The EURUSD pair is correcting towards 1.1347 as the market shifts focus to the Fed’s next moves. Find out more in our analysis for 17 April 2025.

EURUSD forecast: key trading points

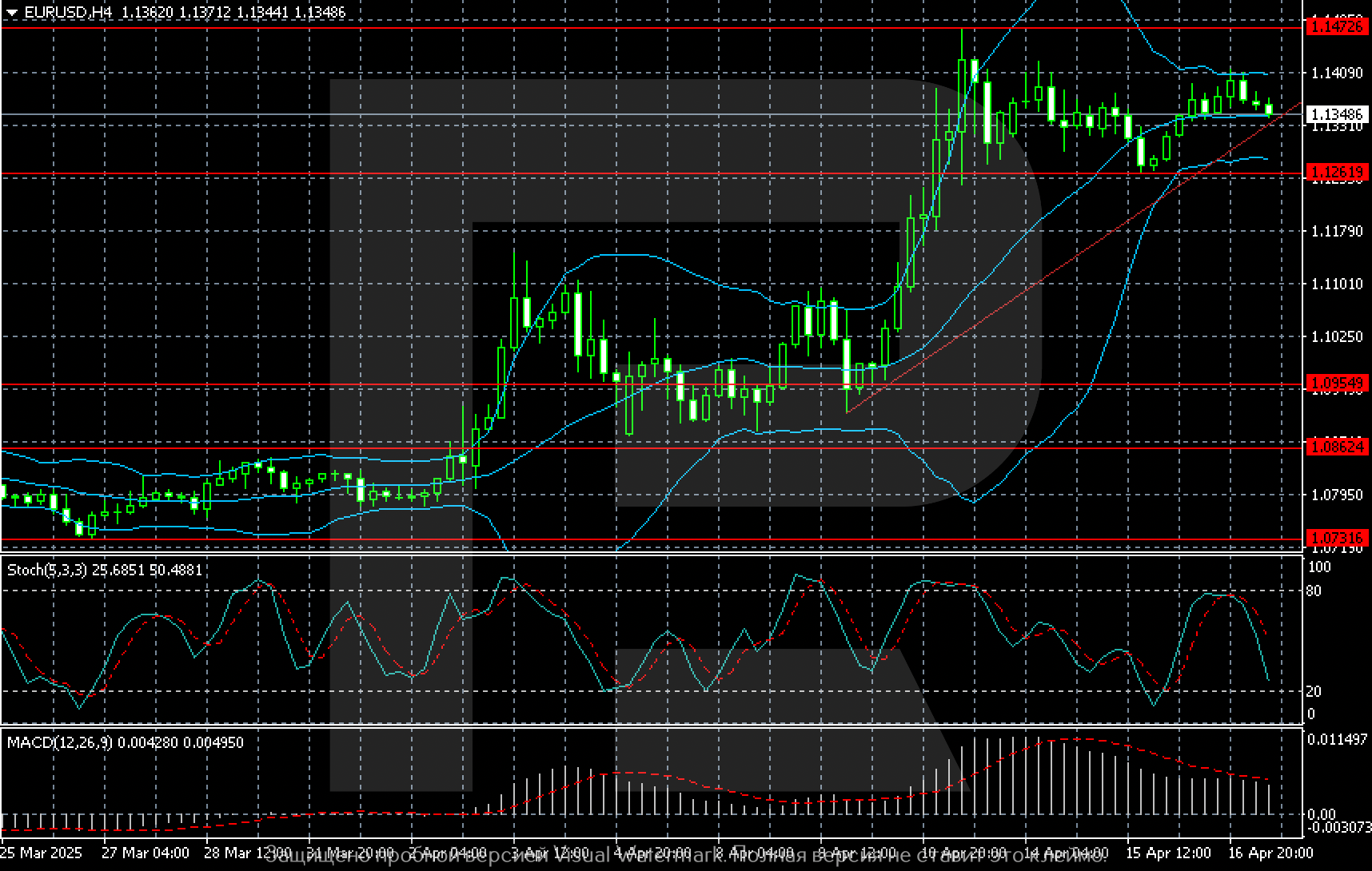

- The EURUSD pair has pulled back after hitting three-year highs

- Market focus shifts to the Federal Reserve’s monetary policy outlook

- The Fed may have to make difficult decisions and assess the chances of a rate hike

- EURUSD forecast for 17 April 2025: 1.1472

Fundamental analysis

The EURUSD rate has dipped to 1.1345 as the US dollar regains some lost ground from the previous session. Traders are reassessing Fed policy expectations amid evolving global trade conditions.

On Wednesday, Federal Reserve Chairman Jerome Powell warned that tariffs could contribute to higher inflation and slower economic growth — a dynamic that complicates the Fed’s dual mandate of price stability and maximum employment.

Powell also reiterated the Fed’s cautious stance, noting that the central bank is not rushing to lower interest rates as it needs greater clarity before making any policy decisions. However, his remarks left the door open for possible rate hikes if inflation gets out of control.

Yesterday’s US retail sales data showed a strong rebound in March, marking the largest increase in over two years.

The EURUSD forecast is favourable.

EURUSD technical analysis

On the H4 chart, EURUSD’s corrective move is limited by the lower boundary at 1.1261. A full test of this level may not be required as the market could soon resume its bullish trend towards 1.1472.

Summary

The EURUSD pair is cooling off after a sharp rally and multi-year highs. Market focus is now firmly on the Federal Reserve’s next steps. The EURUSD forecast for today, 17 April 2025, expects a short-term correction, followed by a renewed push higher towards the 1.1472 target.