Daily technical analysis and forecast for 4 June 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 4 June 2025.

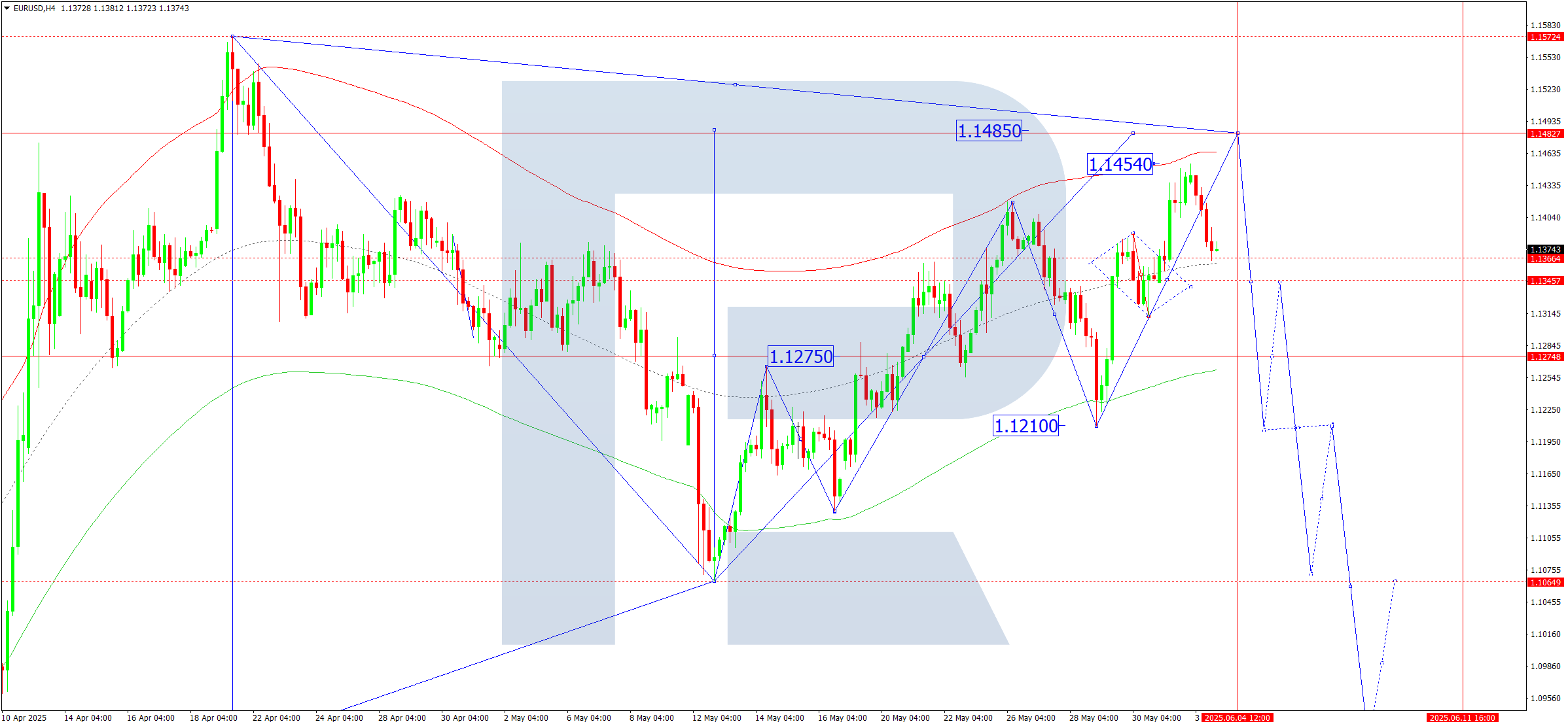

EURUSD forecast

On the H4 chart of EURUSD, the market completed a correction to 1.1366. Today, 4 June 2025, a growth wave is expected to develop towards 1.1485. Afterwards, a new downward wave may begin, targeting 1.1210.

