Declining retail sales may weaken the US dollar

US consumption in focus

The US dollar continues to receive support due to increased geopolitical risks in the eurozone and the Federal Reserve’s hawkish stance at the last meeting. Despite stabilising French markets and euro recovery, the US currency still holds its ground. According to the forecast for 18 June 2024, the EURUSD rate is slightly falling, but traders believe that negative data on retail sales may significantly strengthen the euro.

Total US retail sales in June are projected to rise by 0.2%, both overall and excluding motor vehicles. The retail sales control group index, focused on retail and grocery stores, is expected to increase by 0.4%, offsetting April’s decline.

Investors believe that weaker-than-expected retail sales (as in much recent US economic data) could lead to the risk of a more significant reversal in the EURUSD rate. Current movements in the main currency pair are heavily influenced by geopolitical factors.

EURUSD technical analysis

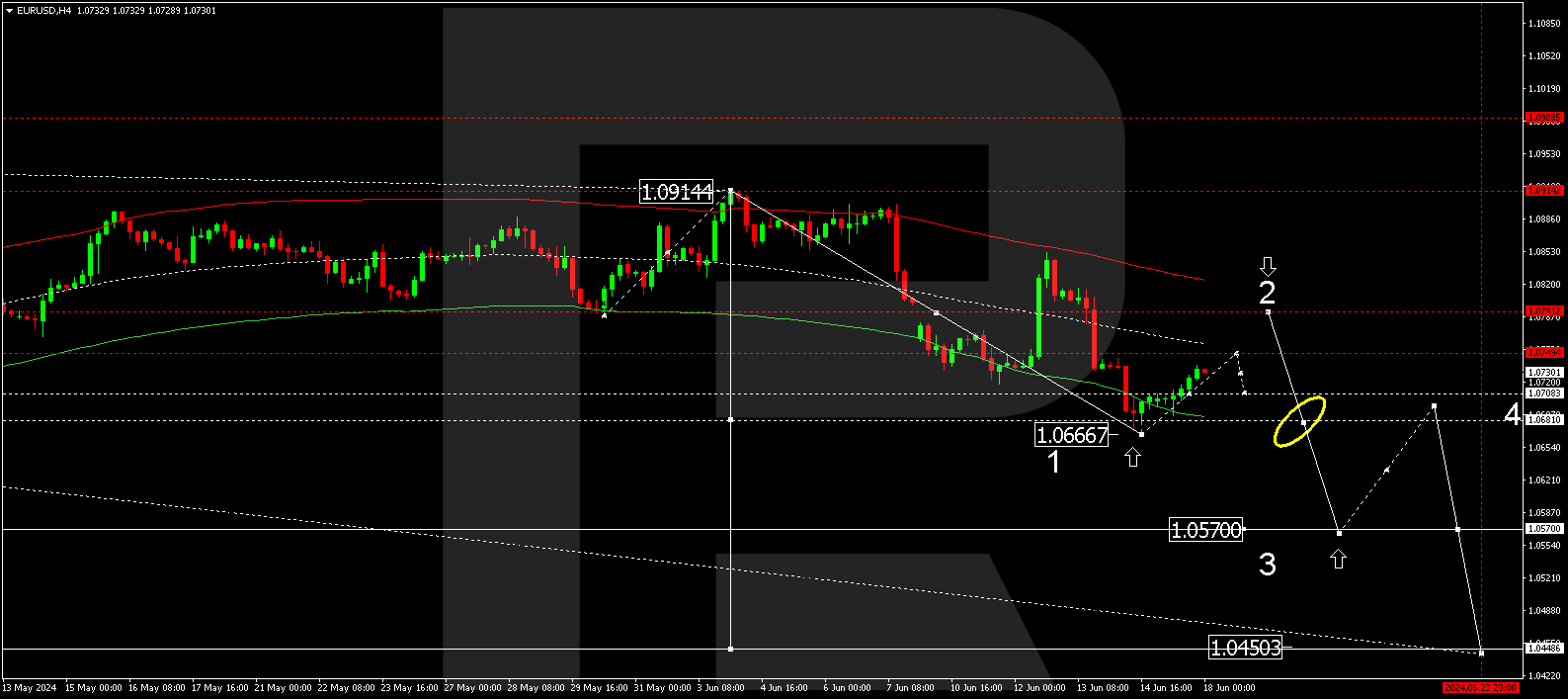

On the H4 chart, EURUSD has formed a consolidation range above 1.0666. The price has broken above the 1.0707 level, opening the potential for a correction towards 1.0750 (testing from below). The EURUSD analysis for 18 June 2024 suggests that once the correction is completed, a new downward structure in the EURUSD rate may begin, targeting the critical level of 1.0680. A breakout of this level would open the potential for a decline wave towards 1.0570, representing a local target.

EURUSD technical analysis 18.06.2024

Technically, this scenario is confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.0680. The market has found support at the lower boundary of the Envelope, with an expected rise to its upper boundary. A correction, potentially extending to 1.0790, would be seen as a test of the Envelope’s upper boundary from below.

Summary

While the US dollar still receives support, indications of a slowdown in US consumer spending could prompt a significant correction. The EURUSD technical analysis points to a potential corrective wave towards at least 1.0750, followed by declines to the targets of 1.0570 and 1.0450.