Daily technical analysis and forecast for 14 October 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 14 October 2025.

EURUSD forecast

On the H4 chart of EURUSD, the market completed a decline to 1.1555 and a correction to 1.1592 (testing from below). A consolidation range has formed around 1.1592. On 14 October 2025, a breakout to the downside and continuation of the downward movement towards 1.1500 are expected, with potential extensions to 1.1480 and 1.1466 as a local target.

Technically, this scenario is confirmed by the Elliott Wave structure and the bearish wave matrix with the pivot point at 1.1622, which is viewed as the key level for EURUSD. The market is expected to move towards the lower boundary of the Price Envelope at 1.1500, with a possible continuation of the trend to 1.1466.

Technical indicators for today’s EURUSD forecast suggest a downward wave towards at least 1.1500.

USDJPY forecast

On the H4 chart of USDJPY, the market completed an upward leg to 152.60. On 14 October 2025, another downward move is expected towards 150.45, with possible continuation of the wave to 149.76 (testing from above). The entire corrective structure is viewed as a retracement to the previous growth wave from 153.27. After this correction ends, a new upward wave towards 154.10 is likely to begin.

Technically, this scenario is supported by the Elliott Wave structure and the bullish wave matrix with the pivot point at 149.76, the key level for this wave. The market continues the correction towards the central line of the Price Envelope at 151.50, with potential continuation towards the lower boundary at 150.45.

Technical indicators for today’s USDJPY forecast point to further correction towards 151.40 and 150.45.

GBPUSD forecast

On the H4 chart of GBPUSD, the market formed a consolidation range around 1.3330. On 14 October 2025, an upward expansion of the range towards 1.3318 is possible, followed by a new downward wave towards 1.3230 and a potential continuation of the decline to 1.3120.

Technically, this scenario is confirmed by the Elliott Wave structure and the bearish wave matrix with the pivot point at 1.3380, which is the key level in this wave. A consolidation range is forming above the lower boundary of the Price Envelope at 1.3260. A short-term rise towards its central line at 1.3380 is possible today, followed by a new downward wave towards the lower boundary at 1.3230, with the trend potentially continuing to 1.3120.

Technical indicators for today’s GBPUSD forecast suggest further correction towards 1.3390 and the start of a decline towards 1.3230 and 1.3120.

AUDUSD forecast

On the H4 chart of AUDUSD, the market continues its downward movement towards 0.6433. On 14 October 2025, the pair is expected to reach this level before correcting towards 0.6500. Afterwards, the next downward wave towards 0.6416 remains relevant as a local target.

Technically, this scenario is confirmed by the Elliott Wave structure and the bearish wave matrix with the pivot point at 0.6525, which acts as the key level in the AUDUSD wave structure. The market is extending the decline towards the lower boundary of the Price Envelope at 0.6416. A breakout below this level could open the potential for further continuation of the trend towards 0.6384.

Technical indicators for today’s AUDUSD forecast point to a possible decline towards 0.6416.