This scenario is supported by the Elliott wave structure and the growth wave matrix with a pivot at 1.1275, seen as key in the EURUSD structure. At the moment, the fifth upward structure is evolving towards the upper boundary of the price Envelope at 1.1485. The price could reach this target level today. Then, a new downward wave may unfold towards the lower boundary at 1.1210, the initial target.

Technical indicators for today’s EURUSD forecast suggest the upward wave might continue to 1.1485.

USDJPY forecast

On the H4 chart of USDJPY, the market completed a correction to 144.34. Today, 4 June 2025, another downward move towards 142.20 is likely. Afterwards, a rise to 144.34 remains likely.

This scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 144.34, viewed as key in the USDJPY structure. Currently, the market has pulled back to the central line of the price Envelope at 144.34. Today, the market might begin a new downward wave towards the lower boundary at 142.20.

Technical indicators for today’s USDJPY forecast suggest a move down to 142.20.

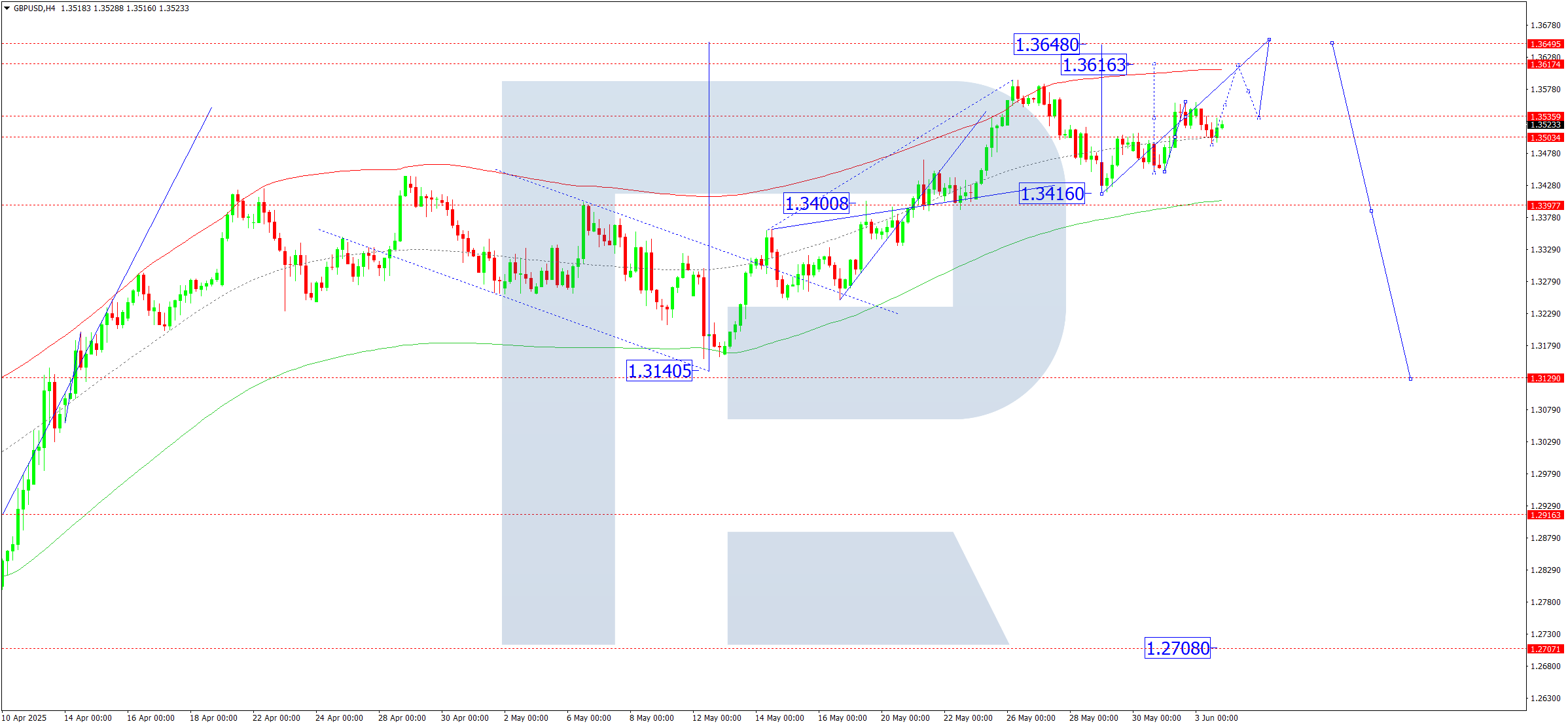

GBPUSD forecast

On the H4 chart of GBPUSD, the market completed a corrective structure to 1.3500. Today, 4 June 2025, a growth wave towards 1.3616 is likely, with a possible trend extension to 1.3648. Afterwards, a new downward wave to 1.3400 may unfold.

This scenario is supported by the Elliott wave structure and the growth wave matrix with a pivot at 1.3400, considered key in this wave. Currently, the market is forming a consolidation range around the central line at 1.3500. A downward breakout may extend the correction to the lower boundary at 1.3400, followed by a rise to the upper boundary at 1.3648. In turn, a breakout upwards may directly continue the trend to the upper boundary at 1.3648.

Technical indicators for today’s GBPUSD forecast suggest a rise to at least 1.3616.

AUDUSD forecast

On the H4 chart of AUDUSD, the market completed a correction to 0.6450. Today, 4 June 2025, a move higher to 0.6515 is expected. Afterwards, a downward wave to 0.6400 remains possible.

This scenario is technically supported by the Elliott wave structure and the growth wave matrix with a pivot at 0.6434, viewed as key in the AUDUSD structure. Currently, the market is consolidating around the central line of the price Envelope at 0.6460. Today, a breakout upwards could initiate a wave towards the upper boundary at 0.6515.

