Daily technical analysis and forecast for 8 August 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 8 August 2025.

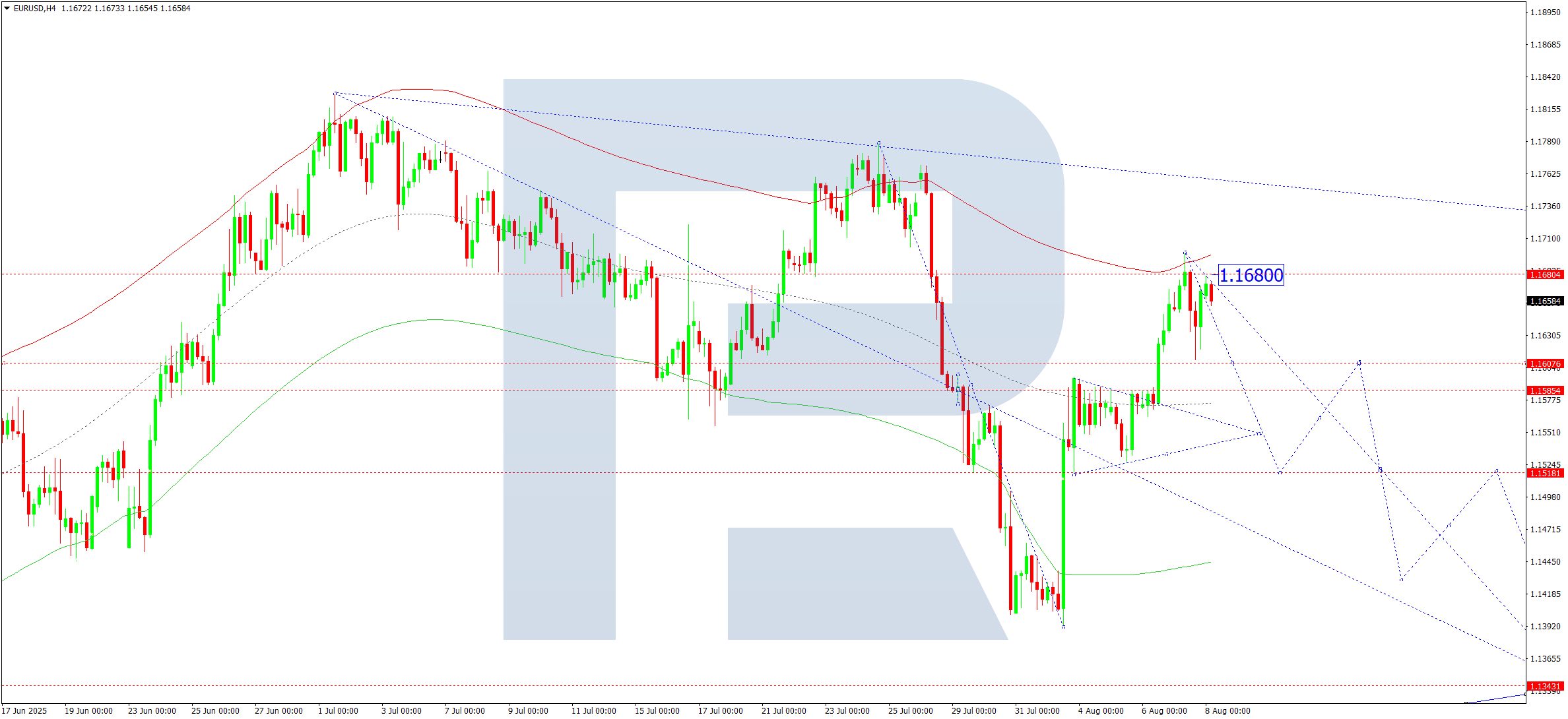

EURUSD forecast

On the H4 chart of EURUSD, the market broke above the consolidation range and completed a correction to 1.1698. Today, 8 August 2025, a downward impulse has reached 1.1611. The market has essentially set the boundaries of a new consolidation range. A breakout below this range towards 1.1520 is expected. If this level breaks, the potential for a further wave towards 1.1343 will open. This is the first target. Later, a possible return of the rate to 1.1550 will be considered as the second target.

