Daily technical analysis and forecast for 6 June 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 6 June 2025.

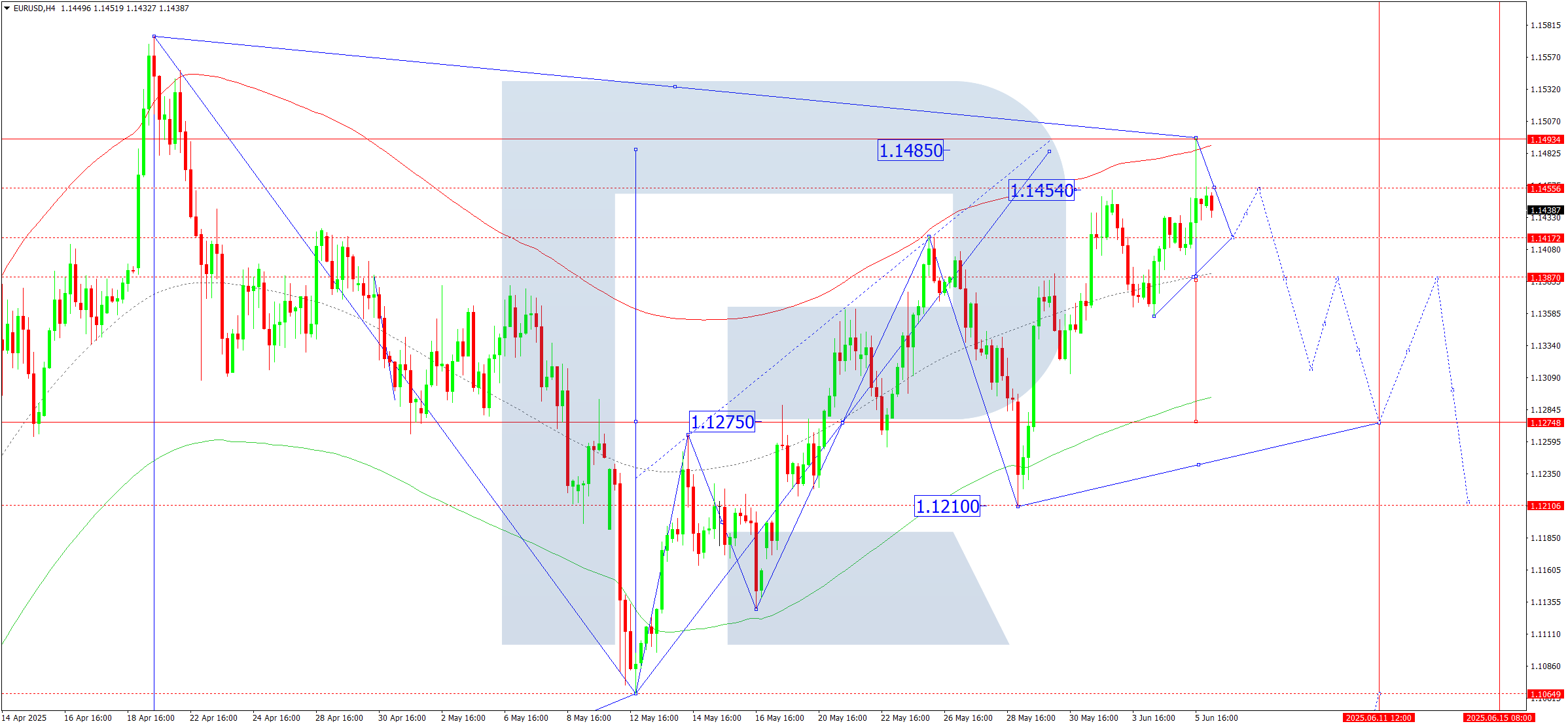

EURUSD forecast

On the H4 chart of EURUSD, the market completed a growth wave to 1.1494, reaching the projected target. Today, 6 June 2025, a downward wave to 1.1417 followed by a rebound to 1.1456 is expected. The market may form a consolidation range between these levels. If the price breaks upwards, the structure may stretch to 1.1515. A breakout downwards would suggest the beginning of a decline towards 1.1275.

