EURUSD has stopped its downward momentum and appears to have found stability. Investors expect a period of consolidation. More insights can be found in our EURUSD analysis and forecast for 24 September 2024.

EURUSD forecast: key trading points

- EURUSD stopped falling

- The euro faced pressure due to weaker-than-expected economic statistics, but the US dollar is also struggling to perform better

- EURUSD forecast for 24 September 2024: 1.1075 and 1.1060

Fundamental analysis

On Tuesday, EURUSD stabilised around 1.1115, marking a critical juncture in the market’s movement.

The euro was under pressure earlier in the week due to concerns about slow economic growth in Europe. Preliminary PMI data for September showed an unexpected contraction in business activity. The services sector PMI dropped to 50.5 points from 52.9, and the industrial sector PMI fell to 44.8 from 45.8 points.

Meanwhile, the US dollar is also facing headwinds, with declining Treasury bond yields, low oil prices, and comments from US Fed officials contributing to its weakness. According to these officials, the Federal Reserve’s decision to cut interest rates by 50 basis points last week was justified as the economy approaches a more stable level faster than anticipated.

Given these factors, the outlook for EURUSD remains subdued, signalling potential challenges ahead.

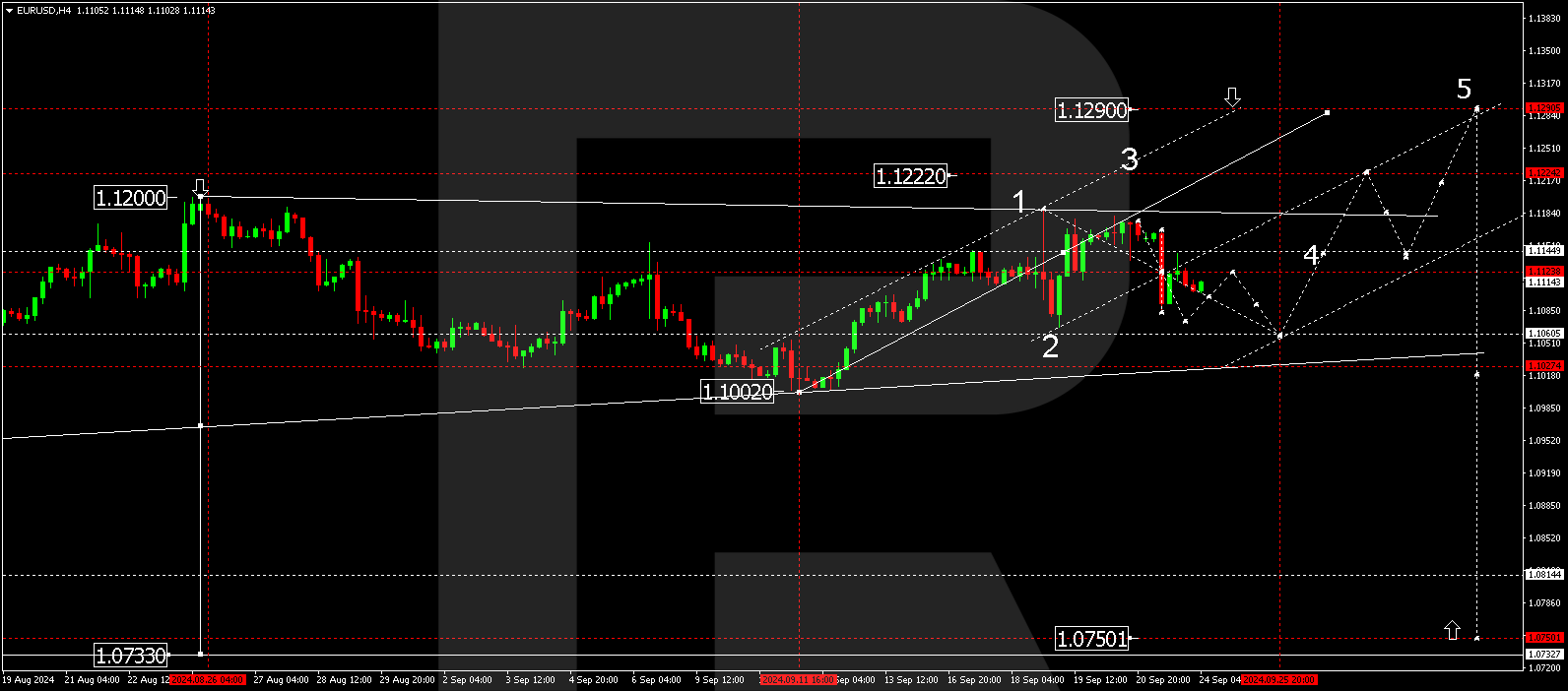

EURUSD technical analysis

On the H4 chart, EURUSD continues to develop within a consolidation range around the 1.1145 level. The range currently extends to 1.1082, with a potential test of the 1.1142 level from below. Today, 24 September 2024, our EURUSD forecast points towards a decline to the 1.1075 level, with a possible extension to 1.1060. Should the market break upwards from this consolidation range, there is potential for growth to the 1.1222 level. Alternatively, a downward exit from the range could open the door for a move towards 1.0966.

Summary

The EURUSD pair has weathered a period of decline and is now stabilising. According to technical indicators and today’s EURUSD forecast, there is a strong signal of potential growth toward the 1.1075 and 1.1060 levels.