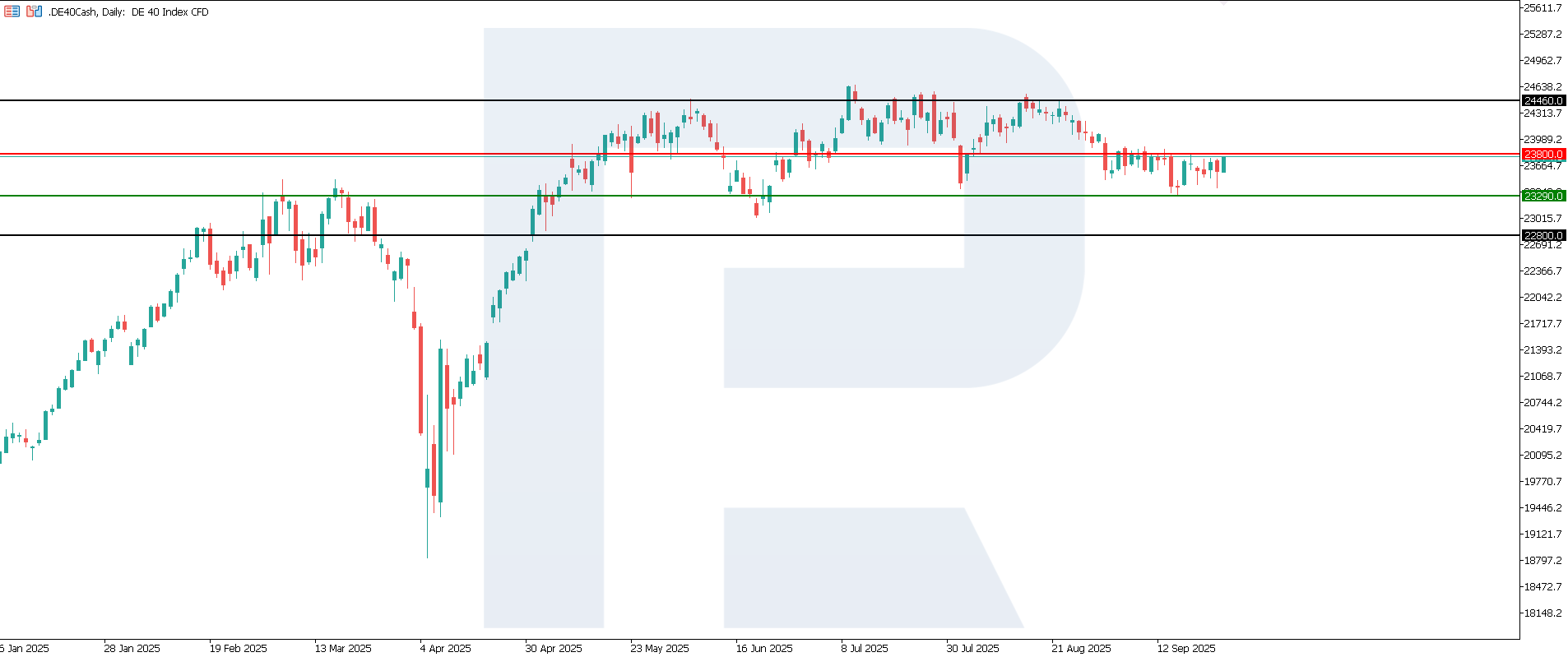

The DE 40 index approached a resistance level, but the downtrend continues. The DE 40 forecast for today is negative.