This scenario is supported by the Elliott wave structure and the growth wave matrix with a pivot at 1.1275, considered key in this wave for EURUSD. The current growth wave reached the upper boundary of the price Envelope at 1.1494. Today, the price could decline towards the central line at 1.1387, with the trend potentially continuing towards the lower boundary at 1.1275 as the first target.

Technical indicators for today’s EURUSD forecast suggest a potential decline towards 1.1275.

USDJPY forecast

On the H4 chart of USDJPY, the market continues consolidating around 143.33. Today, 6 June 2025, a move to 144.20 is expected, followed by a potential decline to 142.20, then a rebound to 144.20. The broader consolidation range continues to evolve around the 144.20 level.

This scenario is confirmed by the Elliott wave structure and the decline wave matrix with a pivot at 144.20, seen as key in this wave. Currently, the market has returned to the central line of the price Envelope at 143.33. Today, a downward wave could continue towards the lower boundary at 142.20.

Technical indicators for today’s USDJPY forecast suggest a decline towards 142.20.

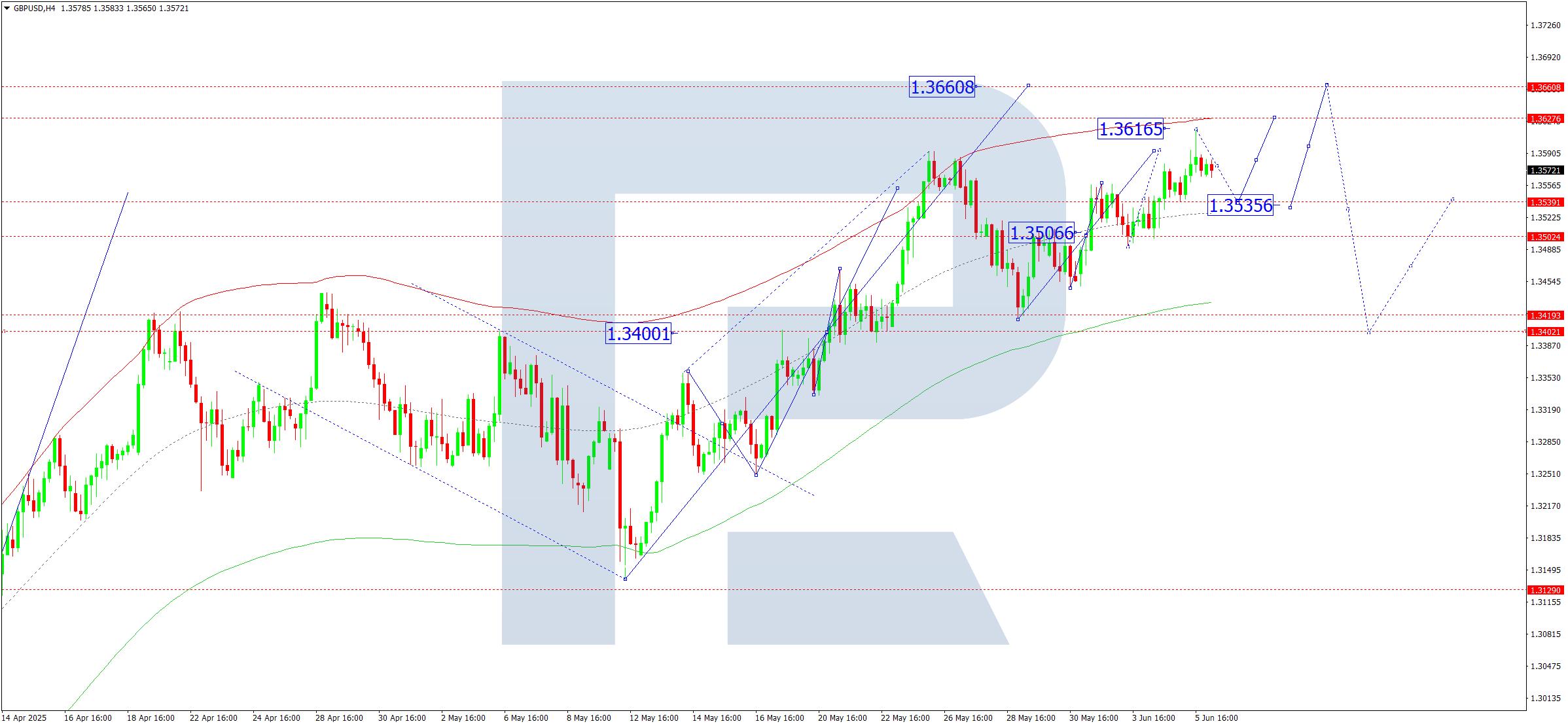

GBPUSD forecast

On the H4 chart of GBPUSD, the market reached 1.3616. Today, 6 June 2025, a pullback to 1.3535 is expected. The upward wave may then extend to 1.3626, with a possible continuation to 1.3660. After that, a drop to 1.3400 may follow.

The Elliott wave structure and the growth matrix with a pivot at 1.3400 support this scenario, viewed as key in the wave. The market has broken out above the consolidation range at 1.3616. A possible extension towards the upper boundary of the price Envelope at 1.3626 may take place. After that, a downward wave towards the lower boundary at 1.3400 becomes relevant.

Technical indicators for today’s GBPUSD forecast suggest a pullback to 1.3535.

