The EURUSD pair is rising ahead of upcoming ECB and FOMC data. After the release of the FOMC minutes, another corrective wave may follow.

EURUSD trading key points

- The eurozone services PMI is projected at 52.6, lower than the previous 53.2

- A speech by ECB official Philip R. Lane

- A speech by FOMC member John C. Williams

- US nonfarm payrolls: prior reading of 152,000 and a forecast of 163,000

- US initial jobless claims: previous reading of 233,000 and a forecast of 234,000

- A speech by ECB President Christine Lagarde

- FOMC minutes release

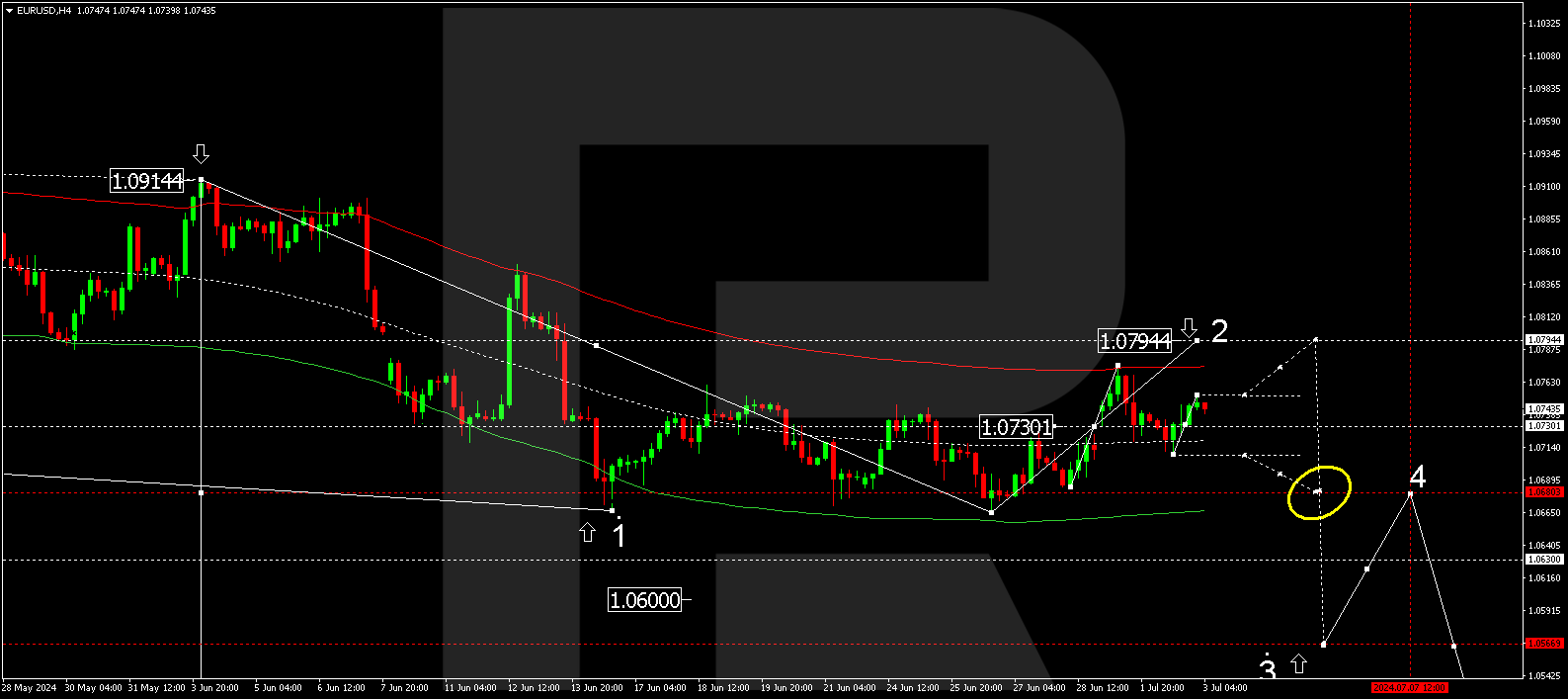

- EURUSD targets: 1.0794, 1.0600, 1.0573

EURUSD fundamental analysis

The EURUSD pair continues to strengthen on the news. The euro awaits speeches by ECB official Philip R. Lane, ECB President Christine Lagarde, and FOMC member John C. Williams, which may adjust the EURUSD rate and help strengthen the euro against the US dollar.

Nonfarm payrolls are projected to rise, and initial jobless claims are expected to increase as well. At this stage, it can be preliminarily concluded that these indicators will not significantly impact the EURUSD rate.

The FOMC minutes will be released at the end of the US trading session, potentially increasing volatility and temporarily supporting the EUR.

EURUSD technical analysis

On the Н4 chart, EURUSD formed a support level at 1.0710 and rose to 1.0753, practically creating a consolidation range around 1.0730, a crucial level for the EURUSD pair as of 3 July 2024. With an upward breakout of the consolidation range, the correction might continue to 1.0794. A downward breakout will open the potential for a decline wave towards 1.0680. The Elliott Wave structure with the centre at 1.0730 technically confirms this scenario.

Summary

Anticipation of speeches by ECB and FOMC officials and technical indicators increase the likelihood of a correction towards 1.0794. Following the FOMC minutes release, the EURUSD rate might decline to the 1.0680, 1.0600, and 1.0573 targets.