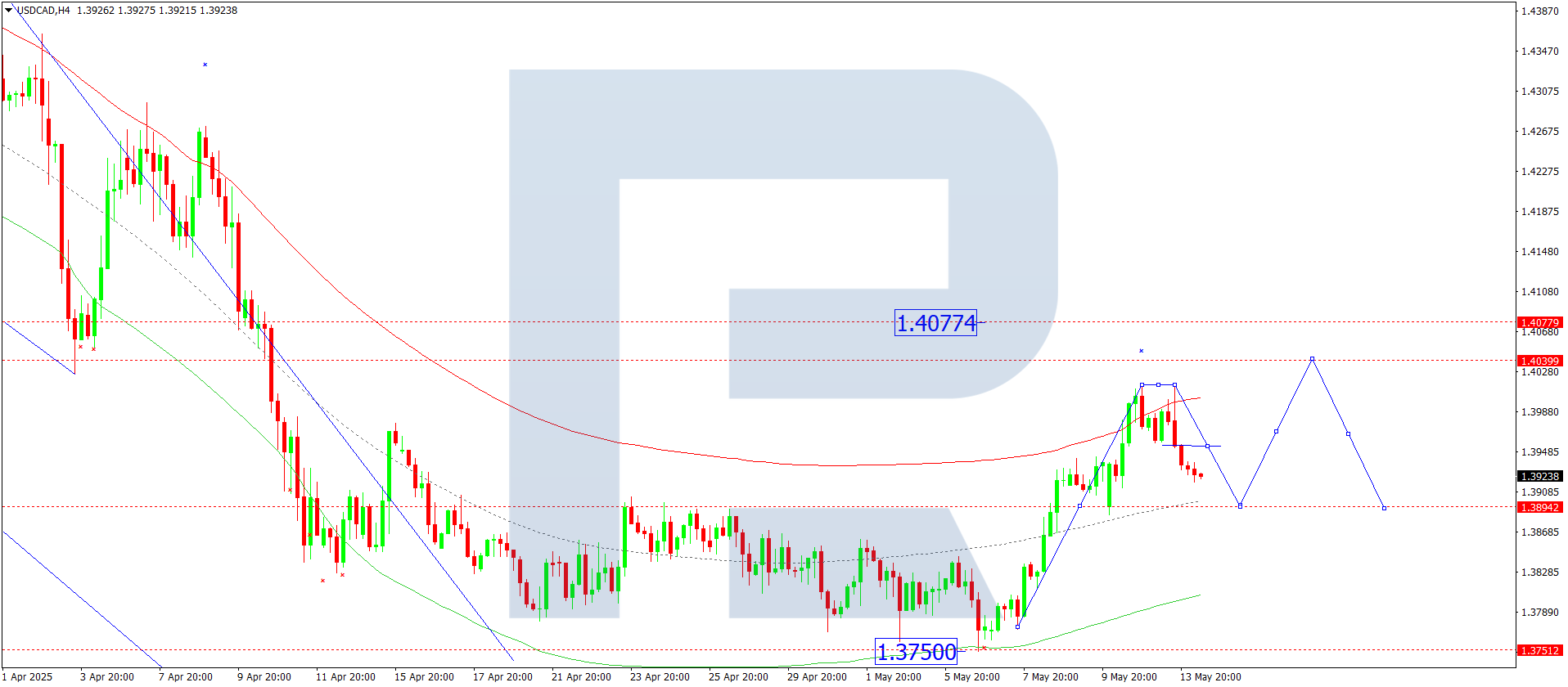

USDCAD forecast

On the H4 chart of USDCAD, the market formed a consolidation range below 1.1414 and broke downwards, suggesting a possible correction to 1.3894. Today, 14 May 2025, we expect this correction to conclude and a new upward wave to begin towards 1.4040.

This scenario is supported by the Elliott wave structure and a growth wave matrix with a pivot at 1.3880, seen as key to USDCAD's wave formation. The market has reached the upper boundary of the Price Envelope at 1.4012. Next, we anticipate a correction to the central line at 1.3894.

Technical indicators for today’s USDCAD forecast point to a corrective downward wave to 1.3894.

