Elon Musk’s ambitious projects could elevate Tesla to a new level. Is it worth investing in its stock now?

Over the past 30 days, the yield on Tesla (NASDAQ: TSLA) shares has exceeded 48%. Elon Musk has grand plans for the company’s future.

Is it worth investing in Tesla stock now? What can prevent Musk from implementing his ambitious plans? Find out more in this article.

Tesla shares have experienced a prolonged decline since January 2024, with the price falling by more than 50% in four months. The price decline could be driven by Tesla’s refusal to pay compensation of approximately 55 billion USD to Elon Musk, who threatened to leave the company.

The situation changed radically on 13 June when the annual shareholder meeting approved this payment. Since that day, the stock price has significantly recovered, rising nearly 50% in just one month.

This article will analyse Tesla’s electric vehicle sales and income sources, explore promising business areas that may significantly increase the company’s earnings, and list the risks associated with investing in Tesla stock.

About Tesla Inc

Tesla was established in 2003 by Martin Eberhard and Marc Tarpenning. In 2004, Elon Musk joined them as a co-founder, becoming the company’s largest investor and taking on the role of Chair of the Board of Directors. Musk assumed the position of CEO in 2008.

While the company was initially involved solely in electric vehicle production, new business areas have emerged. The first battery car, the Tesla Roadster, was unveiled in 2008, kicking off the production of electric vehicles. The company introduced a driver assistance system in 2014, which evolved into a full-fledged autopilot (Full Self-Driving).

In 2016, Tesla acquired SolarCity, a company specialising in solar panel installation, which led to the creation of Tesla Energy. This division is dedicated to producing solar panels and energy storage devices. Shortly, the company plans to launch a robotaxi service that uses autonomous vehicles for passenger transportation, enter the cargo freight market with the Tesla Semi electric truck, complete the development of the Optimus robotic humanoid, and build the world’s largest AI cluster for the Dojo supercomputer.

Tesla Inc revenue streams

Tesla Inc generates revenue through various sources reflecting the diversity of its products and services. The main ones are listed below:

- Automotive sales – this includes direct sales to consumers and rentals

- Regulatory credits – selling regulatory credits to other car makers who need them to comply with environmental standards

- Energy generation and storage – producing and selling solar energy systems and energy storage devices such as Powerwall (for domestic use), Powerpack (for commercial use), and Megapack (for large-scale energy storage)

- Services and others – service and repair centres, the Supercharger network, and insurance services for Tesla electric vehicle owners

- Software and autonomous driving – fees for advanced driver assistance systems (Autopilot), the full self-driving unit (FSD), and software updates

- Sales of batteries and power units – supplying other companies with battery elements, arrays, and power units

- Renewable energy projects – concluding contracts with utility companies and other large energy consumers to implement their energy storage solutions

Tesla Inc Q1 2024 financial performance

Today is 12 July 2024, meaning that the second quarter of the year is over. However, Tesla will only release its Q2 report on 23 July, so we will now analyse Q1 2024 indicators. Below is the Q1 2024 financial performance data compared to Q1 2023.

Key data:

- Total revenues – 21.30 billion USD (a 9% decrease)

- Net profit – 1.10 billion USD (a 55% fall)

- Earnings per share – 0.34 USD (a 53% decrease)

- Operating margin – 5.5% (a fall of 592 basis points)

- Capital expenditures – 2.77 billion USD (a 34% increase)

Revenues by segment

Automotive sector:

- Automotive sales – 17.37 billion USD (a 13% decrease)

- Regulatory credits – 442 million USD (a 15% decrease)

- Leasing – 476 million USD (a 15% decrease)

Energy sector:

- Energy generation and storage – 1.63 billion USD (a 7% increase)

Services and others:

- Services and other revenues – 2.28 billion USD (a 25% increase)

The data on the automotive segment, the primary revenue stream, was disappointing. The decrease in performance was caused by increased competition, which forced the company to lower prices for electric cars, production disruptions at the Giga Berlin factory, and equipment upgrades at the Fremont factory (California). The company attributes a 34% rise in capital expenditures to increased investments in artificial intelligence infrastructure.

There were no problems with the production of Tesla electric vehicles in Q2 2024. According to data released by the company on 2 July, deliveries for this period reached 444,000 electric vehicles, down 22,000 from the corresponding period in 2023. As a result, the sales situation remains challenging.

In the 2024 outlook, the company anticipates lower electric vehicle production due to the launch of next-generation products. However, Tesla is optimistic about deploying energy storage systems and expects growth rates in this segment to outpace the automotive business performance.

To summarise, despite the decrease in revenues, Tesla continues to invest in development and innovation.

