Daily technical analysis and forecast for 29 September 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 29 September 2025.

EURUSD forecast

On the H4 chart of EURUSD, the market formed a consolidation range above 1.1645 and, after breaking upwards, started a correction. Today, 29 September 2025, a rise to 1.1730 is expected. Later, a move down to 1.1690 is possible, followed by a correction extending to 1.1780 (testing from below). After completing this correction, a new downward wave towards 1.1625 may start, with the trend continuing to 1.1464 as a local target.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 1.1780 confirm this scenario, which is seen as key for EURUSD. The market has reached the lower boundary of the Price Envelope at 1.1645 and is now expected to continue its correction towards the central line at 1.1730, with possible extension to the upper boundary at 1.1780.

Technical indicators for today’s EURUSD forecast suggest a corrective move to 1.1780.

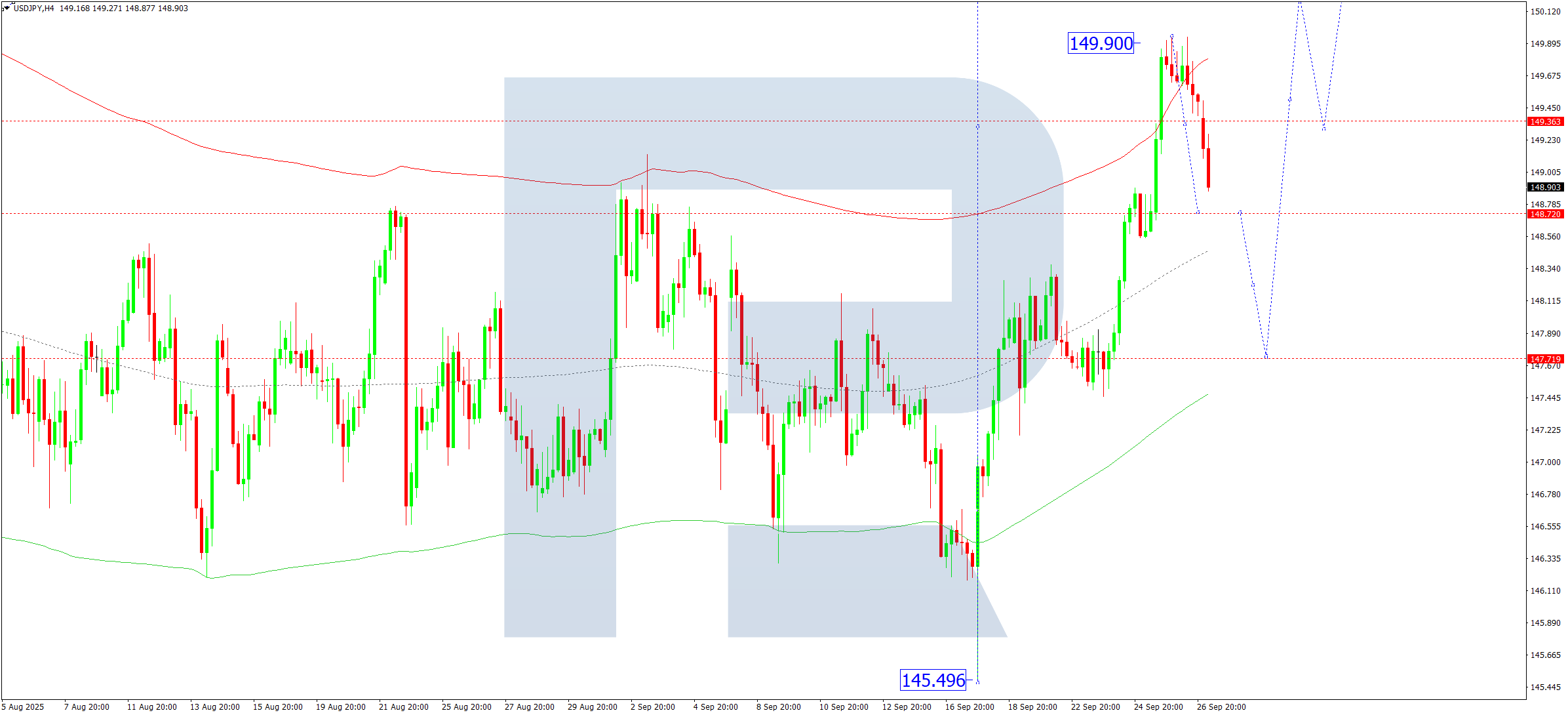

USDJPY forecast

On the H4 chart of USDJPY, the market is building a correction towards 148.70. Today, 29 September 2025, this target is expected, with possible extension to 149.30, followed by a decline to 147.77. At that point, the corrective potential would be exhausted. After the correction, a new growth wave to 150.00 is expected, with prospects of extending to 153.00.

Technically, the Elliott wave structure and the upward wave matrix with a pivot at 147.77 confirm this scenario, which is seen as key for USDJPY. The market reached the upper boundary of the Price Envelope at 149.90. Today, a correction towards the central line at 148.70 and possibly to the lower boundary at 147.77 is relevant.

Technical indicators for today’s USDJPY forecast suggest a correction to 148.70 and 147.77.