Technically, this scenario is confirmed by the specified Elliott wave structure and the downward wave matrix with a pivot at 1.1550. It is viewed as the key structure in the wave for EURUSD. At the moment, the market has completed a correction wave to the upper boundary of the price Envelope at 1.1698. After reaching this target level, the possibility of a decline towards its lower boundary at 1.1343 will be considered.

Technical indicators for today’s EURUSD forecast suggest the start of a downward wave towards 1.1343.

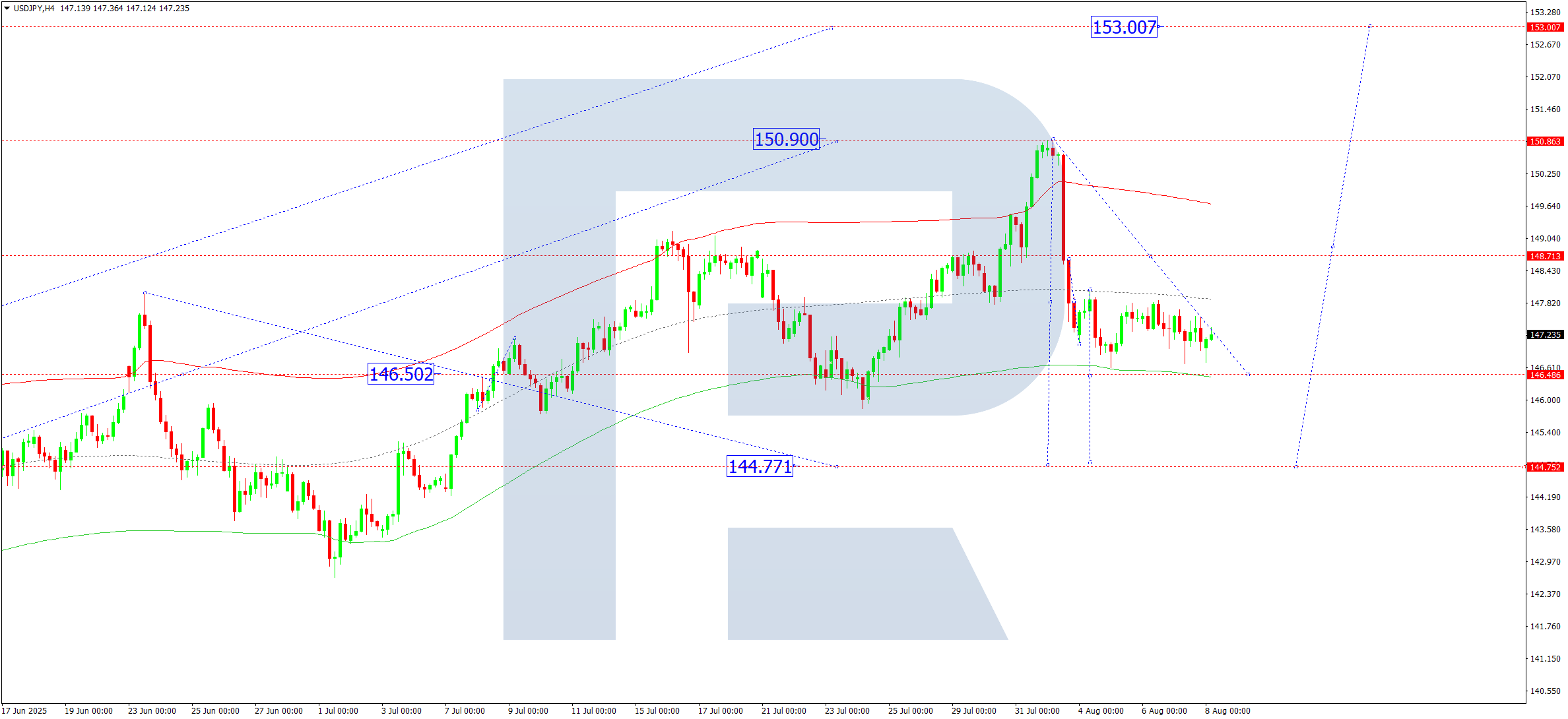

USDJPY forecast

On the H4 chart of USDJPY, the market continues to develop a consolidation range above 146.50. Today, 8 August 2025, a downward breakout with an expansion of the range to 144.77 is possible. If the breakout is upwards, growth towards 149.33 will be considered. A breakout of this level will open the potential for a continued wave towards 153.14 as a local target.