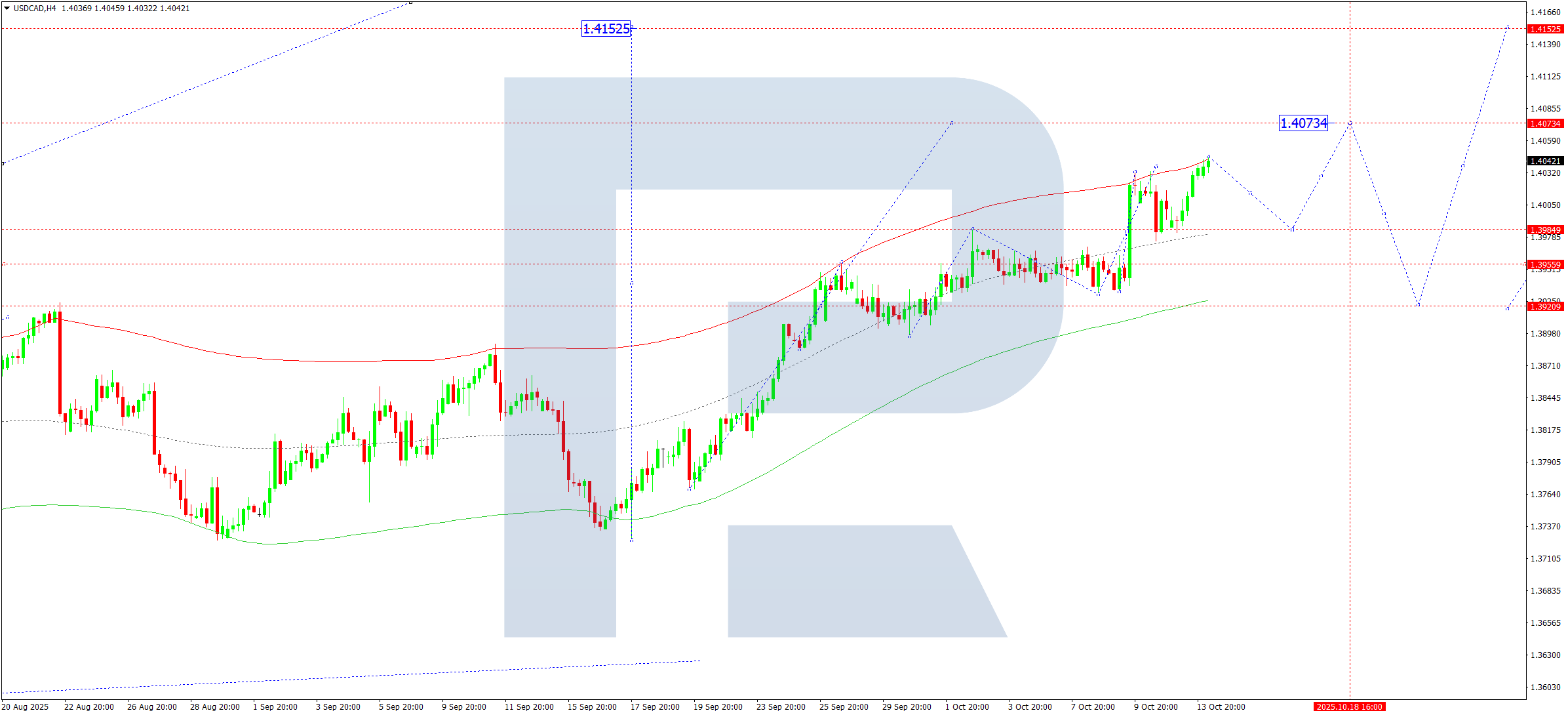

USDCAD forecast

On the H4 chart of USDCAD, the market found support at 1.3985 and completed an upward wave to 1.4045. On 14 October 2025, a correction towards 1.3985 is possible. Afterwards, an upward wave is expected to develop towards 1.4073, with prospects for trend continuation to 1.4152.

Technically, this scenario is confirmed by the Elliott Wave structure and the bullish wave matrix with the pivot point at 1.3920, the key level for the USDCAD structure. The market is developing a wave towards the upper boundary of the Price Envelope at 1.4073. Today, the pair could reach this target before correcting to the central line at 1.3985 (testing from above) and rising to 1.4152.

Technical indicators for today’s USDCAD forecast suggest continued growth towards 1.4073 and 1.4152.

