The DE 40 index is in a downtrend after reaching an all-time high. By the end of this week, it will be clear how deeply the price can fall this time.

DE 40 trading key points

- Recent data: Germany’s consumer inflation CPI in June eased to 2.2% year-over-year

- Economic indicators: decreasing price growth rates in Germany, the EU’s leading economy, may prompt the ECB to take more decisive action to lower the interest rate

- Market impact: a key rate cut will positively impact the capitalisation growth of public companies despite the Bundesbank revising Germany’s GDP growth forecast for 2024 from 0.3% to 0.5%

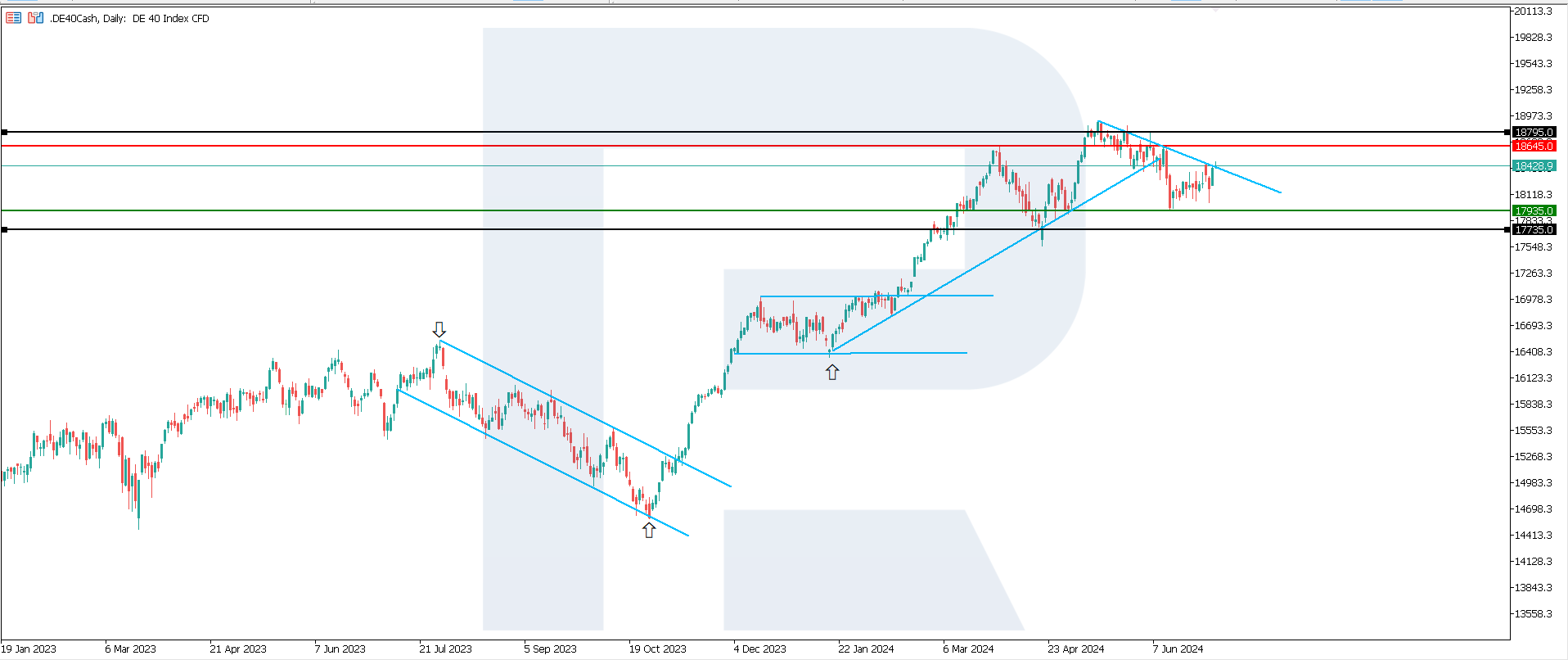

- Resistance: 18,645.0, Support

- DE 40 price target: 18,795.0

Fundamental analysis

Consumer inflation in Germany decreased to 2.2% in June, slightly below the forecasted 2.3%. This figure stood at 2.4% in May and is approaching the 2.0% target. As the EU’s driving force, Germany could see the ECB taking more decisive steps to lower interest rates, potentially boosting stock market capitalisation.

Additionally, some investors may increase their investments in German stocks due to political risks in France. However, this will have a short-term effect.

DE 40 technical analysis

The DE 40 stock index is in a downtrend after reaching an all-time high. However, it still has growth potential. The price is testing resistance at the downtrend line. A breakout above this level could signal a trend reversal, although the possibility of a sideways channel formation cannot be ruled out. Key levels to watch include:

- Resistance level: 18,645.0 – breaking above this level could lead the index to reach 18,796.0

- Support level: 17,935.0 – breaking below this level could target 17,735.0

Summary

German consumer inflation slowed to 2.2% in June, compared to the forecasted 2.3%. The ECB has increasingly more reasons to lower the interest rate more decisively. The DE 40 stock index remains in a downtrend. A breakout above the resistance level may test highs at 18,795.0. However, the formation of a sideways channel cannot be ruled out.