Speeches by ECB and FOMC officials may trigger a further decline. For a detailed analysis, please refer to our forecast dated 24 July 2024.

EURUSD trading key points

- The eurozone’s manufacturing PMI: previously at 45.8, forecasted at 46.0

- US manufacturing PMI: previously at 51.6, forecasted at 51.7

- The Eurogroup meeting

- A Speech by European Central Bank official Philip R. Lane

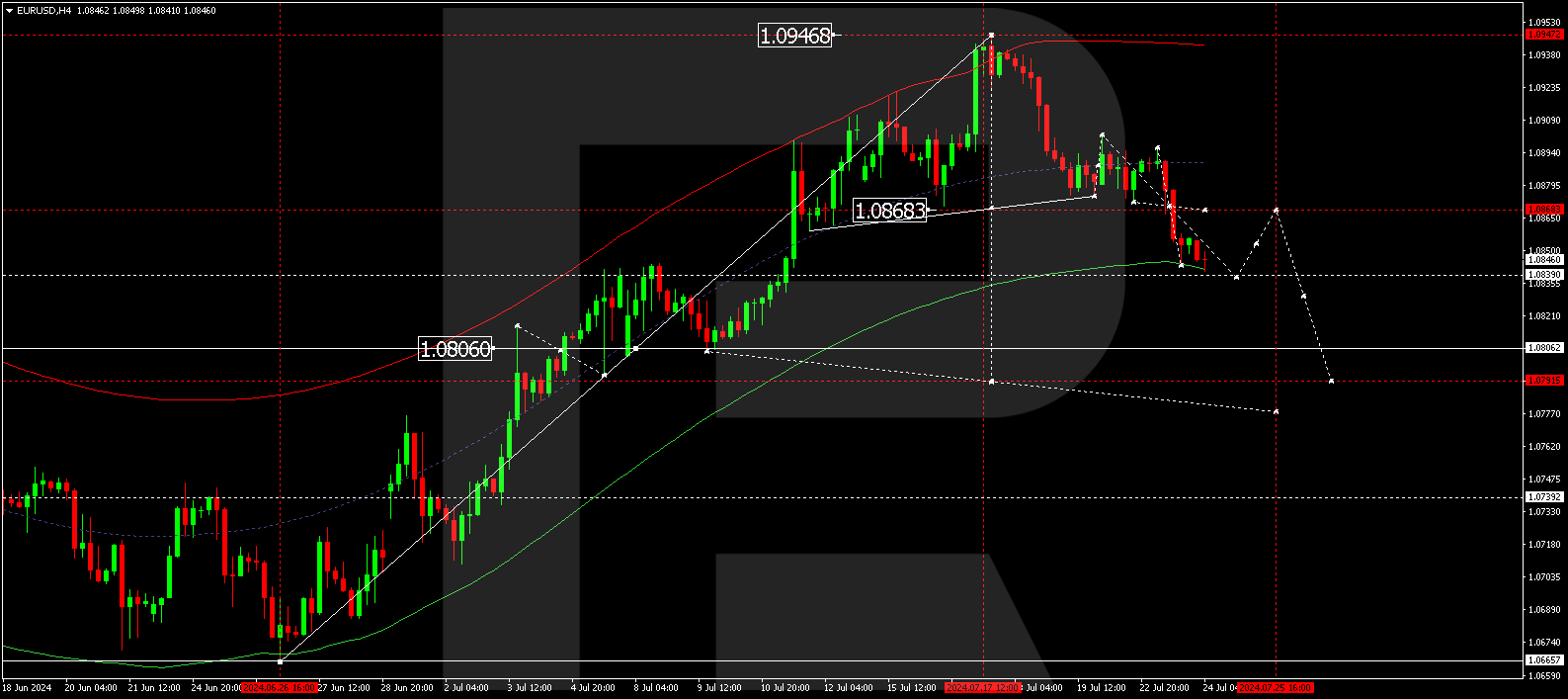

- EURUSD forecast for 24 July 2024: 1.0839 and 1.0792

Fundamental analysis

The Index data set, including the eurozone and US manufacturing PMIs, is scheduled for release on 24 July 2024. The eurozone’s index data is expected to be 0.2 points above the previous reading, and the US index is also projected to increase but by 0.1 point. Readings above 50.0 points indicate economic growth and positively impact the national currency rate, while those below 50.0 points suggest an economic downturn. If the reading holds near 40.0-45.0 for three months, this signals an economic recession.

US indicators appear more confident than the eurozone, which may support the US dollar and deepen a decline in the EURUSD rate.

The Eurogroup meeting and a speech by an ECB official may shed light on the eurozone’s future monetary policy. If negative or pessimistic remarks are made, the euro could weaken further against the US dollar.

EURUSD technical analysis

On the H4 chart, the EURUSD pair has broken below the 1.0868 level, with the descending wave now developing further to 1.0839. The price is expected to reach this level today, 24 July 2024. Subsequently, a consolidation range could form above it. With an upward breakout, a corrective phase could follow, aiming for 1.0868 (testing from below). With a downward breakout, the trend might continue to (at least) 1.0792.

Summary

The EURUSD rate continues to decline, with the data release, the Eurogroup meeting, and a speech by an ECB official potentially exerting further pressure on the euro. Technical indicators suggest a further decline wave in the EURUSD pair, with targets at 1.0839 and 1.0792.