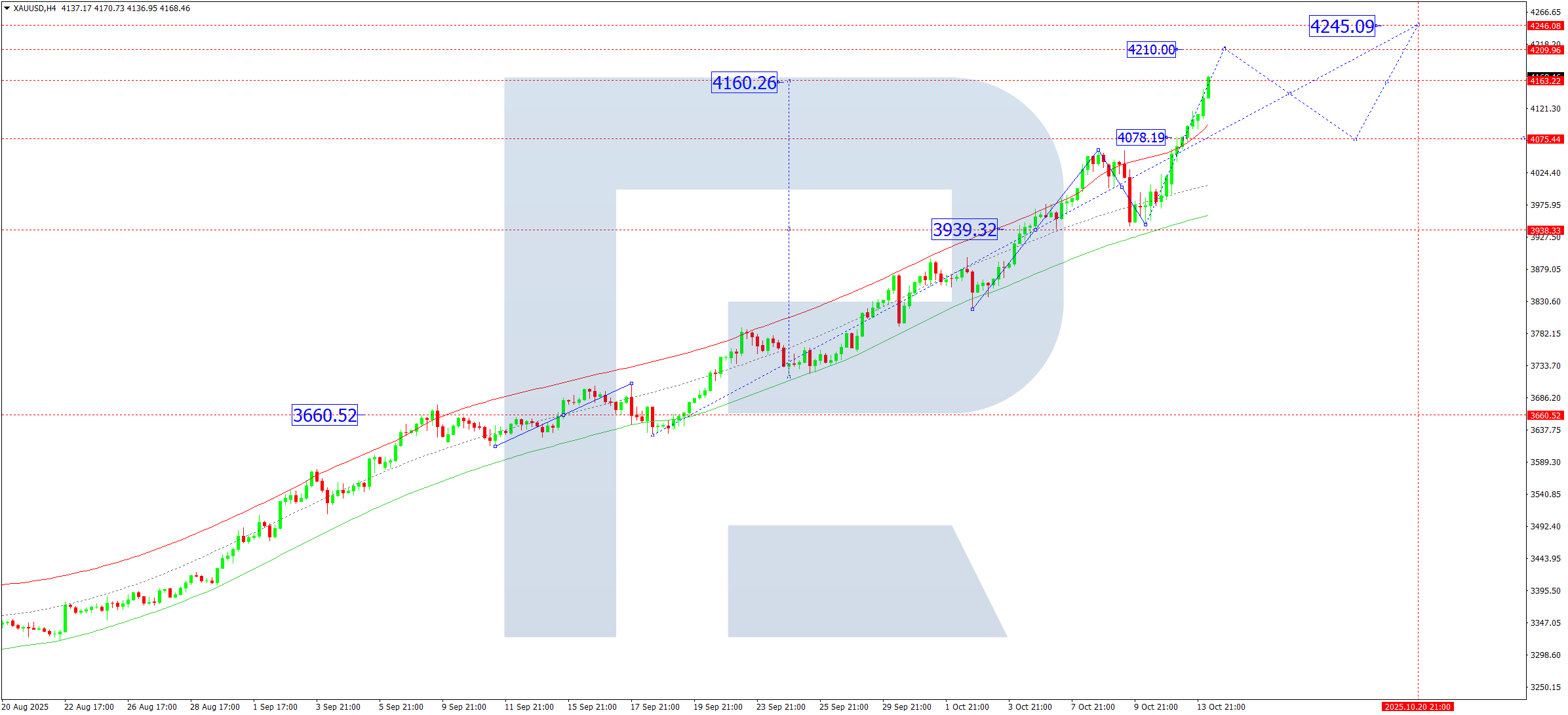

XAUUSD forecast

On the H4 chart of XAUUSD, the market completed an upward structure, reaching 4,179. On 14 October 2025, a correction towards 4,080 cannot be ruled out. After this correction, a new upward leg towards 4,210 is expected. A new consolidation range may form around 4,080. A breakout to the upside would open the potential for continued upward movement towards 4,245, while a breakout downwards may extend the correction to 3,939.

Technically, this scenario is confirmed by the Elliott Wave structure and the bullish wave matrix with the pivot point at 3,660, which is the key level for this XAUUSD wave. The market continues to form the upward structure towards the upper boundary of the Price Envelope at 4,245. Later, a correction towards the lower boundary at 4,080 is possible.

Technical indicators for today’s XAUUSD forecast indicate the continuation of the upward wave towards 4,210 and the start of a correction towards 4,080.