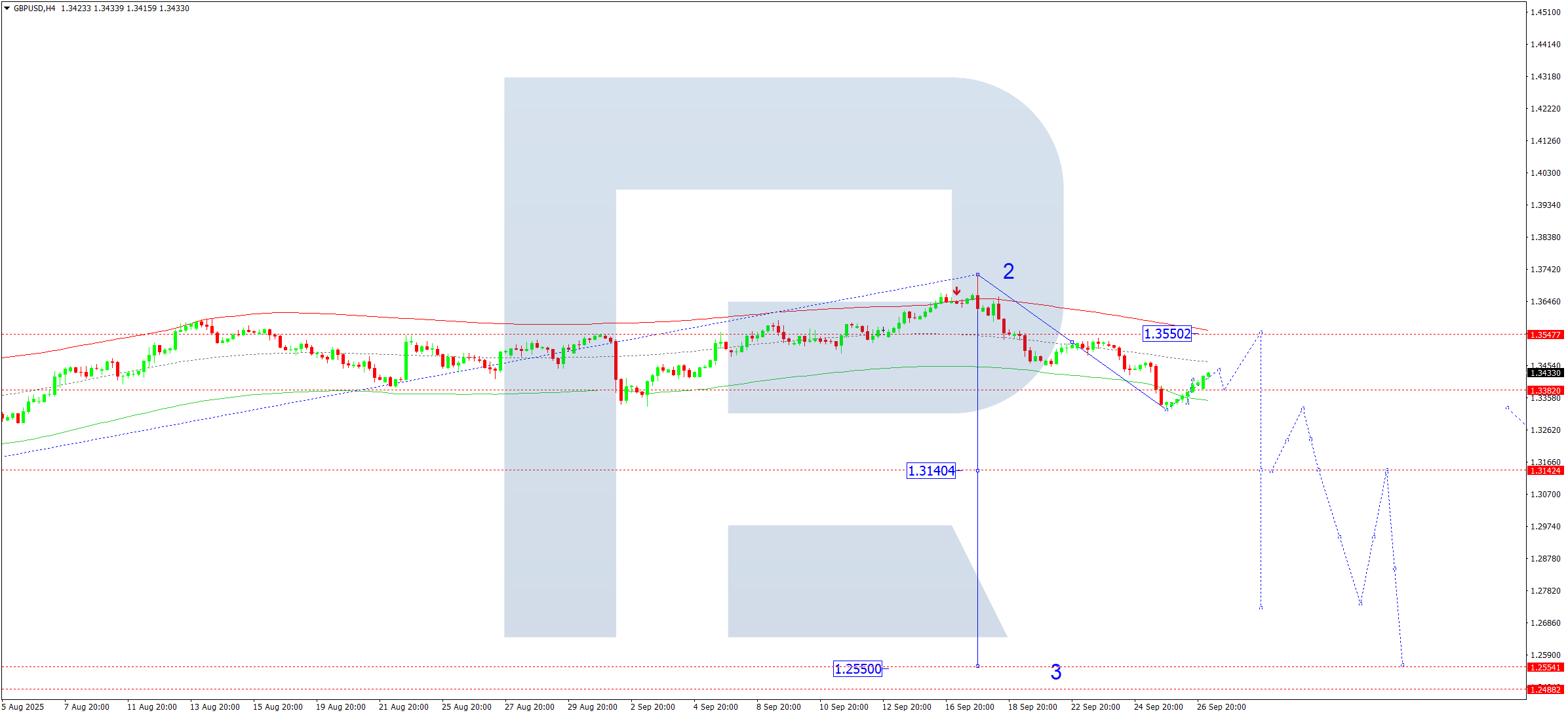

GBPUSD forecast

On the H4 chart of GBPUSD, the market formed a consolidation range above 1.3333 and broke upwards. Today, 29 September 2025, a rise to 1.3444 is expected, followed by a possible decline to 1.3820, and then growth towards 1.3550. After this corrective wave, a new downward wave towards 1.3300 may start.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 1.3550 confirm this scenario, which is seen as key for GBPUSD. The market completed a downward wave to the lower boundary of the Price Envelope at 1.3333. Today, a correction towards the central line at 1.3444 is possible.

Technical indicators for today’s GBPUSD forecast suggest a correction towards 1.3444.

AUDUSD forecast

On the H4 chart of AUDUSD, the market formed a consolidation range above 0.6520 and, after breaking upwards, is continuing its correction to 0.6570. Today, 29 September 2025, this target is expected. A decline to 0.6555 may follow, before extending the correction to 0.6616. After this correction, a new downward wave towards 0.6496 may develop.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 0.6616 confirm this scenario, which is seen as key for AUDUSD. The market completed a downward wave to the lower boundary of the Price Envelope at 0.6525. Today, continuation of the correction towards the central line at 0.6575 is relevant, with possible extension to the upper boundary at 0.6616.

Technical indicators for today’s AUDUSD forecast suggest a correction towards 0.6575.

USDCAD forecast

On the H4 chart of USDCAD, the market formed a consolidation range below 1.3956 and broke downwards. Today, 29 September 2025, a correction to 1.3898 is possible, with potential extension to 1.3838. After this correction, a new upward wave towards 1.3950 may start as a local trend target.

Technically, the Elliott wave structure and the upward wave matrix with a pivot at 1.3838 confirm this scenario, which is seen as key for USDCAD. The market completed a growth wave to the upper boundary of the Price Envelope at 1.3956. Today, correction towards the central line at 1.3838 (testing from above) is relevant.

Technical indicators for today’s USDCAD forecast suggest a correction towards 1.3838.