Tesla Inc promising business areas

In January 2024, the Delaware (US) court invalidated a compensation package worth 55 billion USD payable to Elon Musk for his role as Tesla’s CEO. Musk criticised this decision and threatened to leave the company unless he received the compensation. He later changed Tesla’s registration from Delaware to Texas. At the annual shareholder meeting in June 2024, Musk’s compensation package issue was raised again and was approved. Although the real reasons behind this decision can only be speculated upon, it is evident that shareholders are placing another bet on Elon Musk, expecting the company’s further growth under his leadership.

Below are the promising business areas that Elon Musk is developing that may be successful in the future.

Robotaxi

Tesla is actively developing a robotaxi service, where autonomous cars provide transportation services without involving drivers. In the future, Tesla electric car owners will be able to add their vehicles to the robotaxi network when not in personal use and earn money by renting them out as taxis. Consumers will be able to order Tesla robotaxis by using a mobile app similar to Uber and Lyft taxi services.

Tesla plans to generate profit from robotaxis in different ways:

- Ride tariffs – charging a fee for each ride. This will be the primary revenue stream.

- Network fees – Tesla owners renting out their cars will share a portion of their revenues with the company for using the platform.

In April, Elon Musk posted on his X social networking service page that the Tesla robotaxi would be unveiled on 8 August 2024.

Tesla Semi truck

Tesla Semi is an electric truck developed by the company to replace conventional diesel trucks on the road. It was introduced in November 2017 and is equipped with advanced driver assistance systems, including Autopilot.

Tesla Semi project monetisation includes several areas:

- Direct sales – the main source of income, where large companies such as Walmart (NYSE: WMT), PepsiCo (NASDAQ: PEP), and UPS (NYSE: UPS) have already pre-ordered Tesla Semi.

- Service and maintenance – providing truck maintenance and repair services, selling spare parts and software updates.

- Charging infrastructure – developing a Megacharger network to charge trucks, thereby creating a constant revenue stream from charging payments.

Full Self-Driving (FSD) project

Full Self-Driving (FSD) is a fully autonomous driving system that the company provides to Tesla electric car owners at an extra cost. This project has several options for monetisation. Once the technology is perfected and the company obtains the required regulatory approvals, Tesla can sell FSD software to other car makers. Subsequently, the company will charge a fee for its updates and technical support services.

Tesla Optimus robotic humanoid

Tesla Bot, also known as Optimus, was unveiled at the Tesla AI Day event on 19 August 2021. This robot is intended for various tasks in both industrial and domestic areas.

Tesla plans to benefit from Optimus in different ways:

- Robot sales – selling robots to businesses and organisations for use in manufacturing, logistics, and other industries needing automation of routine tasks. It also provides for selling robots to individuals for household chores and to provide household assistance.

- Rental and subscription – fees will be charged for renting robots for one-time or seasonal tasks, which may be beneficial for companies that do not want to own them. Fees will also be charged for regular software updates and technical support subscriptions.

- Technical maintenance – charging for robot technical maintenance and repair services and selling spare parts.

Tesla’s Dojo supercomputer

Tesla is creating a large artificial intelligence cluster for the Dojo supercomputer, designed to process big data for machine learning models. To decrease reliance on third-party suppliers, the company is developing its own D1 chip to operate Dojo. Tesla’s supercomputer will allow the company to enhance its autonomous driving system. It is also planned to use Dojo for various AI applications, including robot engineering, energy consumption optimisation, and other areas requiring powerful computer resources.

The monetisation of this project includes the following types of income:

- Renting out computing power – providing other companies and organisations with paid access to the supercomputer for complex computations.

- Developing new products and services – launching new services based on powerful AI algorithms trained on Dojo.

Tesla’s energy business

Tesla is actively developing its energy business, which includes producing and selling solar panels, energy storage systems, and energy services.

The company will commercially benefit from the following segments of this business:

- Equipment sales – selling solar panels and energy storage systems to consumers.

- Installation and maintenance – income from equipment installation and technical maintenance.

- Energy services and tariffs – proceeds from connecting clients to the general energy network where they can sell renewable energy surplus.

