Easing inflation in Switzerland supports growth in USDCHF

The USDCHF rate attempts to hold above the resistance level. More details are available in our analysis for 15 October 2024

USDCHF forecast: key trading points

- Member of the Board of Governors of the Federal Reserve Christopher Waller called for caution when lowering interest rates further

- Markets estimate the odds of a 25-basis-point Federal Reserve rate cut in November at 88.2%

- Switzerland’s Producer and Import Price Index decreased by 0.1% in September, continuing its 17-month trend

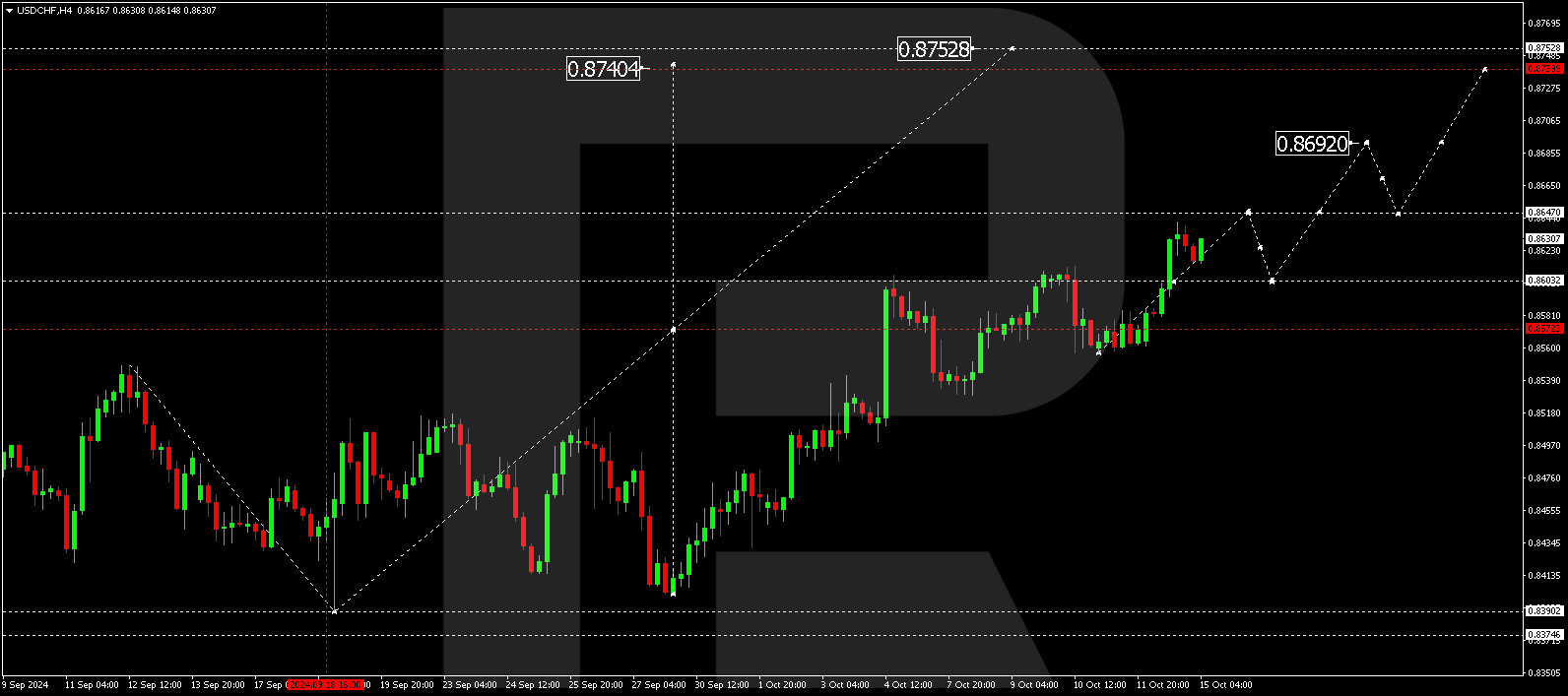

- USDCHF forecast for 15 October 2024: 0.8647, 08692, and 0.8740

Fundamental analysis

The USDCHF rate continues to rise slightly after a surge on Monday, holding above the 0.8605 resistance level. Two key factors currently influence the currency pair: expectations of a more cautious Fed approach to interest rate cuts in the upcoming months and investor disappointment over the stimulus measures proposed by China.

Member of the Federal Reserve Board of Governors Christopher Waller called for greater caution when lowering interest rates further amid the upcoming data.

Markets currently estimate the likelihood of a 25-basis-point Federal Reserve rate cut in November at 88.2%. The latest US economic data showed resilience in the labour market, with consumer inflation in September slightly exceeding expectations. As part of today’s USDCHF forecast, these expectations regarding the Federal Reserve’s actions may help strengthen the US dollar.

Meanwhile, Switzerland’s September 2024 Producer and Import Price Index decreased by 0.1% from August, reaching 107.2 points. The petroleum products segment saw the most significant decline, while oil, natural gas, and food prices rose. The overall level of prices for domestic and imported products fell by 1.3% year-on-year from September 2023.

Investors now await additional comments from Fed officials and the latest US consumer inflation data.

USDCHF technical analysis

The USDCHF H4 chart shows that the market has formed a consolidation range around 0.8572. The price is expected to break above the range’s upper boundary and rise to 0.8647 today, 15 October 2024. After reaching this level, it could plunge to 0.8600 (testing from above). Subsequently, a growth wave might develop, aiming for 0.8692 and potentially continuing the trend towards the local target of 0.8740.

Summary

The USDCHF rate continues to strengthen, holding above the 0.8605 resistance level amid expectations of a soft Federal Reserve policy. Investors focus on the upcoming comments from Fed officials and new US inflation data. Technical indicators in today’s USDCHF forecast suggest a potential growth wave towards the 0.8647, 0.8692, and 0.8740 levels.