Technically, this scenario for USDJPY is confirmed by the specified Elliott wave structure and the growth wave matrix with a pivot at 146.50. It is viewed as the key structure of this wave. At the moment, the market has completed a growth structure to the upper boundary of the price Envelope at 150.90 and a correction to 146.60 (testing from above). An expansion of the range downwards to its lower boundary at 144.77 is possible. Afterwards, growth towards its upper boundary at 153.14 is expected.

Technical indicators for today’s USDJPY forecast suggest the start of a growth wave towards 153.14.

GBPUSD forecast

On the H4 chart of GBPUSD, the market formed a compact consolidation range around 1.3292 and, with an upward breakout, completed a correction to 1.3444. Today, 8 August 2025, a downward wave towards 1.3200 is expected. A downward breakout of this level would open the potential for a further wave towards 1.2940.

Technically, this scenario for GBPUSD is confirmed by the specified Elliott wave structure and the downward wave matrix with a pivot at 1.3366. It is viewed as the key structure of this wave. At the moment, the market has completed a correction wave to the upper boundary of the price Envelope at 1.3444. It will be relevant to consider a further decline towards its central line at 1.3200, with the prospect of a continued wave towards its lower boundary at 1.2942.

Technical indicators for today’s GBPUSD forecast suggest the start of a downward wave towards 1.3200.

