DE 40 analysis: the index rises due to global optimism amid the US Fed rate cut

The DE 40 stock index is rising amid general investor optimism after the first US Federal Reserve interest rate cut in four years. However, the German economic situation does not support this sentiment. The DE 40 forecast for next week is negative.

DE 40 forecast: key trading points

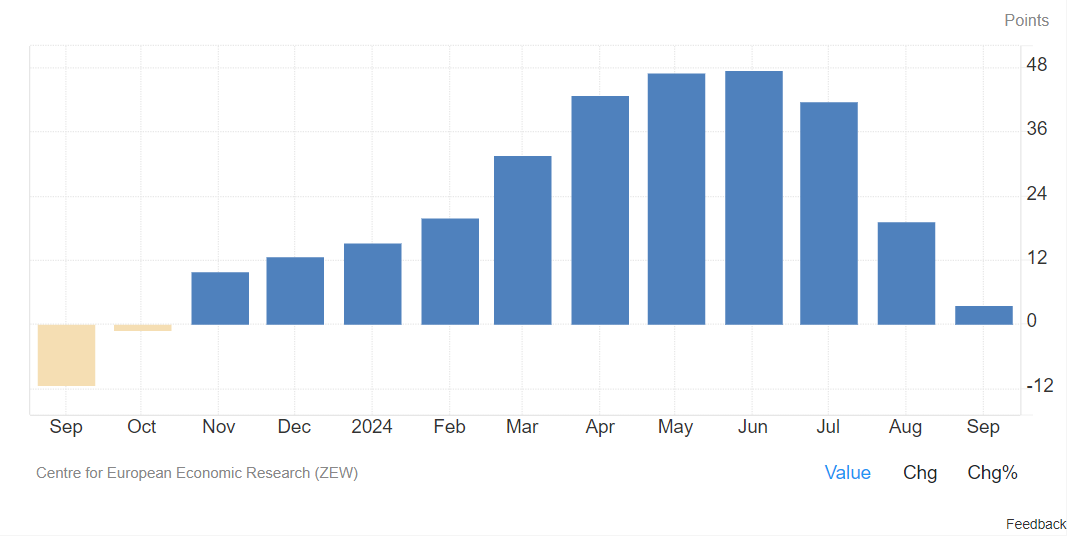

- Recent data: the ZEW Indicator of Economic Sentiment in September stands at 3.6

- Economic indicators: the ZEW Indicator of Economic Sentiment measures expectations of professional investors and analysts regarding economic activity in Germany

- Market impact: the ZEW Indicator of Economic Sentiment significantly impacts the German stock market as it reflects potential demand for German stocks from investors

