Positive US data could trigger a corrective rebound in USDJPY toward 144.00. Full details in our analysis for 15 April 2025.

USDJPY forecast: key trading points

- NY Empire State Manufacturing Index (USA): previous – -20.0, forecast – -12.8

- Redbook Retail Sales Index (USA): previous – 7.2%, forecast – 7.2%

- USDJPY forecast for 15 April 2025: 144.00 and 142.00

Fundamental analysis

The Redbook Retail Sales Index reflects recent changes in US retail activity. The latest figure was 7.2%, and the April 15, 2025 forecast suggests that this value will remain unchanged, indicating stable consumer spending — a potentially supportive factor for the US dollar.

The NY Empire State Manufacturing Index serves as an early gauge of industrial conditions in New York State, often setting the tone for broader US economic sentiment. The index is compiled from surveys of manufacturing firms and includes assessments of new orders, inventories, employment, and short-term expectations. A reading above zero signals expansion; below zero indicates contraction.

Today’s forecast expects an improvement to -12.8%. If the actual result matches or exceeds expectations, it could offer support to the dollar and initiate a correction in USDJPY.

USDJPY technical analysis

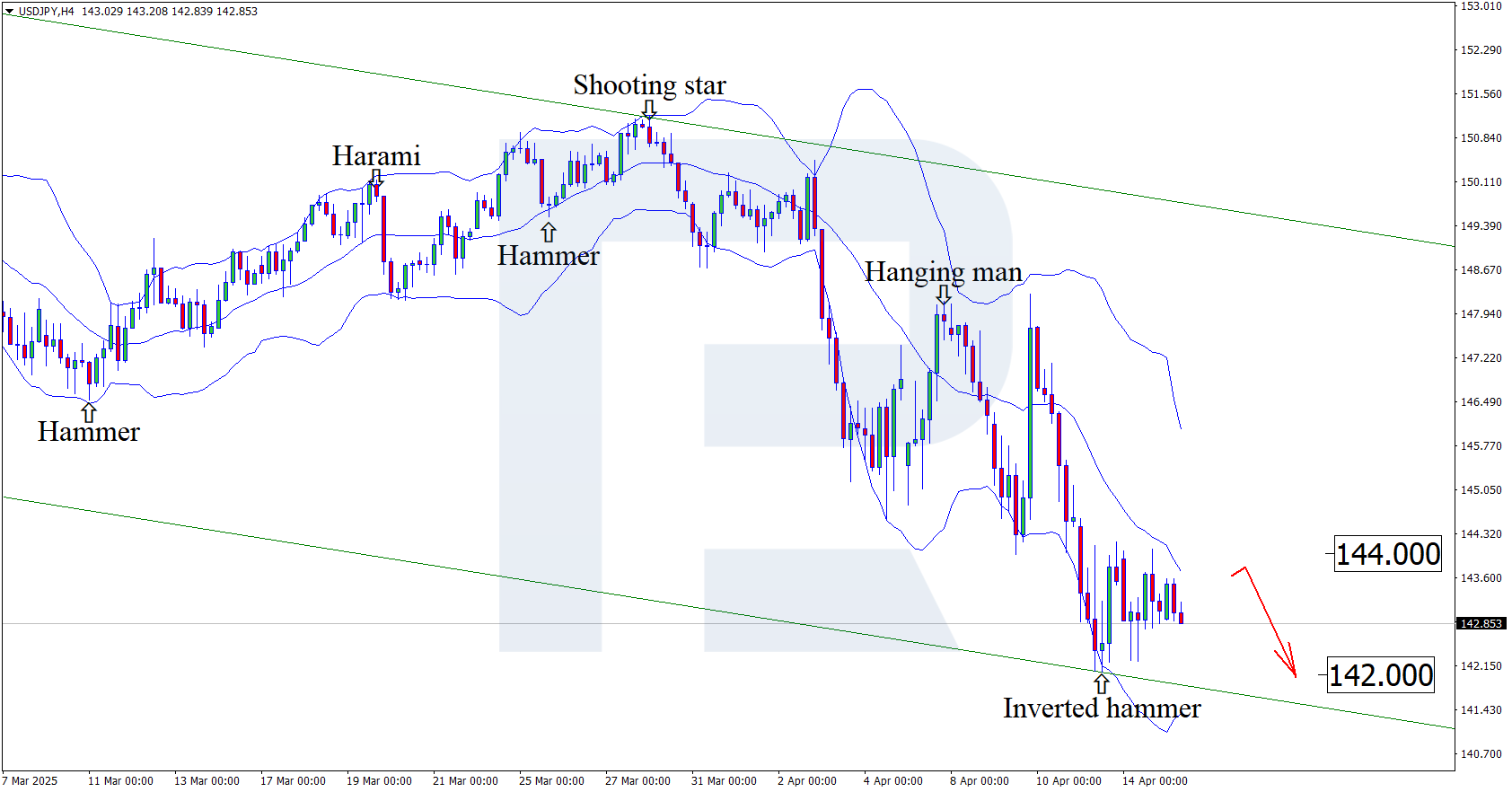

On the H4 chart, USDJPY has formed an Inverted Hammer pattern after testing the lower Bollinger Band. This suggests the pair is forming a corrective wave based on the reversal signal. The price is trading near the lower boundary of a descending channel, which supports the potential for a short-term rebound.

The target for the correction is 144.00. A bounce from this level could be followed by renewed bearish momentum. However, failure to initiate a rebound could see the pair slip further to 142.00 without testing resistance.

Summary

Stability in retail sales and a potential improvement in US manufacturing sentiment could provide support for the dollar. Technical analysis suggests a corrective move in USDJPY toward 144.00 is likely, with downside risk to 142.00 if support fails to hold.