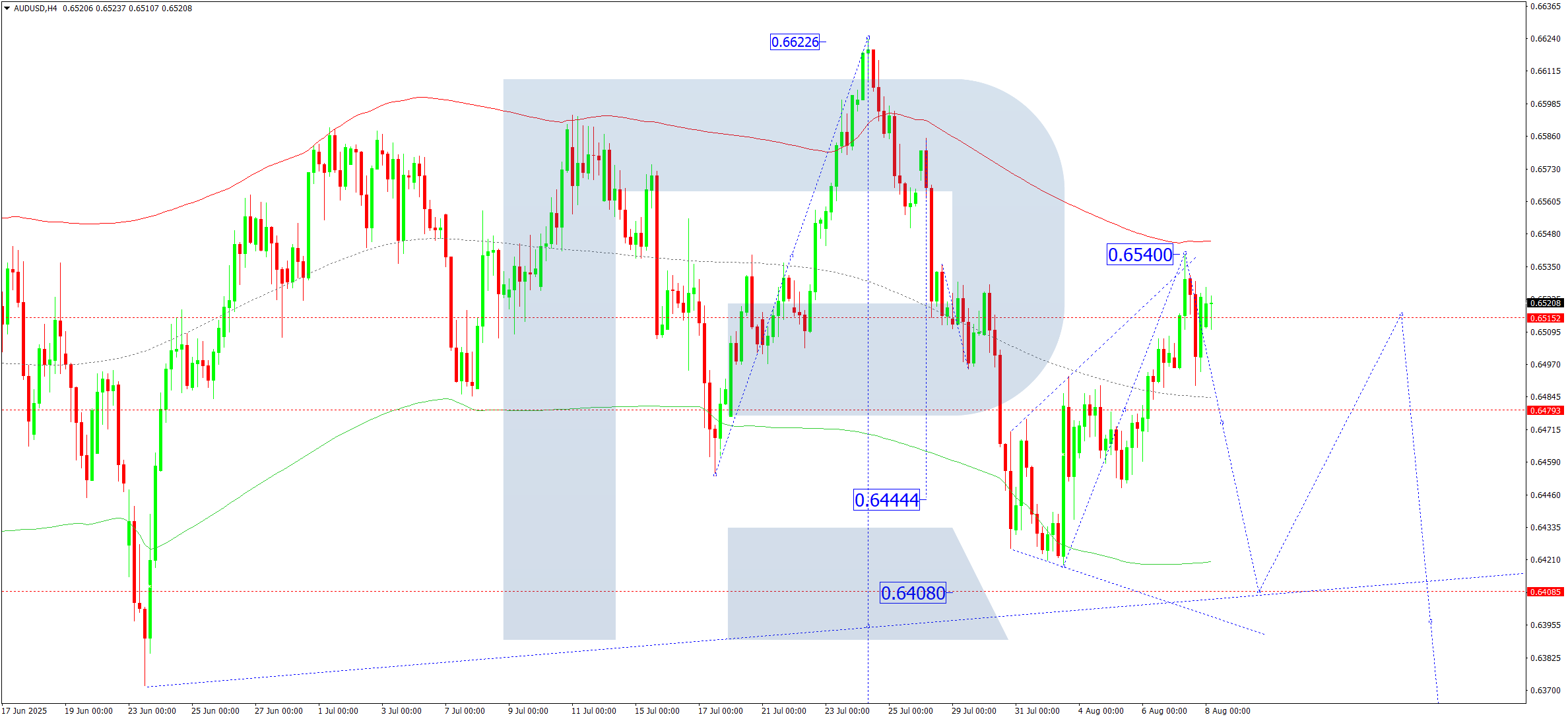

AUDUSD forecast

On the H4 chart of AUDUSD, the market continues to develop a consolidation range around 0.6466. Today, 8 August 2025, an upward breakout towards 0.6544 is expected. Afterwards, the possibility of a downward wave towards 0.6460 will be considered. A breakout of this level will open the potential for a continued trend towards 0.6408 as the first target.

Technically, this scenario is confirmed by the specified Elliott wave structure and the AUDUSD downward wave matrix with a pivot at 0.6515. It is viewed as the key structure of this wave. At the moment, the market has completed a downward wave to the lower boundary of the price Envelope at 0.6417. Today, the possibility of a corrective leg towards its upper boundary at 0.6544 will be considered, followed by a continuation of the wave towards its lower boundary at 0.6408.

Technical indicators for today’s AUDUSD forecast suggest the start of a downward wave towards 0.6408.

USDCAD forecast

On the H4 chart of USDCAD, the market continues to form a correction towards 1.3715. Today, 8 August 2025, this target level is expected to be reached. An extension of this correction to 1.3700 is also possible. After this correction is completed, a new growth wave could start, aiming for 1.3890.

Technically, this scenario is confirmed by the specified Elliott wave structure and the growth wave matrix with a pivot at 1.3715. It is viewed as the key structure for USDCAD in this wave. At the moment, the market has formed a consolidation range around the central line of the price Envelope at 1.3800 and has broken downwards from it. Today, it will be relevant to consider a decline towards its lower boundary at 1.3715. The entire downward structure is viewed as a correction to the previous growth wave. After this correction is completed, a growth wave could start, aiming for its upper boundary at 1.3890.

Technical indicators for today’s USDCAD forecast suggest the start of a growth wave towards 1.3890.

