A decline in US Nonfarm Payrolls may weaken the USD and trigger EURUSD growth towards 1.1875. Details – in our analysis for 3 July 2025.

EURUSD forecast: key trading points

- Change in US Nonfarm Payrolls: previous value – 139K, forecast – 111K

- US unemployment rate: previous value – 4.2%, forecast – 4.3%

- EURUSD forecast for 3 July 2025: 1.1875

Fundamental analysis

According to the forecast for 3 July 2025, US Nonfarm Payrolls may decline to 111K, compared to 139K in the previous period. If expectations match actual data, the market could see increased volatility and a temporary weakening of the US dollar. The Nonfarm Payrolls release almost always sparks excitement in financial markets and can equally either support the US dollar or strip it of its positions.

The EURUSD forecast for today also factors in that the US unemployment rate for June may rise to 4.3%, compared to the previous 4.2%.

A decline in Nonfarm Payrolls alongside rising unemployment in the US could significantly weaken the USD and trigger EURUSD growth.

EURUSD technical analysis

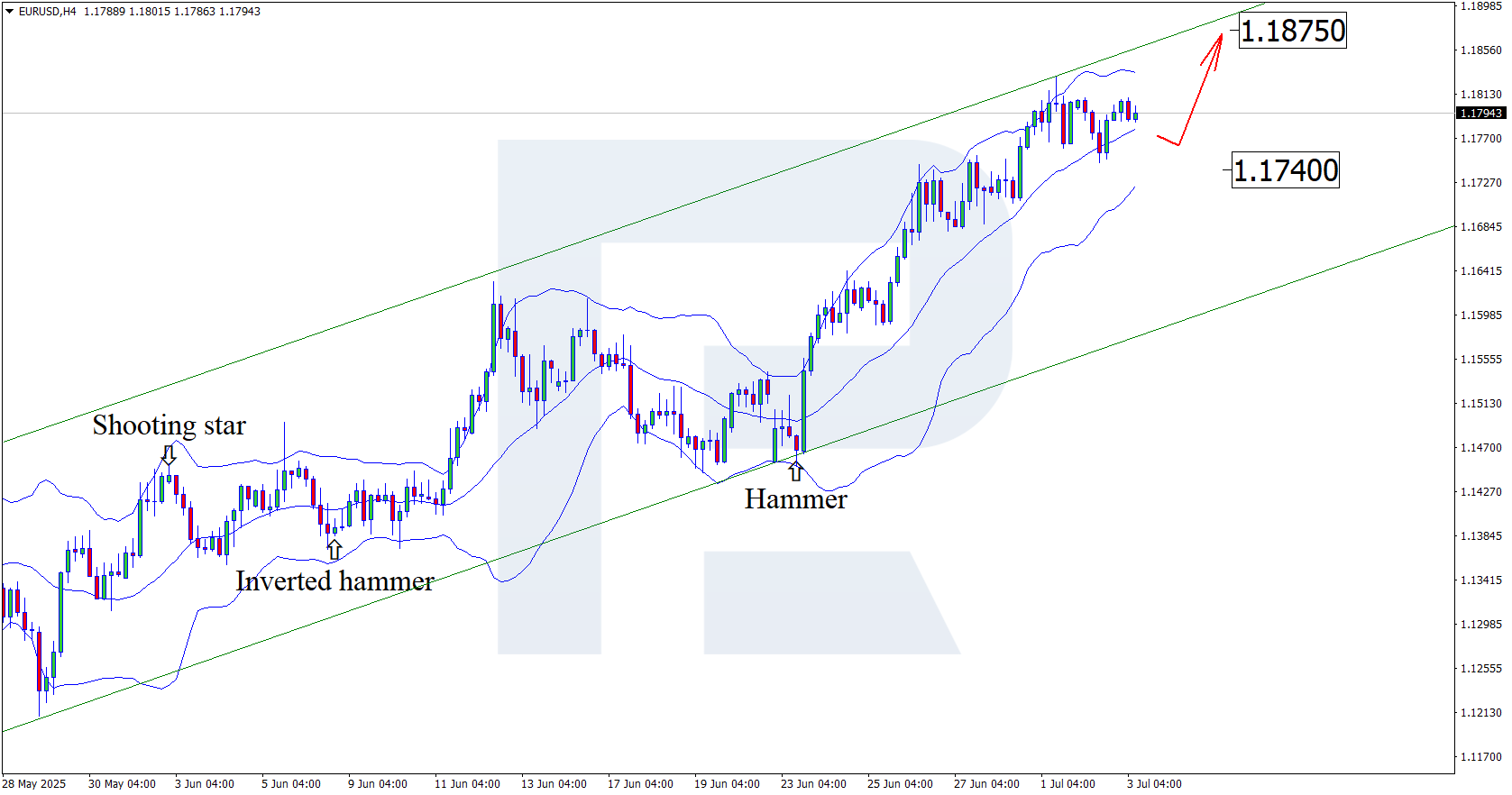

On the H4 chart, EURUSD has formed a reversal Hammer pattern near the lower Bollinger Band. At this stage, it continues the upward wave as it works out the signal. Given that quotes remain within an ascending channel, further growth towards the nearest resistance at 1.1875 can be expected. If the resistance level is breached, the upward trend may continue.

However, the EURUSD forecast also does not rule out a correction to 1.1740 and strengthening of the upward momentum after testing support.

Summary

The forecast for 3 July 2025 fully supports the euro. A decline in US Nonfarm Payrolls, together with technical analysis of EURUSD, suggests price growth towards resistance at 1.1875 USD.