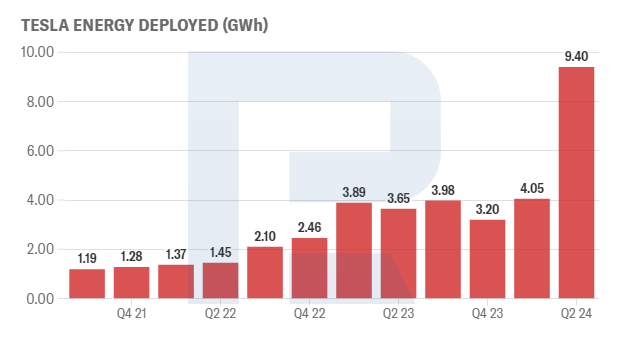

According to statistics, the company is actively developing this business area. Based on the Q3 2021 results, Tesla installed energy storage equipment with a 1.19 GWh volume. In Q2 2024, this indicator skyrocketed by 680% to 9.40 GWh. The business margins amount to 24.6%, markedly exceeding margins for electric vehicle sales.

Technical analysis and forecast for Tesla stock

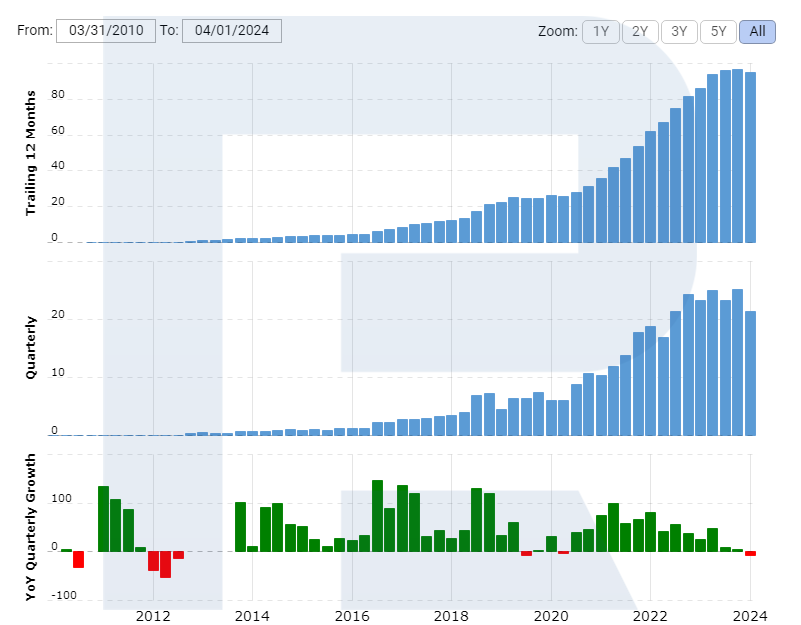

In November 2021, Tesla shares hit an all-time high of 415 USD. This was followed by a protracted decline in the stock price, which ended only in January 2023 at a low of 102 USD, ultimately forming a downtrend.

In March 2023, a support level of 160 USD was formed; the price tested this support in April 2024 but failed to breach it. June’s approval of compensation pay to Elon Musk created a buzz in the market, with the price surging and breaking the downward trendline. This marked the completion of the downtrend.

The stock price has gained 48% since 13 June without significant corrections. Several scenarios are possible in this situation.

The primary scenario is a corrective price decline to 200-220 USD, after which the price might resume growth, aiming for 300 USD. Breaking above this level will open the potential for a rise to 400 USD.

The second, more optimistic scenario suggests a further rise, with the price breaking above the 300 USD resistance level and securing above it. In this case, a further upward price movement is possible, with a target of 400 USD.

The third scenario is adverse, suggesting that the stock price will break below the 200 USD support level and could return to 160 USD. If this level also breaks, the quotes might drop to 102 USD.

Risks of investing in Tesla Inc stock

The information on Tesla’s promising business areas raises the question of where the company will find funding. In 2024, about 80% of Tesla’s revenues will come from electric vehicle sales. Based on the Q1 2024 results, the company’s revenues began to decrease, with the business margins falling to 17.8% from 27.1% in 2022.

The projects are under implementation and require funding; therefore, declining electric vehicle sales may prevent the development of new projects or significantly increase Tesla’s debt load.

Summary

Tesla was founded in 2002, and its first electric vehicle was introduced in 2008. As of 2024, the company has built and operates six electric vehicle manufacturing plants. By the end of 2023, it had produced 1.85 million electric cars, and its stock price has increased by more than 21,000% since the IPO on 29 June 2010. From this perspective, the most lucrative phase of investing in Tesla shares may have passed.

However, the previous growth in the share price was driven by the widespread adoption of electric vehicles, a goal that Elon Musk achieved. Today, Tesla is not just a car manufacturer but a technologically advanced company with ambitious projects. If Elon Musk can once again "achieve the impossible," then Tesla is only at the beginning of its journey.

For this reason, Tesla remains attractive for long-term investments. However, as mentioned above, implementing its projects requires significant financial expenditure, substantially increasing investment risks when purchasing its shares.