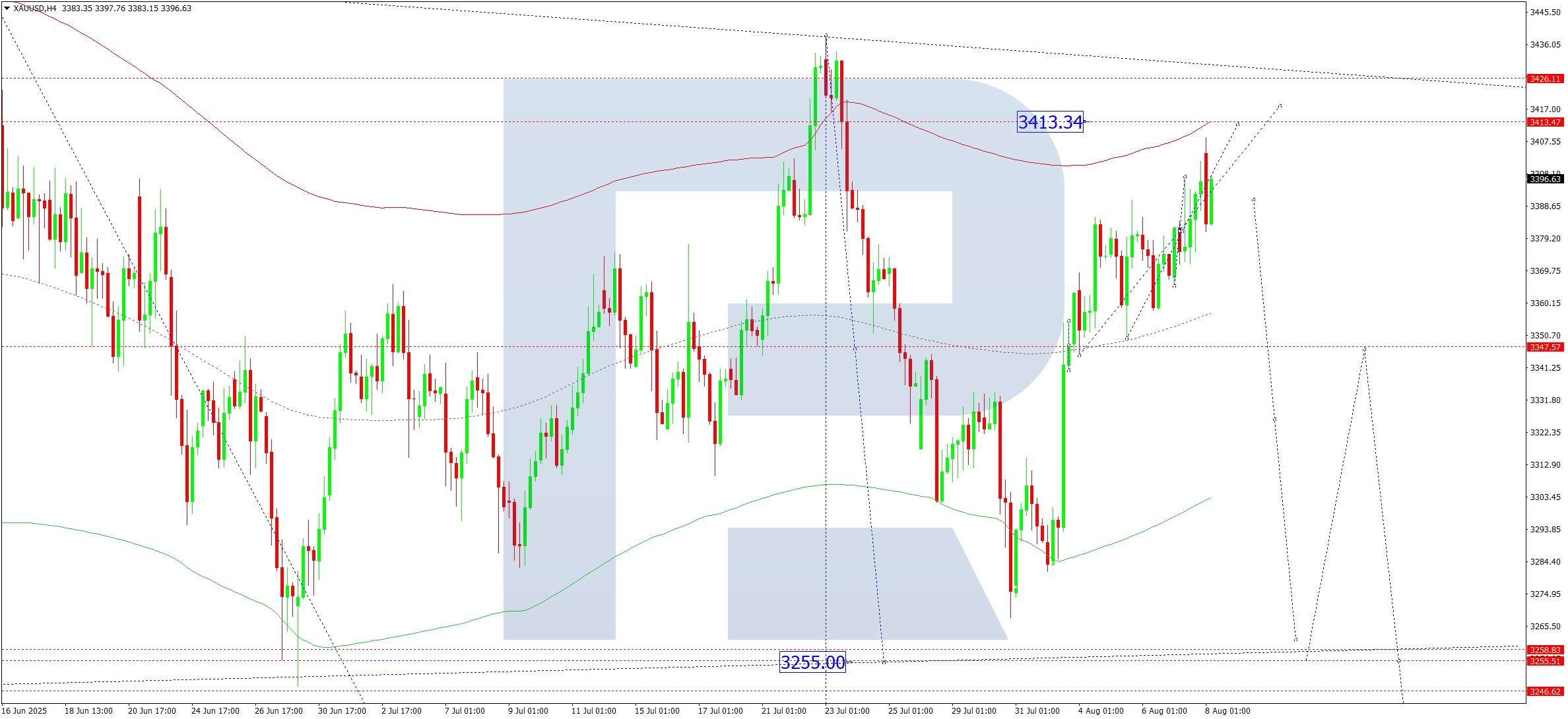

XAUUSD forecast

On the H4 chart of XAUUSD, the market continues to develop a correction towards 3,414. Today, 8 August 2025, the possibility of forming a consolidation range below this level will be considered. A downward breakout from this range and a wave development towards 3,255 are expected. This is the local target.

Technically, this scenario is confirmed by the specified Elliott wave structure and the downward wave matrix with a pivot at 3,345. It is viewed as the key structure for XAUUSD in this wave. At the moment, the market is correcting to the upper boundary of the price Envelope at 3,414. Later, the possibility of a decline towards its central line at 3,333 will be considered, with the prospect of a further wave towards its lower boundary at 3,255.

Technical indicators for today’s XAUUSD forecast point to a potential downward wave towards 3,255.

Brent forecast

On the H4 chart of Brent crude oil, the market is forming a consolidation range above 66.00. Today, 8 August 2025, an upward breakout and the start of a growth wave towards 72.60 are expected. Later, the possibility of a decline to 69.40 will be considered, followed by growth to 76.00 with the prospect of a continued trend towards 79.30.

Technically, this scenario is confirmed by the specified Elliott wave structure and the growth wave matrix with a pivot at 69.50. It is viewed as the key structure for Brent in this wave. At the moment, the market has completed a correction to the lower boundary of the price Envelope at 66.00. It will be relevant to consider growth towards its upper boundary at 72.60, with the prospect of a continued trend towards 79.30.

Technical indicators for today’s Brent forecast suggest the probability of a growth wave towards 72.60.