DE 40 forecast: key trading points

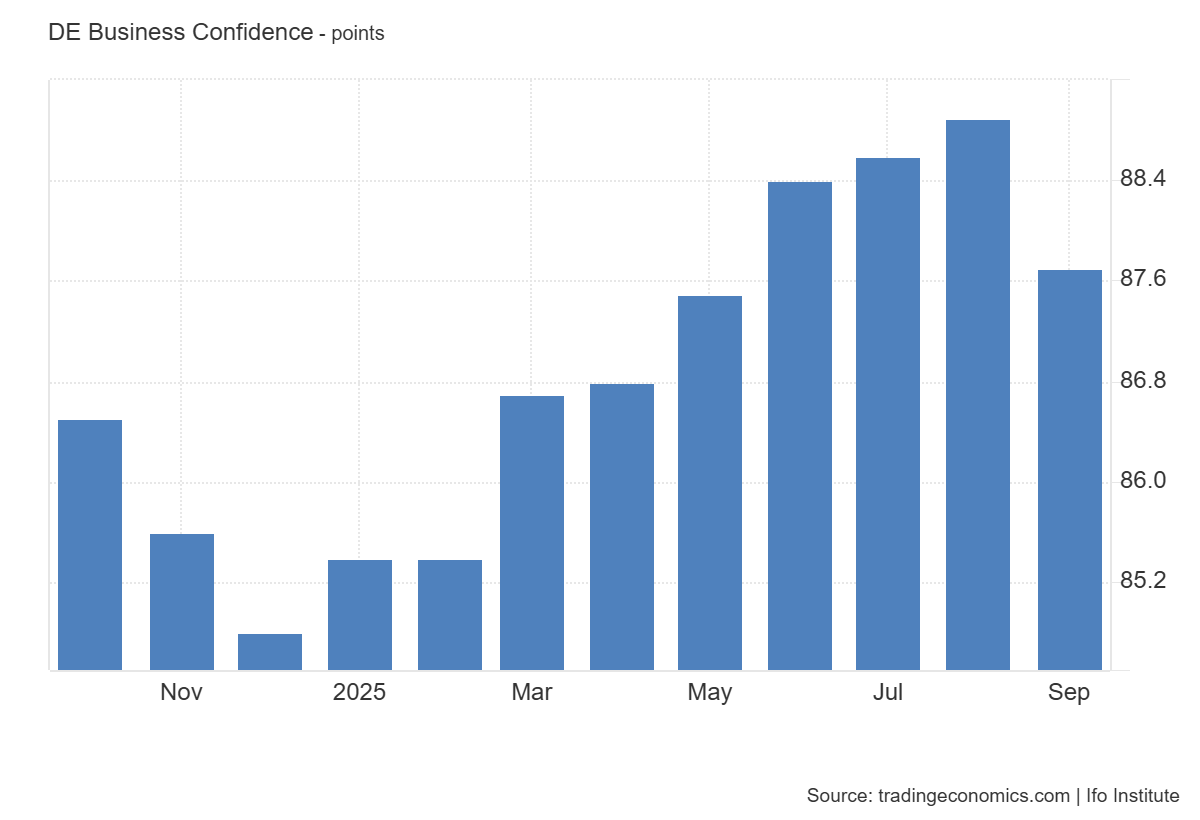

- Recent data: Germany’s ifo Business Climate Index for September 2025 came in at 87.7 points

- Market impact: the figures create a restrictive backdrop for the German equity market

DE 40 fundamental analysis

Germany’s ifo Business Climate Index for September 2025 stood at 87.7 points, below the forecast of 89.3 and lower than the previous figure of 88.9. This reflects weakening optimism among German companies, with cautious expectations regarding business activity, domestic demand, and external conditions. The decline highlights ongoing pressure from high costs, weak exports, and global economic uncertainty.

For the German equity market, these figures form a restrictive backdrop. Declining business sentiment could reinforce investor caution, particularly in industry, machinery, and exports, which are traditionally sensitive to shifts in the business climate. Much will depend on the ECB’s next steps — any monetary easing could help support the German economy.

Germany ifo Business Climate Index: http://tradingeconomics.com/germany/business-confidenceDE 40 technical analysis

The DE 40 index has formed a resistance level at 23,800.0, with support at 23,290.0. The price continues to test resistance, indicating growing bullish activity. While buyers have not yet managed to break above this level, the downtrend will likely end in the short term.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 23,290.0 support level could send the index down to 22,800.0

- Optimistic DE 40 scenario: a breakout above the 23,800.0 resistance level could drive the index to 24,460.0

DE 40 technical analysis for 29 September 2025Summary

For the DE 40, this may indicate limited upside potential in the short term. Investors could shift focus towards defensive sectors such as pharmaceuticals and consumer staples, while cyclical stocks (autos, machinery, and chemicals) may remain under pressure. The next downside target for the index may be 22,800.0.

Open Account