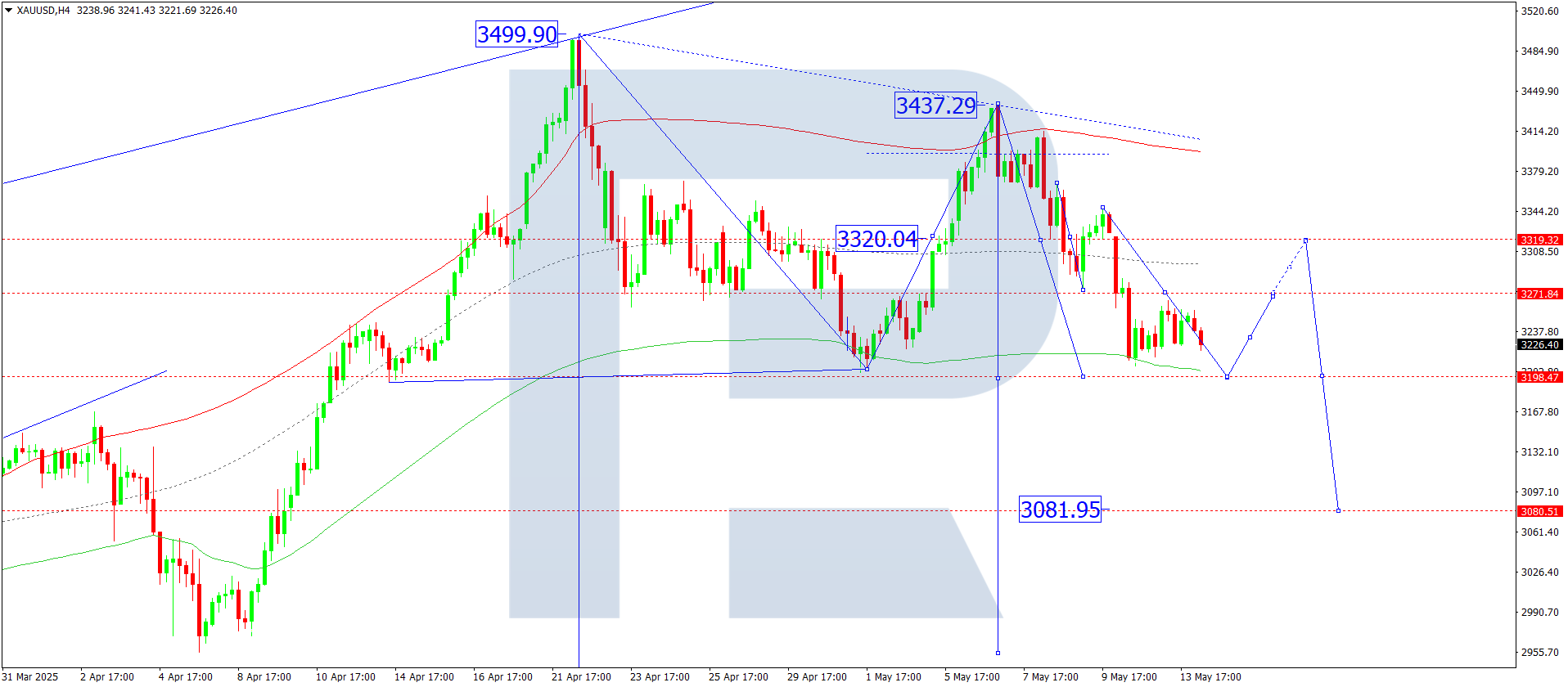

XAUUSD forecast

On the H4 chart of XAUUSD, the market is forming a consolidation range above 3207. Today, 14 May 2025, a move upwards to 3271 is possible. Afterwards, a downward wave to 3080 may begin. This is the local target.

This scenario aligns with the Elliott wave structure and the downward wave matrix, pivoting around 3320, considered key in this wave for XAUUSD. The market has reached the lower boundary of the Price Envelope at 3207. A corrective upward wave towards the central line at 3271 is currently unfolding.

Technical indicators for today’s XAUUSD forecast indicate a possible corrective upward wave towards 3271.