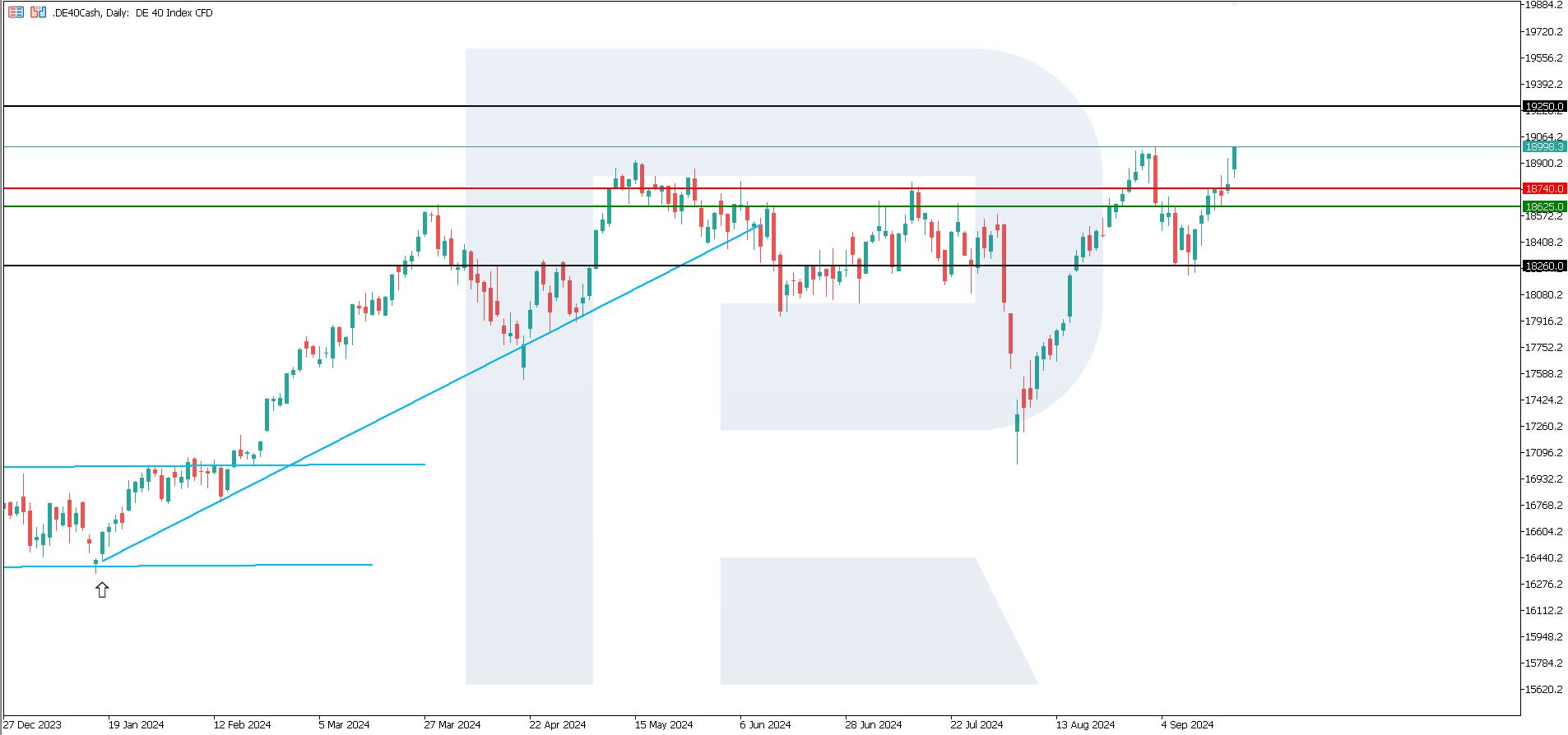

- Resistance: 18,740.0, Support: 18,625.0

- DE 40 price forecast: 19,250.0

Fundamental analysis

The ZEW Indicator of Economic Sentiment came in at 3.6 points in September, falling short of the forecasted 17.1. The decrease in the ZEW index shows that market participants expect an economic slowdown or recession. This may lead to stock sell-offs, especially in cyclical sectors that are highly dependent on general economic growth.

Source: https://tradingeconomics.com/germany/zew-economic-sentiment-index

Negative sentiment may reduce investor confidence in future corporate earnings, which may cause stock prices to decline. The preconditions for this scenario have emerged amid the crisis in the automotive industry.

The German electric vehicle market contracted sharply last month, causing a broader downturn in Europe and prompting automakers to call on Brussels to reconsider key climate targets. EV deliveries in the region’s largest automotive market fell by 69% in August, leading to a total decline of 36% across the region, reported the European Automobile Manufacturers Association on Thursday. Therefore, the medium-term DE 40 index forecast is discouraging.

DE 40 technical analysis

The DE 40 stock index broke above the 18,740.0 resistance level and headed towards new all-time highs. However, the current uptrend is so weak that it might reverse at any moment. At present, the nearest growth target is 19,250.0. Nevertheless, the current trend is unlikely to last for the medium and long term. Therefore, the DE 40 price forecast is negative.

Key levels for the DE 40 analysis:

- Resistance level: 18,740.0 – the price has already broken above this level and may target 19,250.0

- Support level: 18,625.0 – with a breakout below the support level, the quotes could fall to 18,260.0

Summary

The ZEW Indicator of Economic Sentiment declined to 3.6 in September and may shift to negative territory soon, indicating investor readiness for an economic recession. Some indirect signals about this are coming from the German automotive market: electric vehicle deliveries contracted by 69%. All these factors do not provide grounds for long-term growth in the stock market. The DE 40 forecast remains negative.