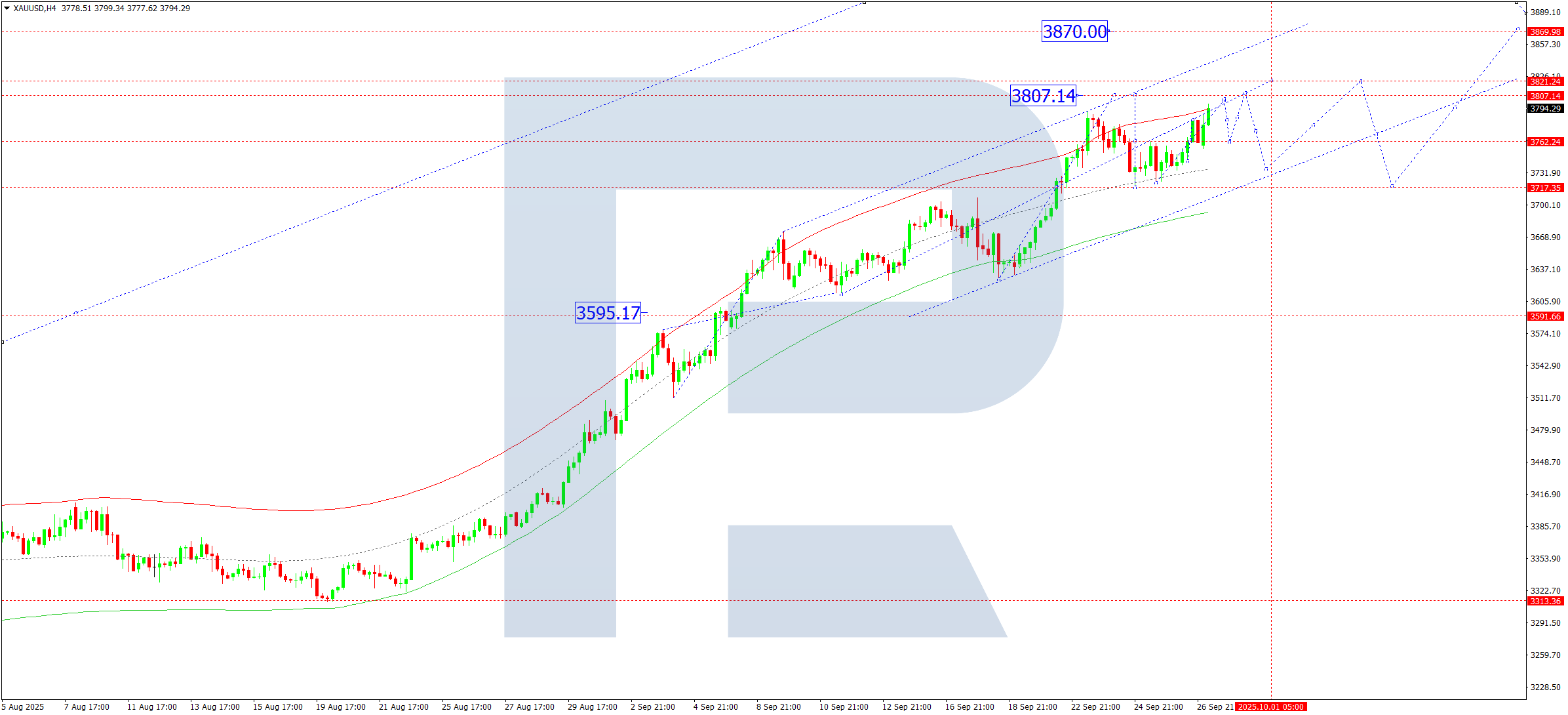

XAUUSD forecast

On the H4 chart of XAUUSD, the market formed a consolidation range around 3,762 and broke upwards. Today, 29 September 2025, the next growth wave is expected towards 3,820. A breakout of this level may open potential for an extension to 3,840 as a local target.

Technically, the Elliott wave structure and the upward wave matrix with a pivot at 3,595 confirm this scenario, which is seen as key for XAUUSD. The market is forming a growth structure towards the upper boundary of the Price Envelope at 3,840. Later, a correction towards the central line at 3,762 is possible.

Technical indicators for today’s XAUUSD forecast suggest growth to 3,840, followed by a correction to 3,762.

Brent forecast

On the H4 chart of Brent, the market completed a growth wave to 69.80. Today, 29 September 2025, a correction to 67.66 is possible, followed by further growth to 70.30 and an extension of the trend to 71.30.

Technically, the Elliott wave structure and the upward wave matrix with a pivot at 67.66 confirm this scenario, which is seen as key for Brent. The market is forming a growth wave towards the upper boundary of the Price Envelope at 70.30. Later, correction towards the central line at 67.66 will be relevant.

Technical indicators for today’s Brent forecast suggest a correction towards 67.66 and a continued upward move towards 71.30.