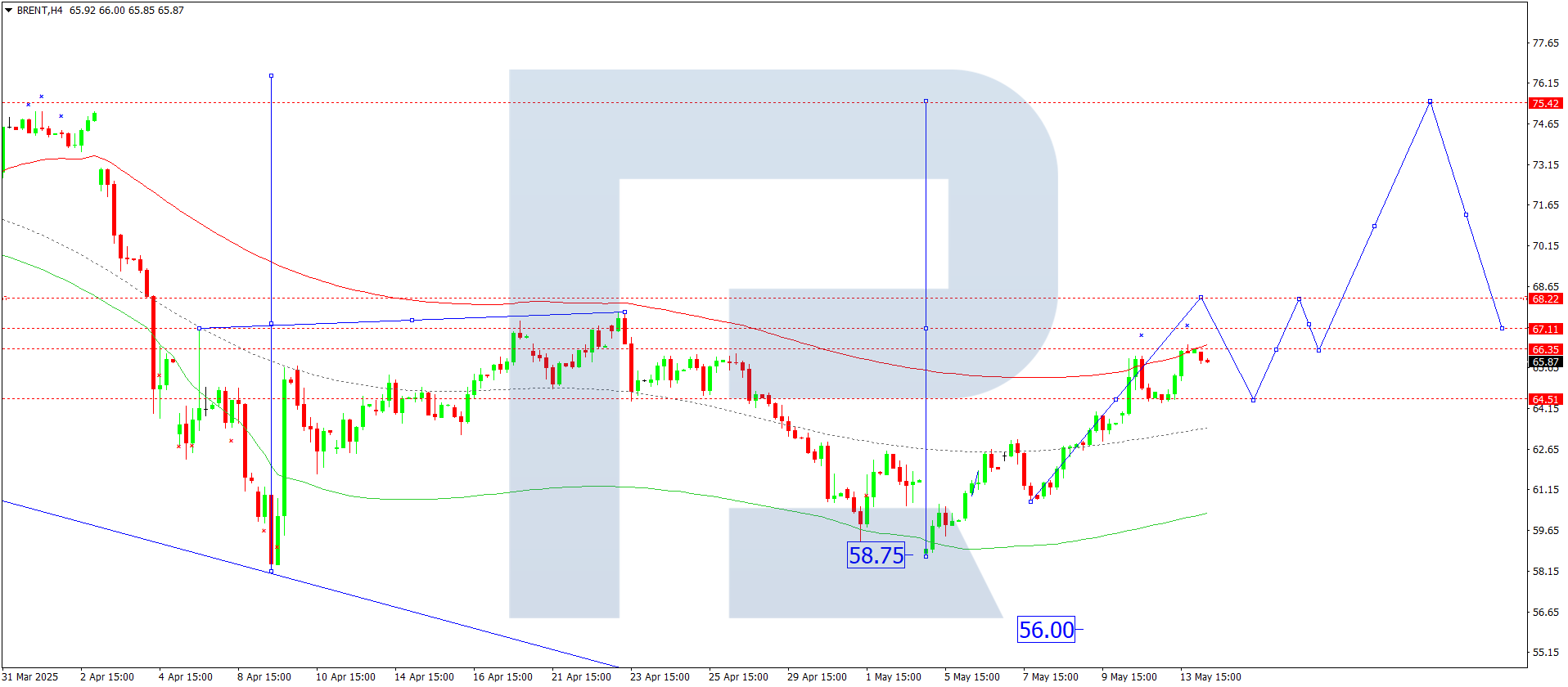

Brent forecast

On the H4 Brent crude chart, the market broke the 63.38 level upwards and completed a growth wave to 66.40. Today, 14 May 2025, a correction towards 64.50 (testing from above) is likely. Afterwards, a new upward wave to 68.22 may develop. If the market breaks this level upwards, the potential will open for a continued upward wave to 73.20. This is the local target.

This scenario finds technical support in the Elliott wave structure and a downward wave matrix with a pivot at 64.50, seen as key in Brent’s wave pattern. The market has completed a growth wave to the upper boundary of the Price Envelope at 66.40. A correction to the central line at 64.50 is likely.

Technical indicators in today’s Brent forecast point to the start of a corrective wave to 64.50.