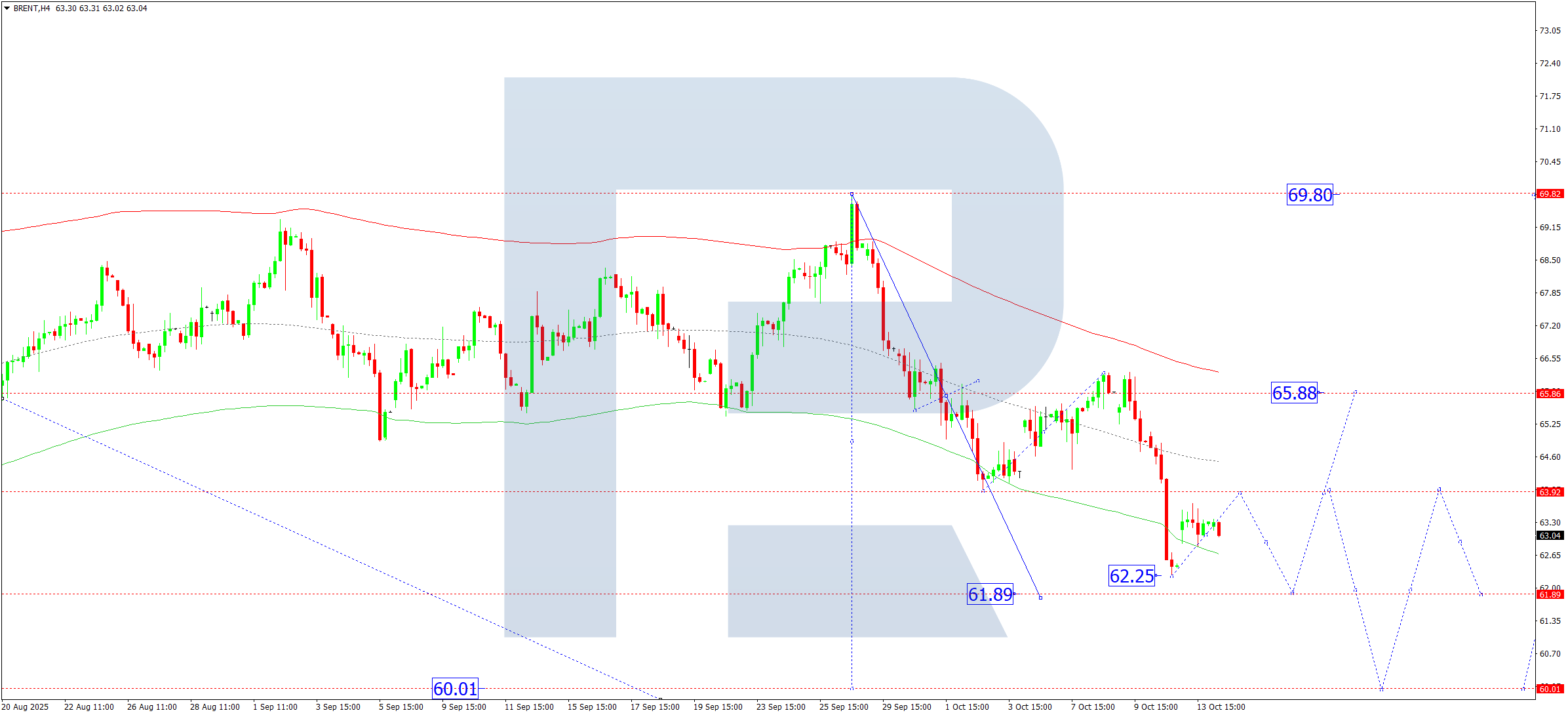

Brent forecast

On the H4 chart of Brent crude, the market is forming a consolidation range above 62.25. On 14 October 2025, a short-term rise towards 63.90 (testing from below) is possible. A broader consolidation range continues to develop around 65.88. A breakout upwards would open the potential for a wave towards 69.80, while a breakout downwards could extend the trend towards 61.61, with a further target at 60.00.

Technically, this scenario is confirmed by the Elliott Wave structure and the bearish wave matrix with the pivot point at 65.88, the key level in Brent’s current wave. The market has already reached the lower boundary of the Price Envelope at 62.25. A correction towards its upper boundary at 65.88 remains possible, followed by a continuation of the decline towards the lower boundary at 61.61.

Technical indicators for today’s Brent forecast suggest a possible correction towards 63.90 and the start of a decline towards 61.61.