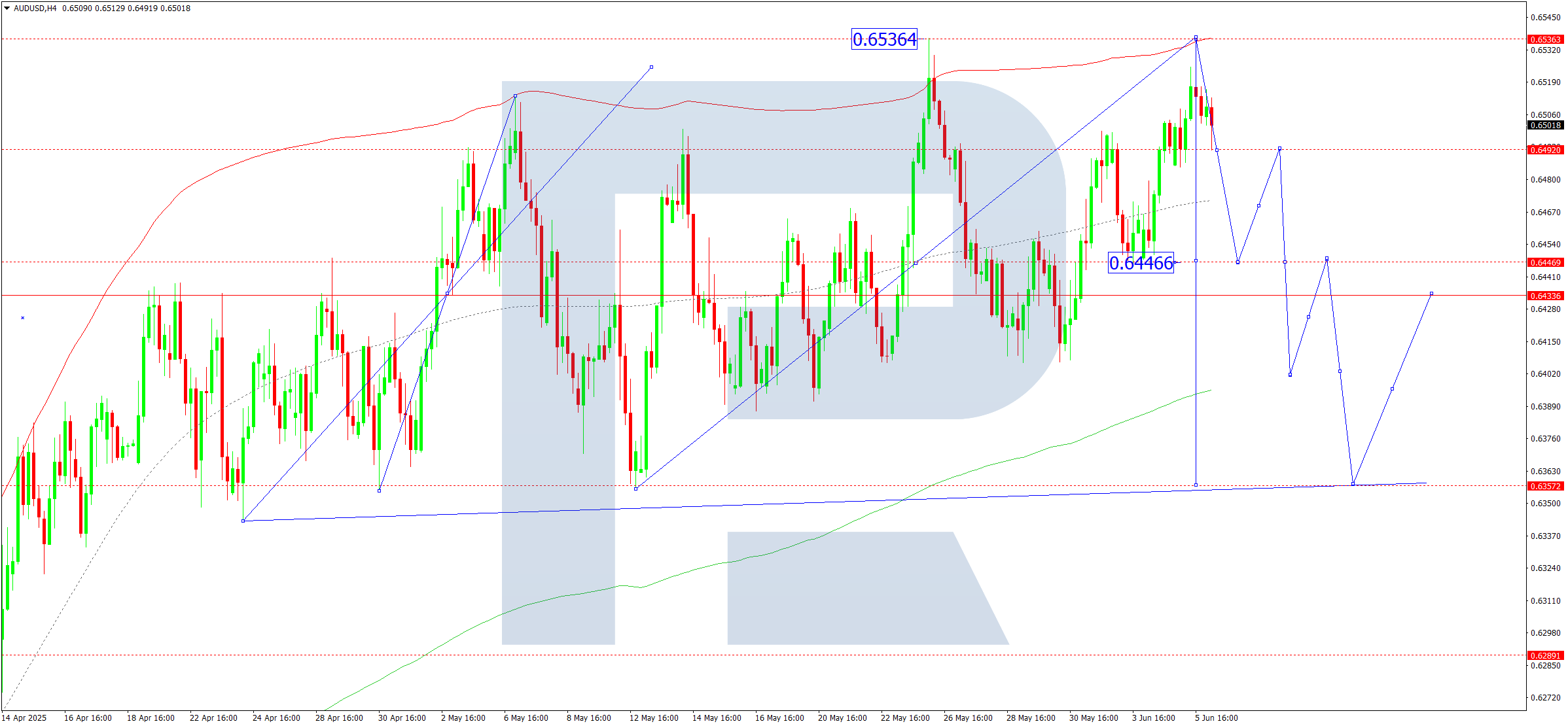

AUDUSD forecast

On the H4 chart of AUDUSD, the market completed a growth wave to 0.6536. Today, 6 June 2025, a decline to 0.6446 is expected, followed by a rebound to 0.6490. The market is expected to develop a consolidation range around this level.

This outlook is supported by the Elliott wave structure and the growth matrix with a pivot at 0.6446, considered key in this wave. Currently, the market has reached the upper boundary of the price Envelope at 0.6536. Today, a move towards the central line at 0.6446 appears likely.

Technical indicators for today’s AUDUSD forecast suggest a decline to 0.6446.

USDCAD forecast

On the H4 chart of USDCAD, the market completed a downward wave to 1.3633. Today, 6 June 2025, a consolidation range could form at these lows. A breakout upwards could initiate a growth wave to 1.3844 as the first target.

The Elliott wave structure and the decline matrix with a pivot at 1.3860 support this scenario. It is viewed as key for USDCAD in this wave. The market has completed the fifth downward wave to the lower boundary of the price Envelope at 1.3633. Today, an upward wave could start, aiming for its central line at 1.3745.

Technical indicators for today’s USDCAD forecast suggest a rebound to 1.3745.

XAUUSD forecast

On the H4 chart of XAUUSD, the market completed a growth wave to 3,400. Today, 6 June 2025, a consolidation around this high is expected. The growth structure might stretch towards 3,418. After this, a decline towards 3,060 remains relevant as the first target.

This scenario is confirmed by the Elliott wave structure and the decline matrix with a pivot at 3,280, viewed as key for XAUUSD in this wave. The market has formed the fifth wave of the correction towards the upper boundary of the price Envelope at 3,400. Today, a new downward wave could begin, targeting its lower boundary at 3,240.

Technical indicators for today’s XAUUSD forecast suggest a coming decline towards 3,240.

Brent forecast

On the H4 Brent crude chart, the market continues consolidating around 64.66 without a clear trend. Today, 6 June 2025, a range extension down to 64.04 and up to 65.75 is expected. A breakout to the upside may continue the wave to 67.17, with potential extension to the local target of 69.70.

This scenario is supported by the Elliott wave structure and the growth matrix with a pivot at 64.66, viewed as key for Brent in this wave. The market is currently forming a growth wave to the upper boundary of the price Envelope at 67.17. A new consolidation range may follow before continuing the trend to 69.70.

Technical indicators for today’s Brent forecast suggest a rise to 67.17.