EURUSD declines after Powell’s comments

The EURUSD rate retreated sharply to 1.0350 following the US Federal Reserve meeting and subsequent comments from Jerome Powell. Find out more in our analysis for 19 December 2024.

EURUSD forecast: key trading points

- The US Federal Reserve lowered the interest rate by 0.25%

- Stock markets are in negative territory, while the US dollar strengthens after the Fed’s decision

- EURUSD forecast for 19 December 2024: 1.0400 and 1.0330

Fundamental analysis

The US Federal Reserve cut its benchmark interest rate by 25 basis points to 4.50% following its two-day meeting on 17-18 December. The decision was expected, but subsequent comments from the regulator’s chief and new economic forecasts adversely affected the stock market (the S&P 500 index fell by 3% at once), strengthening the US dollar against all other currencies.

The US dollar strengthened mainly due to the Fed’s revision of its inflation outlook for 2024 and 2025. Inflation is projected to run at 2.4% at the end of 2024, up from 2.3% in the September release. The Federal Reserve expects inflation in 2025 to be 2.5%, up from 2.1% in the previous forecasts.

At a press conference following the meeting, Federal Reserve Chair Jerome Powell noted that the Fed’s current policy does not negatively affect the economy, allowing the regulator to adopt a more cautious approach to future actions. The Fed wants to see a tangible slowdown in inflation before implementing the next rate cut.

EURUSD technical analysis

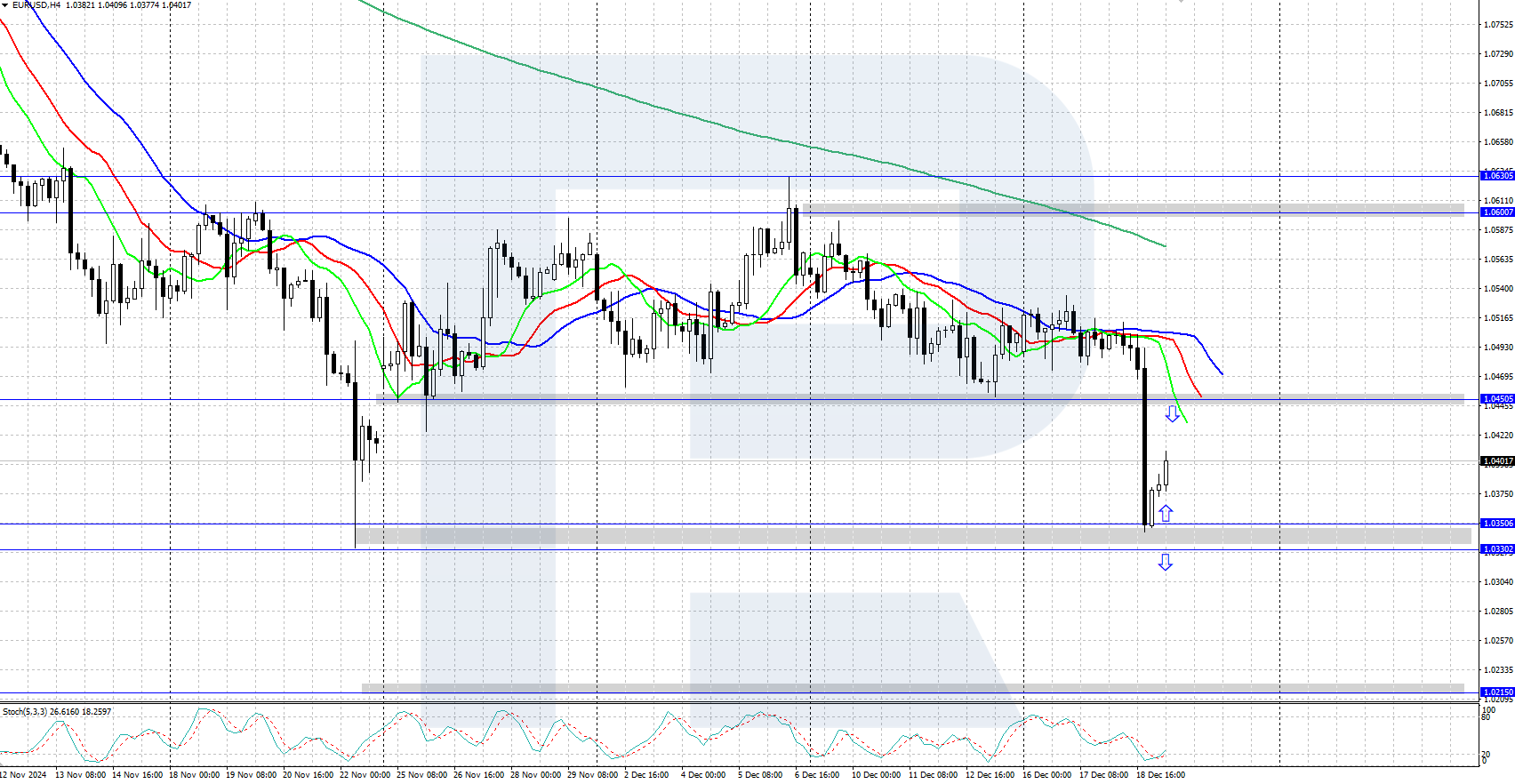

The EURUSD H4 chart shows a decline after the Federal Reserve meeting. The pair plunged to the 1.0330-1.0350 support area, encountering local demand and forming upward momentum. However, the alligator indicator confirms that the daily trend is downward, and the price could resume its decline after a minor correction.

The short-term EURUSD forecast suggests the pair could grow to the 1.0450 resistance level if bulls hold the price above the 1.0330-1.0350 support area. However, if bears overcome the 1.0330-1.0350 support area, the decline may continue to 1.0215.

Summary

The EURUSD pair fell to 1.0350 after a Federal Reserve interest rate cut and its accompanying statement. Market participants expect the US Federal Reserve to pause the monetary policy easing cycle as inflation forecasts were revised upwards.