Technical indicators for today’s AUDUSD forecast suggest a wave towards 0.6515 is likely.

USDCAD forecast

On the H4 chart of USDCAD, the market completed a correction to 1.3742. Today, 4 June 2025, another move up to 1.3765 is possible. Afterwards, a downward wave to 1.3670 may unfold, followed by growth to 1.3860.

This scenario is supported by the Elliott wave structure and the downward wave matrix with a pivot at 1.3860, regarded as key for USDCAD. At present, the market is developing a fifth downward wave to the lower boundary of the price Envelope at 1.3670. Once this level is reached, a new growth wave towards the upper boundary at 1.4040 may begin.

Technical indicators for today’s USDCAD forecast suggest the continuation of the downward wave to 1.3670.

XAUUSD forecast

On the H4 chart of XAUUSD, the market completed a correction to 3,333. Today, 4 June 2025, upward momentum could continue to 3,400. The entire growth structure appears to be a correction to the prior downward wave. Once this correction completes, a new wave down to 3,060 may begin.

This scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 3,260, considered key in the XAUUSD structure. Currently, the market is forming a fifth corrective wave towards the upper boundary of the price Envelope at 3,400. After this correction ends, a downward wave to the lower boundary at 3,240 is possible.

Technical indicators for today’s XAUUSD forecast suggest the wave may continue up to 3,400.

Brent forecast

On the H4 Brent crude chart, the market formed a consolidation range around 64.66 and broke out upwards. Today, 4 June 2025, the market may continue the growth wave towards 67.17, with potential for the trend to extend to 69.72, the local target.

This scenario is backed by the Elliott wave structure and the growth wave matrix with a pivot at 64.66, seen as key in Brent’s wave. The market is currently forming a wave towards the upper boundary of the price Envelope at 67.17. Later, a new consolidation range may form before the trend continues to 69.72.

Technical indicators for today’s Brent forecast suggest the price may rise to 67.17.